Price Sensitivity Remains Central in Online Shopping

One of the main drivers of GDP growth is internal consumption, or, more simply put, shopping. The more consumers spend, the happier companies are. Sadly, Hungarian growth outlooks for this year do not look very good. However, consumers are not a homogenous mass, and shopping habits may differ significantly based on income, and not least, age.

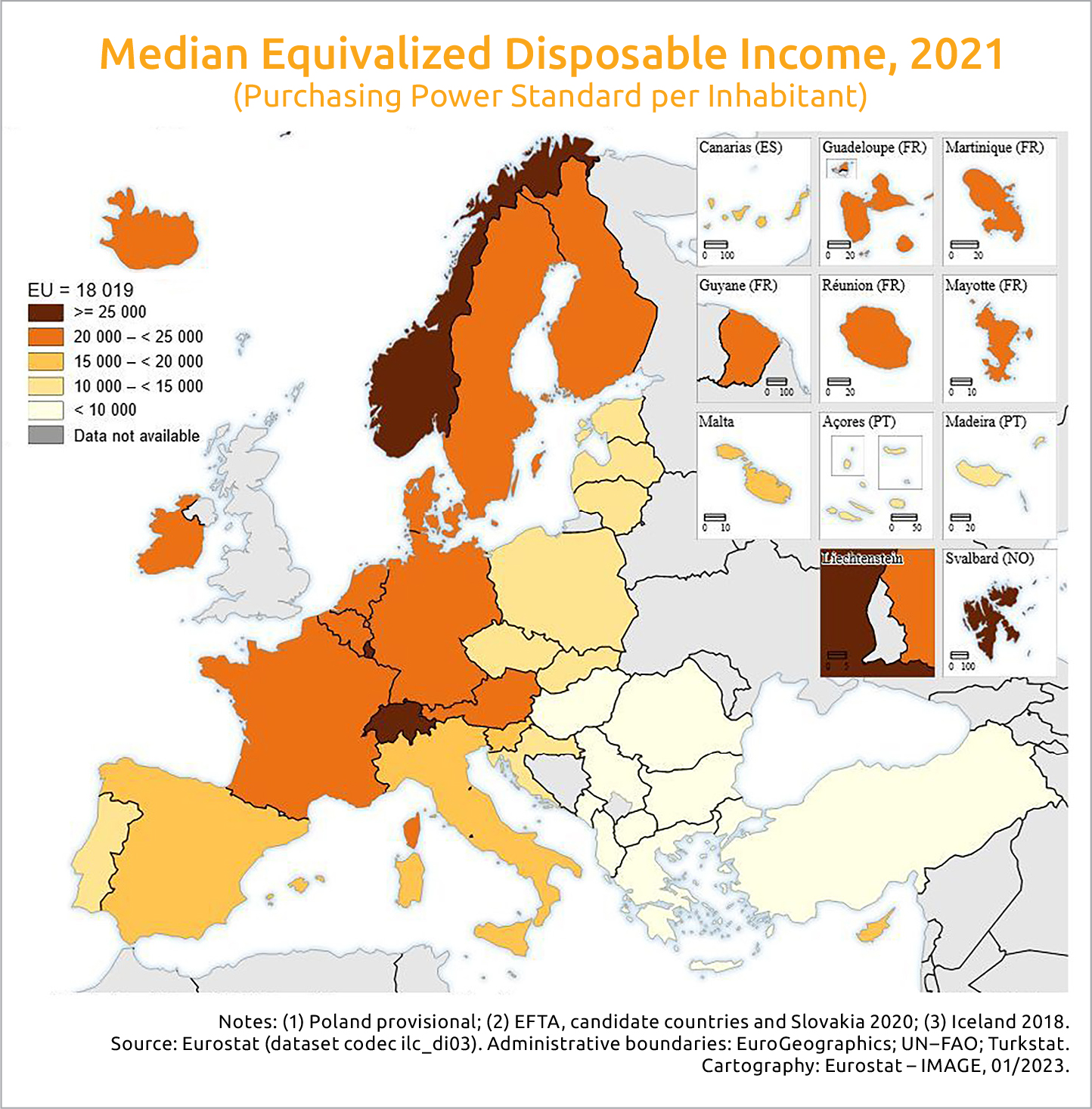

Before looking at online shopping trends, we should examine the financial situation of Hungarian households. One approach is given by the EU statistical office, Eurostat, with the indicator of equivalized disposable income. While it sounds complicated, it basically shows the total income of a household, after tax and other deductions, that is available for spending or saving.

For a more precise calculation, Eurostat divides this by the number of household members converted into equalized adults, and household members are made equivalent by weighting each according to their age, using the so-called modified OECD equivalence scale. This income is not expressed in currencies but in purchasing power standard, or PPS.

In January this year, Eurostat released its report on equivalized disposable income for 2021, when COVID lockdowns were still in place in several countries. The median amount per inhabitant in the EU was 18,019 PPS. As expected, at the higher end were Luxembourg (32,132), the Netherlands (24,560), Austria (24,450), and Germany (23,401). With 9,982 PPS, Hungary ranked among the lowest in Europe, together with Romania (8,703), Bulgaria (9,375), and Greece (9,917).

In 2022, inflation started growing, and the war in Ukraine added to the problems already mounting in EU countries, meaning that the PPS measured by Eurostat for 2021 must now be lower.

Fitch Ratings released its review on Hungary on January 20, maintaining the “BBB” sovereign rating but changing the outlook from “stable” to “negative.” Justifying its decision, the agency noted that “inflation is among the highest of all Fitch-rated sovereigns as price caps have proved ineffective and added to fiscal costs, while monetary policy transmission is being hampered by targeted mortgage interest rate caps.”

Decelerating Growth

While GDP growth was a decent 4.7% last year, Fitch expects it to slow to 0.4% in 2023. As for household consumption, it will be impacted by “elevated inflation, decreasing real wages, and low consumer sentiment.”

That “elevated inflation” Fitch expects to peak in the first quarter at around 25%, and it will not fall below 17.6% for the year. Good news and bad news are mixed in the Fitch forecast, with inflation “decreasing toward 6% y.o.y. by year-end, although commodity prices, domestic price caps and regulated utility prices add significant uncertainty. Nominal wage growth will remain below but close to inflation, increasing the risk of a wage-price spiral.”

Surveys confirm that shopping habits dramatically changed during the past year. COVID lockdowns were good business for online stores since these were among the few channels for buying products. With the gradual lifting of the lockdowns, sellers were hoping that the online sale trends would keep their high pace and reopened offline stores would simply add to the revenues in 2022.

Unfortunately, the war in Ukraine quickly cooled down the optimism. Customers became worried and opted instead to save their money for “just in case” scenarios. The Christmas season raised sales, as was expected, but it did not generate the revenue spikes it had in previous years.

István Zabari, founder of lighting products web store lumenet.hu told financial portal penzcentrum.hu that the number of transactions is clearly dropping. Impulse shopping has basically disappeared, and even median-income customers are increasingly searching for cheaper products, Zabari said.

Repackaged Sales

A similar trend is seen at online retailer eMAG. One of the product categories available online is repackaged products. These are items returned by customers and resold by eMAG at a lower price but with similar return and warranty conditions. And the lower price is attractive, as eMAG saw a 25% surge of sales in this category in the last 12 months compared to the previous year.

The most popular repackaged products at eMAG were mobile phones and washing machines, but PC peripherals such as mouses and loudspeakers also sold well. Besides these, the top 10 repackaged list included TV sets, smartwatches, kitchen appliances, refrigerators, notebooks and headphones.

A more extensive survey was conducted by eMAG together with the GKID market research company. The data was compiled in a period when the monthly inflation surpassed 20%, which means that this probably reflects stable shopping habits for the next few months.

Seven out of 10 online customers questioned said that their monthly income is sufficient, and they even have some spare money to spend, which allows them some additional spending on treats once or twice per month.

Only 20% of the respondents said they would probably reduce the number of online orders in 2023 to save money. Perhaps surprisingly, there is a narrow group that even plans to increase online orders this year. The reasons are many: some wish to save fuel, others find it helpful to compare prices, and some are just bored of going to bricks and mortar stores. The most active online shoppers are in the 30-year-old age group, who, on average, placed 27.2 orders in 2022.

However, some products are still sold mainly in offline stores: FMCG staples such as food, cleaning and washing products, which will also be purchased in traditional stores in 2023, according to the survey.

Among the reasons to prefer online shopping versus offline stores, prices again play an essential role. One-third responded that internet ordering allows shoppers to find cheaper options, and a similar percentage said it is better than spending money on fuel to shop in offline stores. Time, too, seems to be precious for online shoppers; 40% responded that using this channel allows them to reduce time shopping.

This article was first published in the Budapest Business Journal print issue of January 27, 2023.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.