Investment Activity Restrained Across CEE Region in 2023

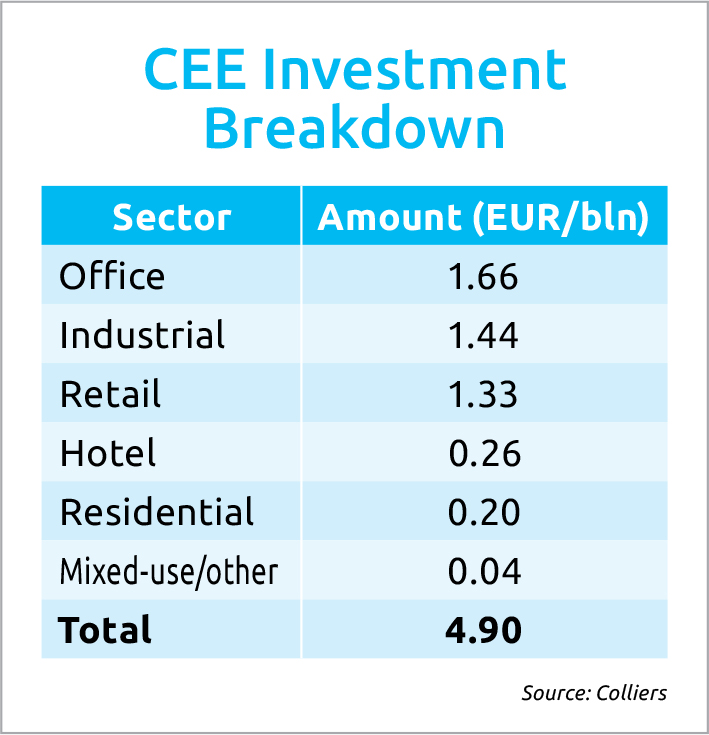

Total CEE investment for 2023 stood at around EUR 4.9 billion, according to preliminary figures from Colliers. The forecast for 2024 is EUR 5.5 bln-6 bln. All countries in the CEE 6 suffered a year-on-year fall in volumes, with the drop for Hungary a 32% fall compared to 2022.

“With the rise in interest rates, long-term government bond yields, and challenging economic and geopolitical events experienced over the past 18 months, the real estate market in terms of pricing (yields) has had to pivot to reflect the change in investor risk and sentiment,” comments Kevin Turpin, director of Colliers CEE, on the current state of the CEE investment market.

The result has been a drop-off in investor demand as buyers and sellers “recalibrate their acquisition plans” in this new economic reality, he explains.

“Therefore, I would describe the current climate as one of ongoing price realignment. The factors mentioned have impacted which real estate opportunities are actively (or even quietly) being marketed while, in parallel, we have experienced a bit of a slowdown in the growth of new buildings entering the markets across several real estate sectors,” Turpin adds.

Traditionally, the Czech Republic and Hungary see a high proportion of investment activity from domestic investors.

“The Czech capital accounted for circa 28%, and Hungarian capital accounted for circa 11% of CEE investment volumes in 2023. With all CEE domestic capital accounting for circa 56%, this significantly boosted liquidity rates across the region,” Turpin says.

“This figure is almost double the share of, say, three to four years ago. While we expect domestic investors to remain equally active in 2024, we also expect international investors to return as conditions and opportunities improve as the year progresses,” he says.

Hungarian Yields

Colliers put yields for Budapest at 6.25% for prime office, 6.75% for prime industrial and 8% for shopping centers. This compares to Prague, with the lowest yields in the region at 5.5% for prime office, 5.25% for prime industrial and 8% for shopping centers.

Colliers Hungary traced eight significant investment deals for 2023 in the office, industrial and retail sectors. In office, this includes the purchase of H2Offices by Erste fund from Skanska and the acquisition of RoseVille by BXR from Atenor.

Bence Vécsey, head of capital markets at Colliers Hungary, predicts an improving investment market in the country in the second half of the year. A decrease in value may boost activity, and financing will be more moderate. Finally, he says, ESG compatibility is a must. Turpin agrees and says the consultancy is well-placed to benefit from this latter trend.

“We have grown our ESG advisory services across the CEE in anticipation of this and across quite a wide spectrum of disciplines. From the environmental (‘E’) and social (‘S’) side, these include Leed, Breeam, Well, Fitwel [sic] and Access4You certifications, ESG due diligence, energy audits and energy procurement, through to employee engagement and well-being, to disclosure and reporting, to name a few,” the regional director says.

“The general consensus is that we are facing another challenging year when measured against the previous five- and 10-year investment volume averages (EUR 12 bln and EUR 11 bln, respectively).” He adds that improved economic indicators, a lowering of interest rate costs and an easing of geopolitical tensions would all help facilitate a return in investor confidence.

This article was first published in the Budapest Business Journal print issue of February 9, 2024.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.