On the Path to Being a European Cycling Powerhouse

Giant, the world’s largest bike producer, opened its second European plant in Hungary in 2019.

Whether making two- or four-wheeled vehicles, Hungary’s role in mobility is constantly strengthening. As an overview by the Hungarian Investment Promotion Agency (HIPA) showcases, the country is a leading industrial investment hub that no longer attracts just the attention of car and battery-making investors but is also on the right track to becoming a bicycle manufacturing heavyweight.

To claim that automotive is big in Hungary is an understatement. It is enormous and makes the country a sectoral powerhouse in the EU. Some 700 automotive companies, including five original equipment manufacturers with production sites here, three with service centers, and 66 TIER1 suppliers, produce half a million autos and 2.1 million engines per year.

Moreover, Hungary is the only place outside Germany that hosts production units of all three premium German carmakers (Audi, BMW, and Mercedes). On top of that, it is the largest battery cell producer in Europe; with manufacturing capacity to hit 150 GWh by 2025, it is sure to remain among the frontrunners.

Foreign direct investment fuels the engine driving those impressive figures to a great extent. HIPA guided 176 large FDI projects in automotive between 2014 and 2021 that generated an investment volume of more than EUR 9.6 billion and created nearly 40,000 new jobs. In the past three years, the battery industry alone mobilized EUR 6.2 bln in FDI. Year after year, automotive is one of the sectors that attracts the most capital from foreign investors.

Sector statistics include the performance of the bicycle industry, which has a tradition of more than 90 years in Hungary. While Csepel is the brand that has been around the longest, it is challenged by local, next-gen players such as Neuzer, Gepida, and Accell Hunland, whose high-quality products can also be found in some European shops. The ecosystem is further supported by Bosch’s activity specializing in e-bike powertrains and smart systems.

13 and Rising

According to Eurostat, Hungary ranks 13 in the EU regarding the number of bicycles manufactured. That position is set to improve soon, though. For one, HIPA is assisting leading Hungarian manufacturers in ramping up production. More importantly, Taiwanese-based Giant, the world’s largest bike producer, opened a new plant in Gyöngyös (80 km northeast of Budapest) with a EUR 48 mln investment in 2019 that is scheduled to produce up to one million units annually in a few years. These capacity expansions combined could propel Hungary to the top five largest bike manufacturers on the continent.

Giant’s Hungarian facility is the company’s second European location where bicycles are made. As chairperson Bonnie Tu notes, being a consumer-driven company, it wants to show its long-term commitment to dealers and consumers by being rooted in the market, not only through its brands and sales but also in manufacturing and supply.

“Hungary is at the center of a high growth potential region, with perfect conditions and location, a favorable business climate and policies, and an excellent place to develop cycling infrastructure and culture. Here is the right place for us to further expand, settle and cultivate for the future,” she explains.

The bicycle maker can be happy about its 2021 results, which saw revenues of USD 2.3 bln and 4.9 million units sold in the aftermath of the pandemic. However, gloom also looms over the industry. Supply chain disruptions, raw material shortages, and shipping delays are significant issues, not to mention the impact of inflation and the war in Ukraine. Recent lockdowns in China put an extra burden on production, delaying the ability to catch up with overdue orders.

“It will take us a lot of effort to rebuild and improve the fundamental basics,” adds Tu.

The good news is that the demand for bikes is at an all-time high. Rising environmental awareness is undoubtedly part of the story, but so is the post-pandemic trend that, after the lockdowns, people are just yearning to be outdoors, and ever more often on two wheels.

20 Year High

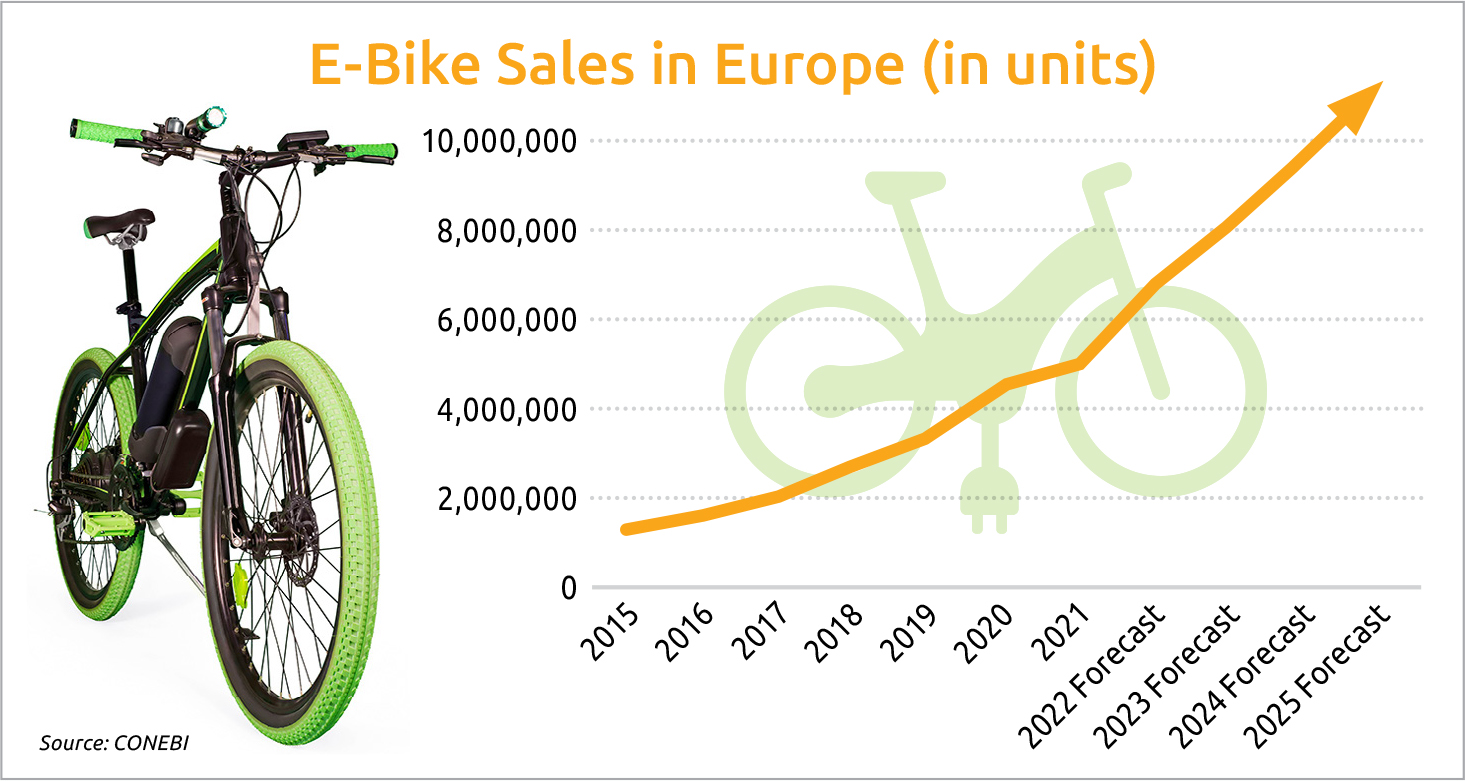

All this translates into purchases. As the Confederation of the European Bicycle Industry (CONEBI) reports, bicycle and e-bike sales totaled nearly 22 million in the EU and the United Kingdom combined in 2020, the highest figure in the past 20 years. One of the reasons behind this boom is the great innovation and continued development of bicycles. Giant, for instance, started e-bike R&D back in the 1990s.

Customer interest doesn’t show any signs of dropping, and in Hungary, it is also driven by programs like the grants offered by the Hungarian Ministry of Innovation and Technology, the second wave of which offers generous state subsidies for some 10,000 e-bikes. Tu expects the current boom to slow down but growth to continue in the long run. However, supply chains must be shortened, and although reshoring can help prevent disruptions, costs won’t drop much any time soon, which will keep prices high. Tu is still optimistic, though.

“We need to be brave to take the opportunity of growth and take our responsibility to continue pushing bicycles to the world because this is the right thing to do. We will invest more in onshore manufacturing, cluster the supply chain, and develop short-chain supply to be reliable and responsive to the market and our consumers,” she says.

“The bike industry will continue innovating and developing products to make cycling more comfortable, convenient, and connected.”

Momentum for European Cycling

The second most prestigious cycling race after the legendary Tour de France, the Giro d’Italia draws roadside crowds and TV viewers’ eyeballs on a massive scale. A feature is that the starting location for the Grande Partenza (literally the Grand Departure) has changed each year since the 1960s.

The cyclists of the 2022 edition departed from Budapest for the first time. On that occasion, HIPA, Giro organizer RCS Sport and CONEBI co-hosted a flagship event on the sidelines on what is shaping the industry in Europe.

The high-level speakers agreed that better infrastructure, more government subsidies, and raising social awareness are all needed to make cycling a natural everyday mobility option. Electrification is just as important to appeal to the larger public.

“We need to get decision-makers to be interested and make people aware of the benefits of cycling. We need to seize this momentum,” RCS Sport managing director Paolo Bellino concluded.

This article was first published in the Budapest Business Journal print issue of May 20, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.