CEE-6 Investment Market Corrections to Continue in 2024

Kevin Turpin, head of CEE capital markets at Colliers, explains the CEE-6 growth figures.

Investment volumes for the Central and Eastern European six (Bulgaria, the Czech Republic, Hungary, Poland, Romania, and Slovakia) hit a 10-year low falling by 52% year-on-year for 2023, according to the latest figures from Colliers.

A period of “price discovery” will continue throughout this year at the same time as the imposition of ESG hits both buyers and sellers. Despite these issues, the CEE-6 still has investment potential, in the view of Colliers.

“Investor perception remains an issue from the outside, but companies within the CEE-6 enjoy robust results,” Kevin Turpin, head of CEE capital markets at Colliers, told the Sustainable Investment Breakfast by Colliers and Dentons at the W Budapest Hotel on April 11.

As a reflection of the central importance of environmental, social and governance concerns for all stakeholders, sellers are re-assessing their strategies and optimizing their portfolios in terms of letting capabilities regarding ESG compatibility.

“ESG compliance is becoming the market norm for investment transactions, reflecting a broader commitment to sustainability from all parties. However, given the current investment environment, the timing in terms of ESG costs is not ideal,” said Turpin.

He estimates a “good” CEE-6 market recovery would be between EUR 8 billion and EUR 10 bln and growing from there. In 2022, the CEE-6 investment volume was on par with the 10-year average at about EUR 10.7 bln. To put this into perspective, however, that figure is approximately 15-20% of the volumes for Germany for the same time frame.

In the current environment, Bence Vécsey, head of investment services at Colliers Hungary, estimates that the total investment volume for Hungary for 2023 could be around EUR 500 million. The country has generated about 10% of CEE-6 volumes from 2019 to 2023. According to Colliers figures, Poland, the leading CEE investment destination, recorded EUR 27 bln, the Czech Republic EUR 10.6 bln, Hungary EUR 5 bln and Romania EUR 4 bln.

Hungary Playing Catch-up

Over this period, Hungary has traded on»average EUR 950 mln a year, the Czech Republic EUR 2.1 bln and Romania EUR 800 mln.

“Therefore, there is quite some catching up for Hungary to do with regard to the Czech Republic and, given the current perception of Hungary (partly from a political risk angle), this may take a while. Romania is not far from Hungary by the investment average and could take the third spot,” commented Turpin.

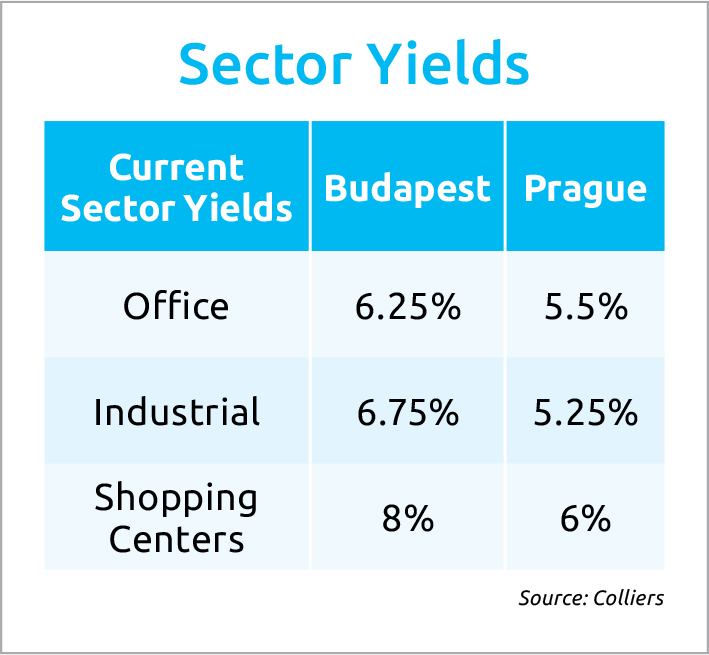

Budapest has current yields of 6.25% for office, 6.75% for industrial and 8% for shopping centers, according to Colliers. This provides a yield premium on Prague, which has the lowest yields in the region at 5.5% for office, 5.25% for industrial and 6% for shopping centers.

Budapest has a total office stock of 4.4 million sqm with a vacancy rate of 13%. Prime capital values for the office sector are significantly lower than in Poland and the Czech Republic. Industrial stock in Hungary stands at 5.1 million sqm, with a 7.6% vacancy rate. Capital values for Hungary are higher than those in Poland, although lower than those in the Czech Republic and Slovakia.

Regarding sources of capital from 2019 to 2023, the share of CEE-6 capital and international capital stands at 34% and 66%, respectively. However, the share of CEE capital in 2023 investment volumes reached approximately 56%. For Hungary, the amount of domestic capital in the investment market in 2023 was 62%, while for the Czech Republic, it stood at 46% and was a lowly 2% for Poland.

The Hungarian and Czech markets have traditionally always had a strong representation from domestic investors, while, in Poland, their role has been limited. Analysts now divide the source of money in CEE between domestic national investors, domestic regional investors, and international investors.

Sustainable Investment Breakfast by Colliers and Dentons at the W Budapest.

This article was first published in the Budapest Business Journal print issue of May 6, 2024.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.