German Companies Want Predictability and the Euro

Two significant business organizations, the Hungarian economic research institute GKI and the German-Hungarian Chamber of Industry and Commerce (DUIHK), have recently published data on the economic mood in Hungary.

The business sentiment of Hungarian companies has been unable to recover from a significant fall in»2022, registering only minor ups and downs each month. This was again the case in the third and fourth months of the year: after a three-point improvement in March, the business sentiment fell two points in April, according to GKI.

The DUIHK Business Climate Survey, published twice a year, in spring and fall, gives a more detailed insight from German companies operating in Hungary. To provide some context to the spring 2024 report, which carries the subtitle “Weak Growth Prospects, Challenges in the Labor Market,” let us look briefly at the findings of the 2023 survey.

Last year, the situation of the Hungarian economy was described as “significantly worse” than in spring 2022, with the outlook for the next 12 months seen as relatively weak, according to the feedback provided by 250 executives of DUIHK member companies.

As for the quality of the investment environment, respondents were critical of the predictability of economic policy, which most likely reflects state interference in market mechanisms, such as administrative price regulations or intervention in foreign trade.

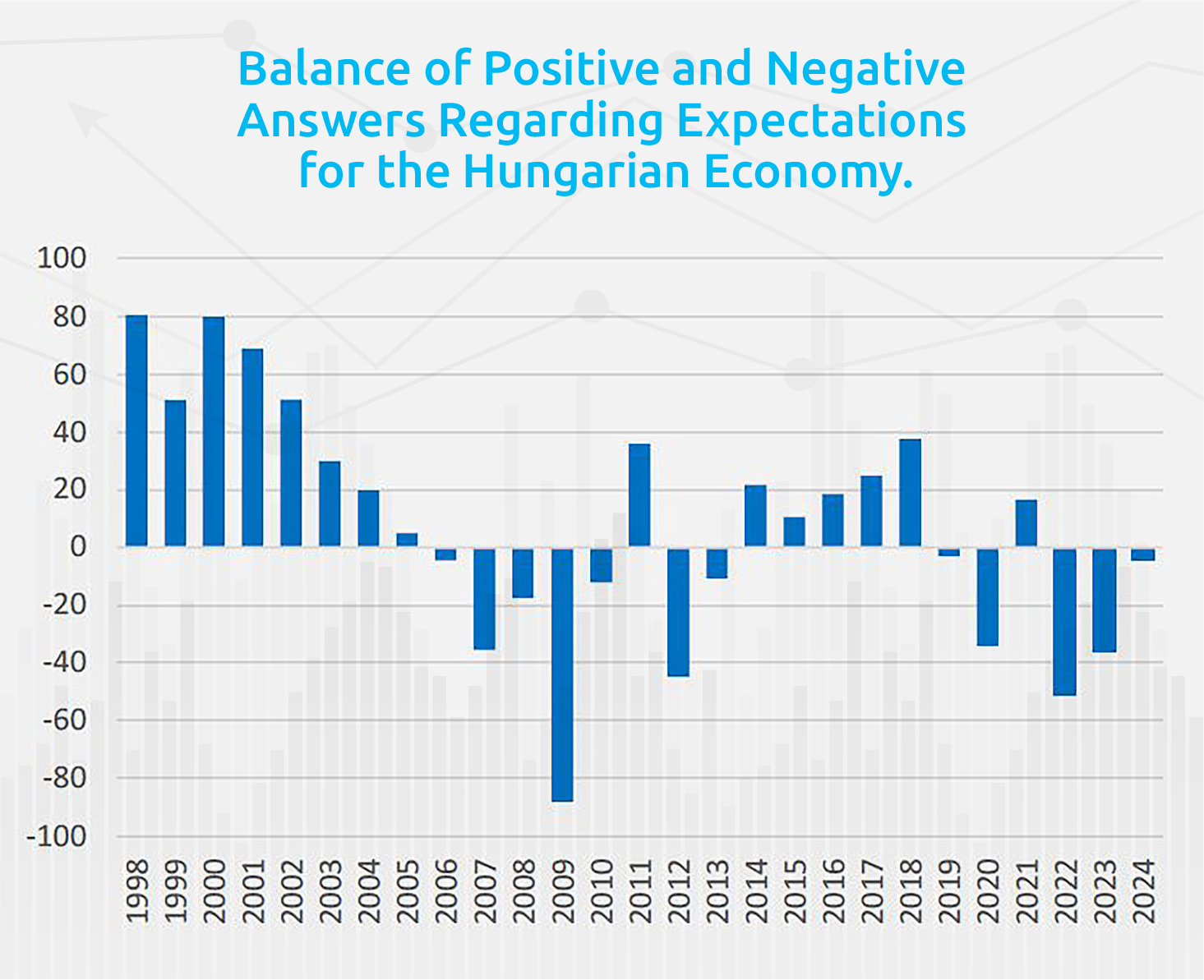

Overall, the share of companies with a positive outlook equaled those with negative expectations. The last time the ratio was this negative was 10 years ago, the 2023 survey reported.

Bottoming Out?

The tone of this year’s study has not improved much. At the launch event, DUIHK President András Sávos said that after the “very pessimistic expectations” reflected in the fall 2023 report, the lowest point may have been reached, but a significant economic rebound cannot be expected as yet.

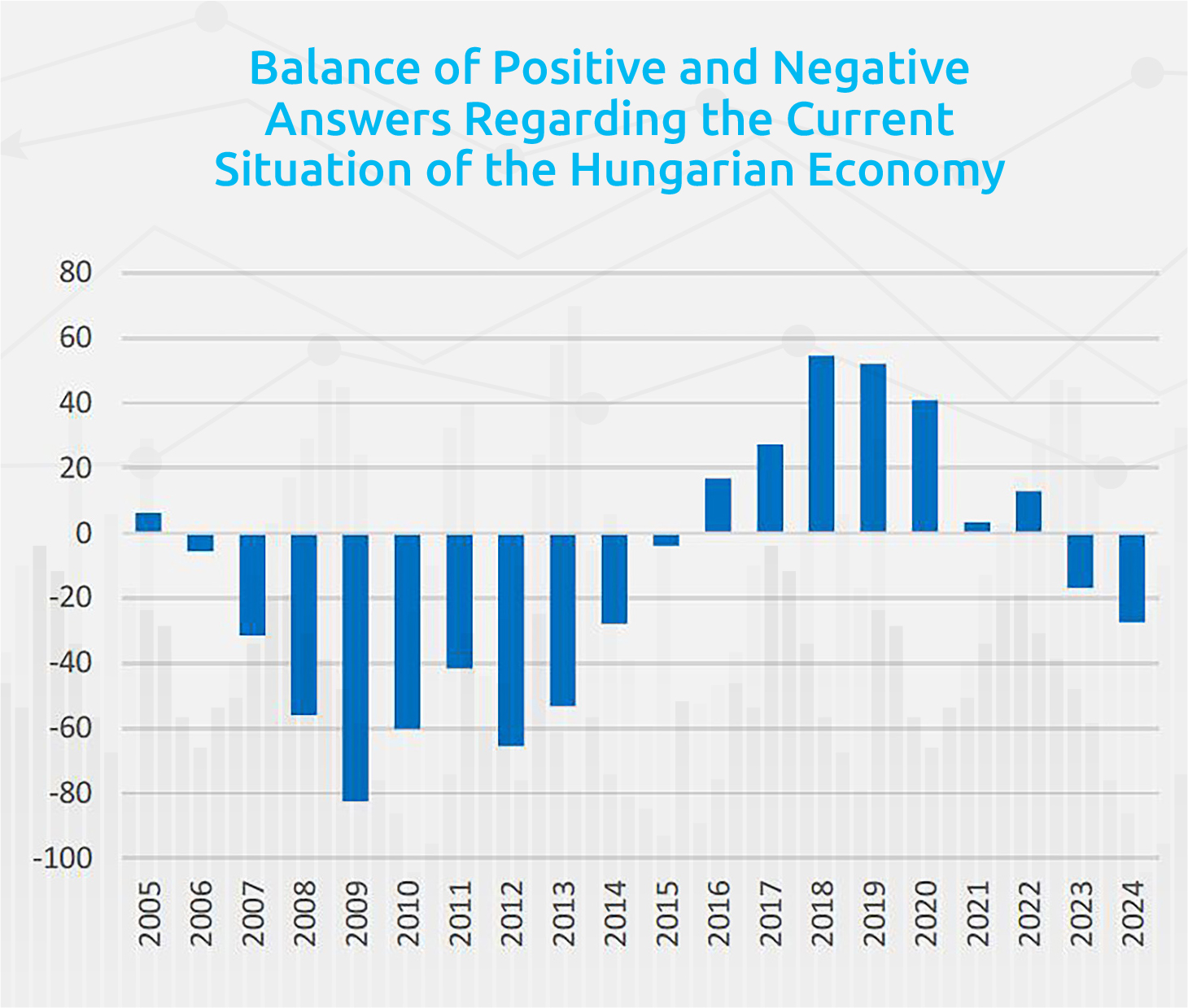

Only 14% of the respondents rated the situation of the Hungarian economy as “good,” while 41% saw it as “bad,” even worse than the 2023 report. Although the balance between the positive and the negative answers has improved from -36 to -4, we are still far from what could be seen as signs of perceptible economic growth, Sávos said.

Not surprisingly, given this environment, barely more than a quarter (27%) of the respondents consider their current business situation as “good,” down from 39% last year. In comparison, a majority of 59% described it as “satisfactory” and 14% “bad.” A quarter expect the situation to worsen this year, while 29% count on an improvement. On a regional comparison, the Hungarian results are average at best and, in most cases, weaker.

While the macroeconomic environment may be accepted as a given, the companies would expect at least the variables to show some improvement. However, the score for critical factors like economic policy and legal certainty remained low and even worsened compared to last year, when they were already indicated as problematic areas, Sávos said.

More than half (60%) of respondents were more or less unsatisfied with predictability, and 48% were unhappy with the level of legal certainty. Such figures were last registered in 2017, the German chamber says. The continuous “governing by decree” since 2020 does not contribute to efficient planning and predictability of business, Sávos noted.

Windfall taxes also do not indicate a healthy budget; generally speaking, interventions in economic processes always come with high risks, Sávos noted. For 10 years, between 2012 and 2022, satisfaction regarding the tax system was on an upward trend, but that started falling in 2023 and has continued in 2024. Other factors perceived as unsatisfactory in Hungary were the fight against corruption and transparency of public procurements.

Mid-table

Despite all these factors, Hungary is situated relatively well in regional comparison, ranked seventh among 15 countries, with Poland, Estonia and Lithuania leading the list. On the positive side, Hungary has a well-functioning state administration and infrastructure, and here, Hungary is placed among the five best-performing states in the region.

For years, a critical issue for companies has been the availability of a skilled workforce. Dirk Wölfer, the chamber’s head of communications and the survey’s author, pointed out that the labor shortage and the costs related to the labor force have long been significant challenges.

With slower economic growth, the absorption of the labor force lowered, which was somewhat helpful for companies. Still, 55% of the respondents were unhappy with labor force availability, although this percentage is not outstanding within the region. The most sought-after categories are physical workers for industrial production, IT specialists and research and development professionals.

As for the cost of labor, these are among the lowest in Europe, barely one-third of the German level. However, these costs are growing, and productivity cannot keep pace, which means that companies will have to raise retail prices. This will have a negative impact on competitiveness, Wölfer warned.

Finally, the German chamber members were asked whether Hungary should join the euro, and an overwhelming majority, 73%, replied “Yes.” Such a high ratio has not been seen since 2011 and is related to the volatility of the HUF/EUR rate, Wölfer said.

This article was first published in the Budapest Business Journal print issue of May 6, 2024.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.