R&D in Automotive Technology: Huge Potential for Hungary

Western European automakers, facing major challenges in R&D, can improve competitiveness in Central and Eastern Europe, according to the latest study by McKinsey & Company, presented in Budapest on January 23. This could also be a big opportunity for Hungary.

The European automotive industry has been a real success story, but is now facing huge challenges. Competition is increasingly coming from Asia, while it is simultaneously tackling a number of megatrends such as self-driving, e-mobility, connectivity and car-sharing, all of which require significant R&D investment.

In its report “Rethinking European Automotive Competitiveness: The R&D CEE Opportunity” consulting firm McKinsey concludes that Europe’s leading automotive position may be under threat. Compared to how the industry has evolved in the past, recent changes in the sector are more specific, because they are simultaneously faster, more complex and more disruptive, experts warn.

Software development is playing an increasingly important role in the automotive industry, so it is very important for European manufacturers to be able to compete in this field as well.

Automotive software development is expected to grow by 13% over the next five years, which will increase demand for software engineers by 6% year on year. Acquiring and retaining talent in these fields and high costs are all posing structural challenges for the European automotive industry and have a major impact on its competitiveness.

The consulting firm is convinced, however, that Western European automakers do not have far to go to solve these problems, just “next door” in Central and Eastern Europe.

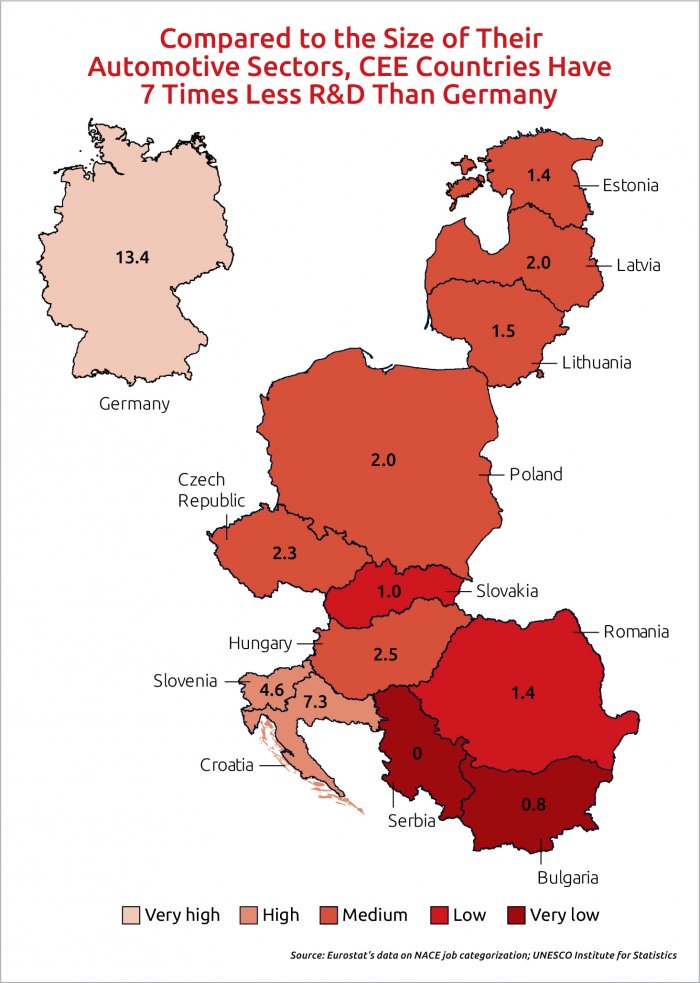

The deployment of R&D activities in the Eastern European region is an aspect that automotive manufacturers cannot ignore. For a start, there is room to breathe; R&D capacities are around seven times lower in CEE than in Germany.

There are 6.6 million skilled employees in the sector in the countries of the region, and since their wages are 60% lower than in more developed countries, it is affordable for manufacturers to outsource. Above all, this region is also an attractive option because of tax incentives for manufacturers and direct state subsidies. And even if that were not enough, the states of the region have an advanced infrastructure in terms of real estate, internet and terms of delivery.

Virtuous Circle

McKinsey’s experts seem to see the possibility for a virtuous circle. A broad-based automotive ecosystem extending across the region would boost local specialist training and further strengthen the entire R&D sector in the area.

In their recent study, the consulting firm identifies Western European automotive companies and Central and Eastern European countries as the main drivers of this potential change. However, it is essential that the car manufacturers decide on the targets at the CEO level, what further steps are needed in R&D, choosing the right location in Central and Eastern Europe and launching the necessary investments.

At the same time, countries in the region can anticipate change by encouraging the formation of regional clusters, encouraging business to engage with higher education, trade, civil and governmental institutions.

As a result, Central and Eastern Europe can develop an R&D-rich ecosystem that can have a positive impact on the economy of the region as a whole. The resulting values may also benefit other industries such as aerospace, defense and advanced electronics.

Moving R&D to Central and Eastern Europe is not the only option, of course. Asia is another option, as is outsourcing to specialist companies. That said, McKinsey lists five reasons working in the region’s favor:

1. Available Talent. In Central and Eastern Europe, only 10-15% less skilled labor is available than in Germany (6.6 million vs. 8 million), but labor market competition is much smaller, as global technology and computing firms are less present.

2. Competitive wages. Labor costs in the R&D sector are about 60% lower in Central and Eastern Europe than in the West.

3. Existing automotive capacities and R&D maturity. Many manufacturers are already present in the region, but its research and design capacity utilization rate is far from high, with R&D activity representing only 1.5% of value-added.

4. Advanced infrastructure. The CEE region has fast access to airports, modern highways and railways, and advanced digital infrastructure.

5. Government support. The countries of Central and Eastern Europe encourage technology investments in many ways, including tax breaks, investment grants, simplified review processes or support for training cooperation.

Shift in Global R&D Strategy

“Automotive manufacturers are increasingly competing with high-tech companies for leadership in the mobility industry,” said Andreas Tschiesner, the European leader in the automotive industry at McKinsey & Company.

“Skilled workforce will be a growing asset: the number of job vacancies in information technology and communications technology increased by 43% between 2016 and 2018,” he adds.

According to Tschiesner, in order to remain successful, the European car industry needs to carefully consider its R&D strategy. He believes the contribution of Central and Eastern Europe can be crucial.

“These companies and the CEE region as a whole will benefit from the R&D development of European automotive manufacturers here,” agrees András Kadocsa, McKinsey & Company’s head of automotive for Central and Eastern Europe.

“With the changes, Europe’s motor industry can become stronger and more agile, and Central and Eastern Europe become more competitive.”

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.