Poor Q4 2023 Data Overshadows January’s Headline Inflation News

The unexpected base rate cut of 100 basis points in late February undermined support for the forint.

At 3 p.m. on a Tuesday, Mammut Shopping Center in Buda has a fair sprinkling of visitors. If the linguistic clues were removed, the mall could pass for one of its Western European peers. Certainly Nick Shaishmelashvili, a teacher of English, on holiday from Tbilisi, Georgia, felt so.

“It’s very modern, very Western, yeah,” he told the Budapest Business Journal in a random encounter, only to add: “But it depends what you are comparing it to. When I was in Spain, there was a big difference. If you look at the streets, you can feel it. The ones here are like, Eastern, and Spain is more West.”

Indeed, had the Georgian ventured towards the back of the first floor of the Mammut I building, he might also have tempered his judgment on the mall. Your correspondent counted some 10 units closed or empty on this floor, clear symbols of the faltering Hungarian economy over the past 18 months, even if this evidence was well camouflaged behind colorful advertisements.

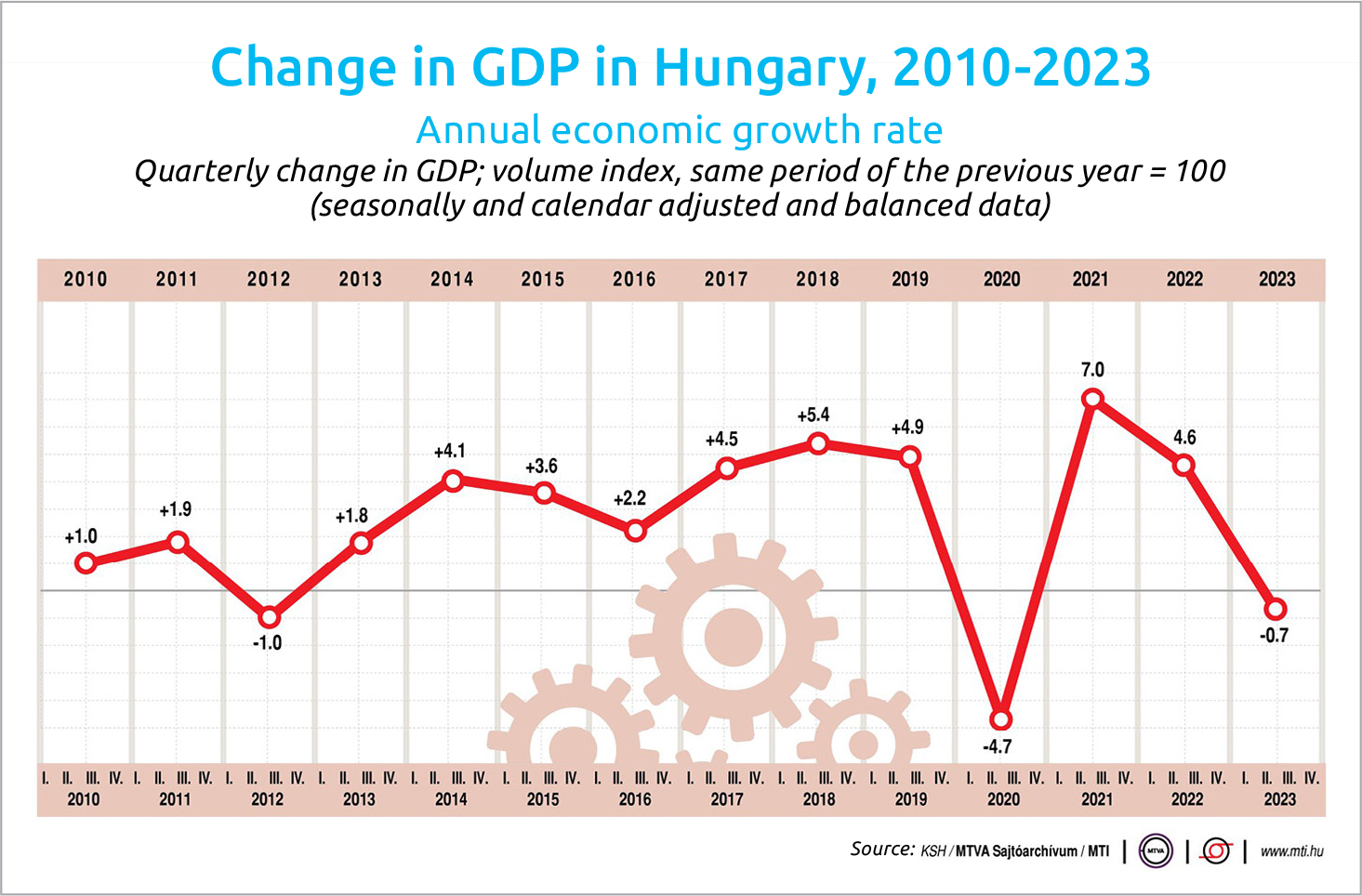

There is, however, hope of a return to some growth this year, even if results in the final quarter of 2023 disappointed. Unadjusted output for the quarter was unchanged, although it edged up by 0.5% when seasonally and calendar adjusted, the Central Statistical Office stated in its final reading, released on March 5.

This end-year weakness meant the economy for the full year contracted by 0.9%, or 0.7% when adjusted, compared to 2022.

“Agriculture saved the day, again,” OTP Bank Securities headlined its flash report the next day, further warning, “Domestic sectors may have hit bottom, but stagnation in Q4 and gloomy export outlook suggest that growth could be modest in 2024.”

Indeed, such was the impact of the agricultural sector, which expanded by almost 82% last year (following a drought-hit year in 2022) that its growth contribution was 2.5 percentage points to the final result.

Worse Than Expected

“Hence, the non-farm GDP contracted by 2.6% year-on-year in Q4, after shrinking by 4.1% in Q3 (and declining by 3.2% in 2023 as a whole). This 2.6% contraction was even worse than our -2% expectation [….] meaning that the growth structure was even worse than we had forecast,” OTP analysts lamented.

In particular, industry (down 6.4%) and construction (down 7.4%) played a significant role in the fourth-quarter data.

The downbeat GPD report somewhat obscured one item of what, at least initially, appeared as good news: the National Bank of Hungary (MNB) Monetary Council’s decision to cut the base rate by 100 basis points to 9% on Feb. 27.

Following four consecutive monthly cuts of 75 basis points, the decision came as some surprise, especially after what analysts described as the “hawkish tone” of the council’s January press conference.

However, the rate-setters felt emboldened by January’s headline inflation news, which saw CPI fall to 3.8%, the first time in 34 months 34 months that this indicator was within the MNB’s inflation target band of 3% +/- 1%.

Yet, given the many economic uncertainties, the likely one-off larger cut failed to please the markets and the forint began to slip in the wake of the announcement, falling to HUF 396.80 to the euro at one point on March 4, a 12-month low, before recovering to around HUF 394 as this paper went to press.

The poor fourth-quarter GDP news has dampened analysts’ hopes for the year, in contrast to the government’s current projections of 4% growth.

Harsh Reality Check

In an assessment entitled “Walking on thin ice,” written before the detailed fourth-quarter data was announced, the ING Bank team, headed by Péter Virovácz, wrote: “The economic recovery got a harsh reality check as GDP stagnated in 4Q23. [….] Against this backdrop, we lower our full-year GDP forecast from 3.1% to 2.1%, mainly due to a much less positive carry-over effect.”

Moreover, although the report acknowledges the surprise inflation numbers for January, it points out that it was primarily due to the base effect (CPI peaked at 25.7% in January 2023) and warns of an expected increase in inflation later this year.

“We will be closely monitoring the repricing of services, as we expect strong repricing in March and April on the back of price increases by telecoms, banks, and insurance providers,” ING said.

And, while headline inflation in the immediate future is likely to remain below the upper limit of the central bank’s tolerance band, “from May, we see a slight reflation driven by base effects. In this context, another round of reflation will emerge towards the end of the year, hence our call for year-end inflation in the range of 5.5-6%,” it argues.

As a result, the ING team sees the base rate falling to 6.5% at the June rate-setting meeting but then sticking at this level, with year-end inflation in the range of 5.5-6%.

However, the owners of Mammut and other malls can take heart, as ING has good news for the retail sector.

“Consumers will receive a significant income boost from retail bond coupon payments throughout the first quarter (approximately 2% of GDP), which, if not reinvested, will support consumer spending, while consumer confidence is trending higher,” the ING analysts predict.

OECD Cautiously Optimistic on Hungary, but Outlook ‘Subject to Significant Risks’

Economic output in Hungary is projected to hit 2.4% this year, compared to 2023, but the outlook remains “subject to significant risks,” the OECD warns in its latest report on Hungary, released shortly before this edition of the BBJ went to press.

In its report, the Paris-based organization details a long list of concerns regarding Hungary and its economic policies, which, it argues, hamper economic development.

“Beyond uncertainty related to inflation and energy prices, rising business failures may cause an increase in non-performing loans, which would further reduce credit distribution and weigh on economic activity,” it states.

Furthermore, while any “incomplete or late delivery” of European Union funds that are currently subject to the implementation of rule-of-law reforms in Hungary constitute “another key risk for investor confidence, the cost of capital and the exchange rate,” in addition to the direct negative impact this loss will have on investment and public finances.

Among the many factors the survey urges policymakers to address, it turns the spotlight on poor productivity growth (although this has seen improvements since 2016) and the need to focus on more inclusive growth, that is, to reduce inequalities of opportunities between men and women and between income groups.

“Social transfers keep income inequalities and poverty low. However, those in the upper-income quintile receive a larger share of social transfers than those in the lower-income quintile,” the OECD points out. It advocates better targeting of social transfers to achieve the same redistribution but in a “more cost-effective way.”

It also blames the education system for failing to assist those from a poor socio-economic background to develop their economic potential, noting that “on average, it takes seven generations for children in the lowest income decile to reach an average income level.”

In short, if you are born into a low-income family, your chances of making even an average income in Hungary are extremely remote.

This article was first published in the Budapest Business Journal print issue of March 8, 2024.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.