Hungary’s Disinflation Process Breaks in April

Fresh data suggests that the decline in the consumer price index stopped in April. According to analysts, inflation could return above 4% in May. Although no significant price pressure is expected in the Hungarian economy in the coming months, the process could mean inflation will return to the target tolerance band of the National Bank of Hungary (MNB) only in 2025.

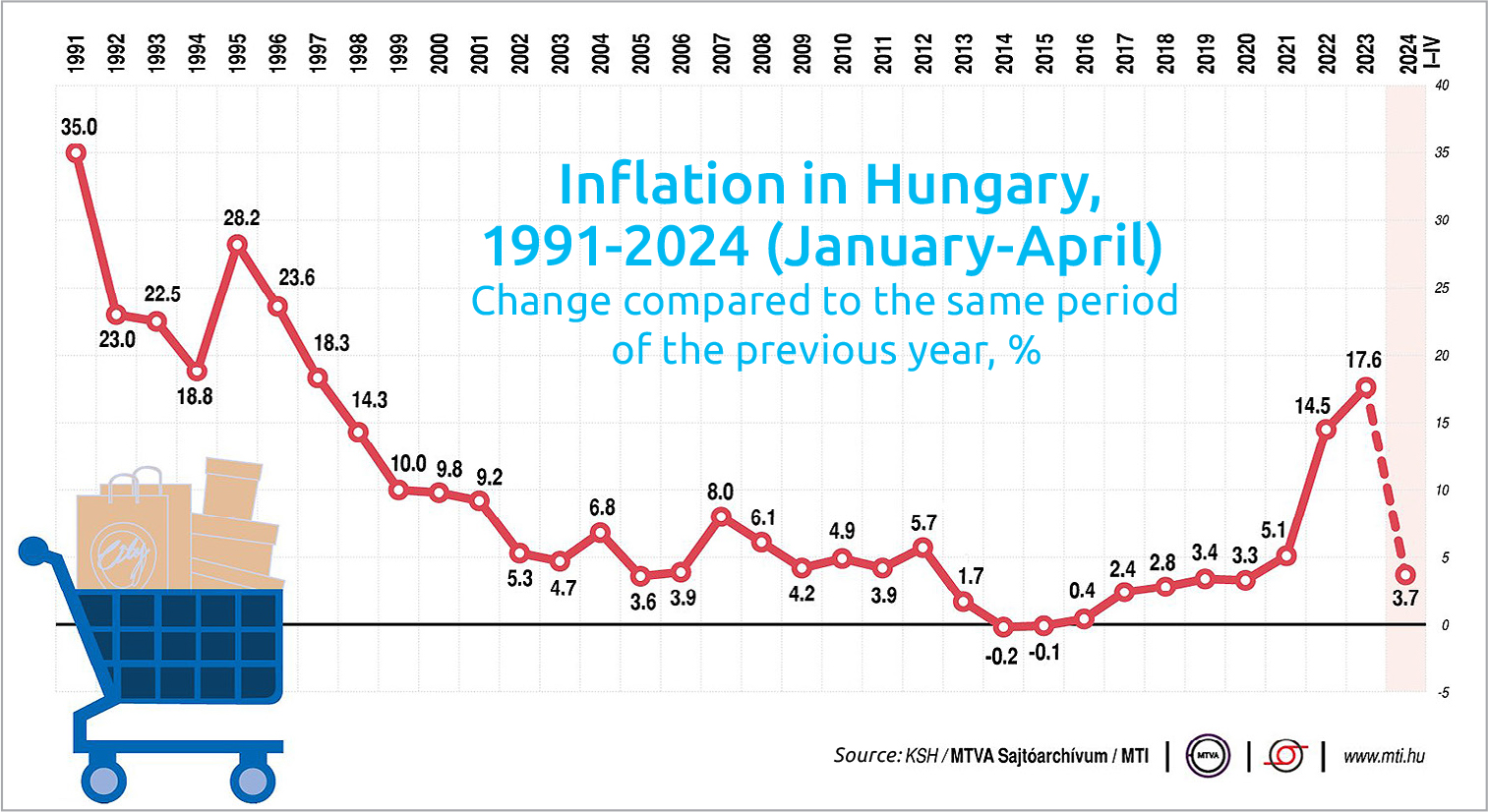

After 14 months of decline, inflation rose again in April. The year-on-year increase was 3.7%, following 3.6% in March. The main reasons for the rise were the more expensive market services and increasing fuel prices. Although the index is expected to rise above 5% by the end of the year, no huge price pressure is expected.

“The domestic headline index is still within the tolerance band of 2-4%, but we still believe that the current return of inflation [….] is a temporary phenomenon for the time being,” Erste Bank analyst János Nagy comments on the data.

He says the base effect was still supportive in April, but annual inflation rates are expected to rise again from May. In the short term, a critical pro-inflationary factor is the continued practice of backward-looking pricing, especially in the service sector, as well as the outflow of wages and the expected increase in consumption. The latter factor will likely be more decisive in the second half of the year.

“Overall, we expect fluctuating annual inflation figures of between 4-5% throughout the year without a definite trend,” Nagy says.

“The favorable base effects of the Hungarian inflation trend have finally run out,” Péter Kiss of Amundi Alapkezelő says. He expects a fluctuating rise in inflation from May. “We will certainly have to revise our expectation of 4.8% for December,” the analyst notes.

Slower Rate Cutting

In light of the current data, the central bank could still reduce the base rate in May at the predicted slower pace, but depending on the base processes, a slowdown of up to 25 basis points is possible.

“From the middle of the year, the question marks will become more frequent. [.…] The course of domestic inflation within the year is questionable, as the analyst consensus expects a higher inflation trajectory than our forecast. On the other hand, the external environment can also change dramatically due to the incoming macroeconomic data,” Kiss says.

“The main question now seems to be how much of a real interest rate premium compared to regional countries is sufficient so that the forint does not weaken too much,” Kiss concludes.

“After the 0.8% in March, the monthly inflation in April was still high at 0.7%, which is otherwise the same as the monthly repricing in January and February,” says ING Bank analyst Péter Virovácz. “There is still significant inflationary pressure in the Hungarian economy since, to sustainably reach the 3% inflation target, one-month inflation would have to be around 0.2-0.3%,” he warns.

Difficult to Predict

“For now, however, it is quite difficult to predict the second half of the year. The performance of the Hungarian economy seems to be weak; the tightness of the labor market has eased, which puts a brake on the favorable process of wage outflow. We do not have to fear the formation of a price-wage spiral. Caution is still present in the economy, and we still have to wait for the meaningful start of consumption. These will act as a brake on inflation in the months ahead, so they are more of a downside risk for our forecast,” Virovácz says.

Zoltán Árokszállási, of MBH Bank expects the increase in the price of services will slow down in the coming months as it becomes less justifiable to use last year’s inflation as the basis for pricing decisions. At the same time, rising internal demand, driven by high real wage growth, makes it easier for businesses to raise prices.

“As a result of these effects, we are projecting a slow decline in the annual price index of services for the coming months, which may significantly exceed the annual inflation calculated for the entire consumer basket during this year,” Árokszállási says.

MBH is maintaining its forecast that this year’s average inflation rate will be 4.1%. For the rest of the year, annual inflation data might be over 4%, and for December, an increase in prices of around 5% could be forecast. The stable and sustainable achievement of the MNB’s inflation target of 2-4% is expected in 2025 at the earliest, but even then, the average annual inflation may exceed 3%, the analyst concludes.

This article was first published in the Budapest Business Journal print issue of May 17, 2024.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.