MNB swap stock to fall HUF 38 bln after tender

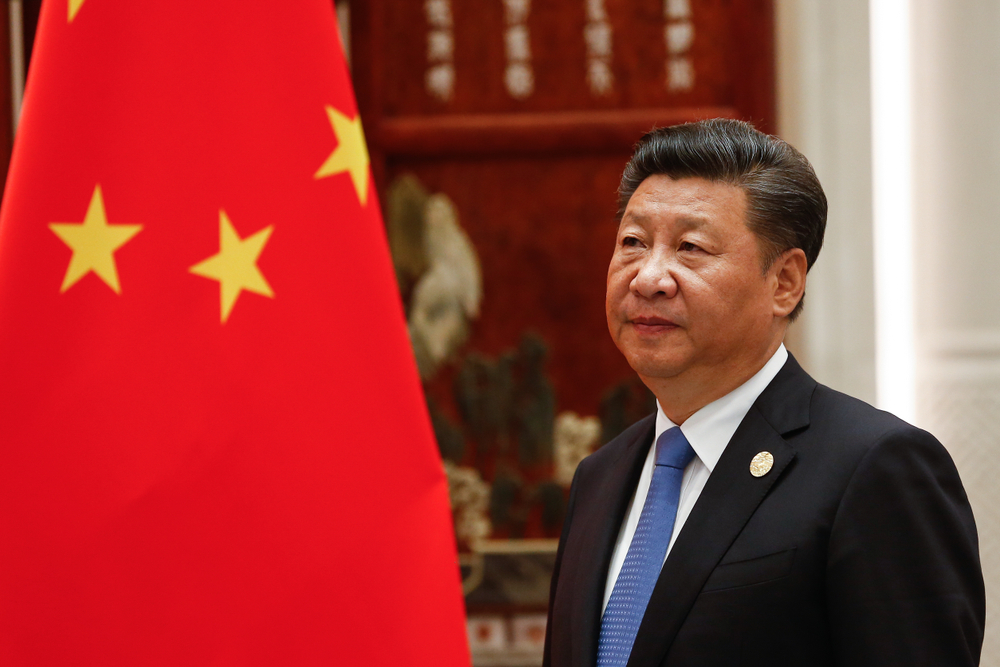

Photo by Adriana Iacob/Shutterstock.com

The National Bank of Hungaryʼs (MNB) stock of FX swaps, which the central bank uses to pump liquidity into the banking sector, will fall by about HUF 38 billion to HUF 2.235 trillion as the result of a weekly tender held on Monday, state news wire MTI reports.

Photo by Adriana Iacob/Shutterstock.com

MNB received bids for all four maturities - one-, three-, six- and 12-month swaps against euros - at the tender, but accepted none of them.

MNB data show about HUF 38 bln of swaps - HUF 25.11 bln of the three-month and HUF 12.67 bln of the six-month maturity - will mature on January 22, the value date of the tender.

After these redemptions, the swap stock will include HUF 83 bln of one-month, HUF 369 bln of three-month, HUF 683 bln of six-month and HUF 1.1 tln 12-month swaps.

The bankʼs policymakers decided at a meeting in December to crowd out HUF 300 bln-500 bln from central bank instruments that pay the base rate in Q1 2020, unchanged from the level set for the previous quarter. The rate-setters take the crowd-out level into account when setting the stock of MNB swap instruments.

Forint firms after tender result

The forint traded at 336.88 to the euro minutes before the tender results were announced, but firmed to 334.76 some 40 minutes afterward, suggesting the market interpreted the fall in the swap stock as policy tightening.

MNB has rejected all bids for some maturities at earlier FX swap tenders, but never all bids for all four maturities.

The bankʼs policymakers have left the central bank O/N deposit rate at -0.05% and the base rate at 0.90% unchanged since a policy meeting last March; however, they have tweaked monetary policy on a quarterly basis, coinciding with the publication of the central bankʼs Inflation Report, by adjusting the amount of liquidity to be crowded out from central bank instruments that pay the base rate.

MNB downplays change to swap stock

In a regular statement posted after the release of the tender results, the MNB reiterated that it is "prepared to change the swap stock in a flexible manner to ensure that interest rate transmission changes are in line with decision of the Monetary Council".

MNB explained that the swap stock is used as a counter to autonomous liquidity effects to achieve the crowd-out target, adding that "in itself, changes to the swap stock cannot be interpreted from the point of view of monetary policy".

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.