Inflation Closer to Central Bank Target, for Now

Annual inflation slowed to 3.6% in March from 3.7% in the previous month. It confirms that the price index is still slowing for now, although higher figures are expected for the rest of the year. February Industrial production data brought some good news, but construction data suggests that the sector lost its momentum in the second month of the year.

The March inflation data confirms that the massive price rises are over in Hungary. Food prices, in particular, slowed the inflation figure, with the rate of price increase of only 0.7% on an annual basis, within which the Central Statistical Office (KSH) measured only a 0.1% increase in one month in March.

Overall, consumer prices increased by 3.6% on average in March 2024 compared to the same month in 2023. The index rose by 0.8% on average on a monthly basis.

According to ING economist Péter Virovácz, the joy of seeing the data is somewhat clouded due to the one-month repricing. In the last two months, the general price level rose by 0.7%, and repricing even accelerated in March to 0.8%.

Overall, there is still significant inflationary pressure in the Hungarian economy since to reach the 2-4% inflation target sustainably, one-month inflation should be around 0.2-0.3%, Virovácz says.

The service sector accounts for 72% of the 3.6% inflation, which means that, as in other developed countries and in the regional neighbors, this item is now causing the biggest headache for monetary policy. All the more so because this type of inflation is more likely to stay than the price effect of items outside the core inflation basket, the analyst notes.

Weaker Repricing

“In April, we expect that the monthly repricing will be slightly weaker than the indicator seen in the last three months,” says Virovácz. This can primarily be related to the seasonal price changes of food and clothing items.

He also expects that the increase in fuel prices will stop, primarily as a result of negotiations between the government and MOL. On the other hand, the price increase of services may continue. As a result, the consumer price index will be able to stay around the current level for a while on an annual basis.

After that, however, the inflation indicator may begin to rise again; that is, the inflationary picture that now seems more favorable will gradually start to deteriorate.

“We continue to expect a two-round reflation. The first round is expected to start in May and the second in October. As a result, our inflation forecast for December 2024 remains unchanged in the range of 5.5-6%, currently closer to the top of the range,” Virovácz concludes.

According to Gábor Regős, head economist at Gránit Alapkezelő, the latest inflation data does not pose an obstacle to the further relaxation of monetary policy. He adds that, in this regard, the limits are less Hungarian inflation but rather the monetary policy of the regional and large central banks. From this point of view, the U.S. inflation data, which was again minimally higher than expected, does not help so that it may point to a later start in the Fed’s easing.

Péter Kiss, Amundi’s investment director, says that due to the running out of base effects and seasonality, he expects a fluctuating increase in inflation from May, with a year-end figure of 4.6%, marginally above the inflation target band. He also thinks that the central bank will continue the interest rate cuts in its predicted, slower schedule regardless of the latest inflation data.

Significant Volume Increase

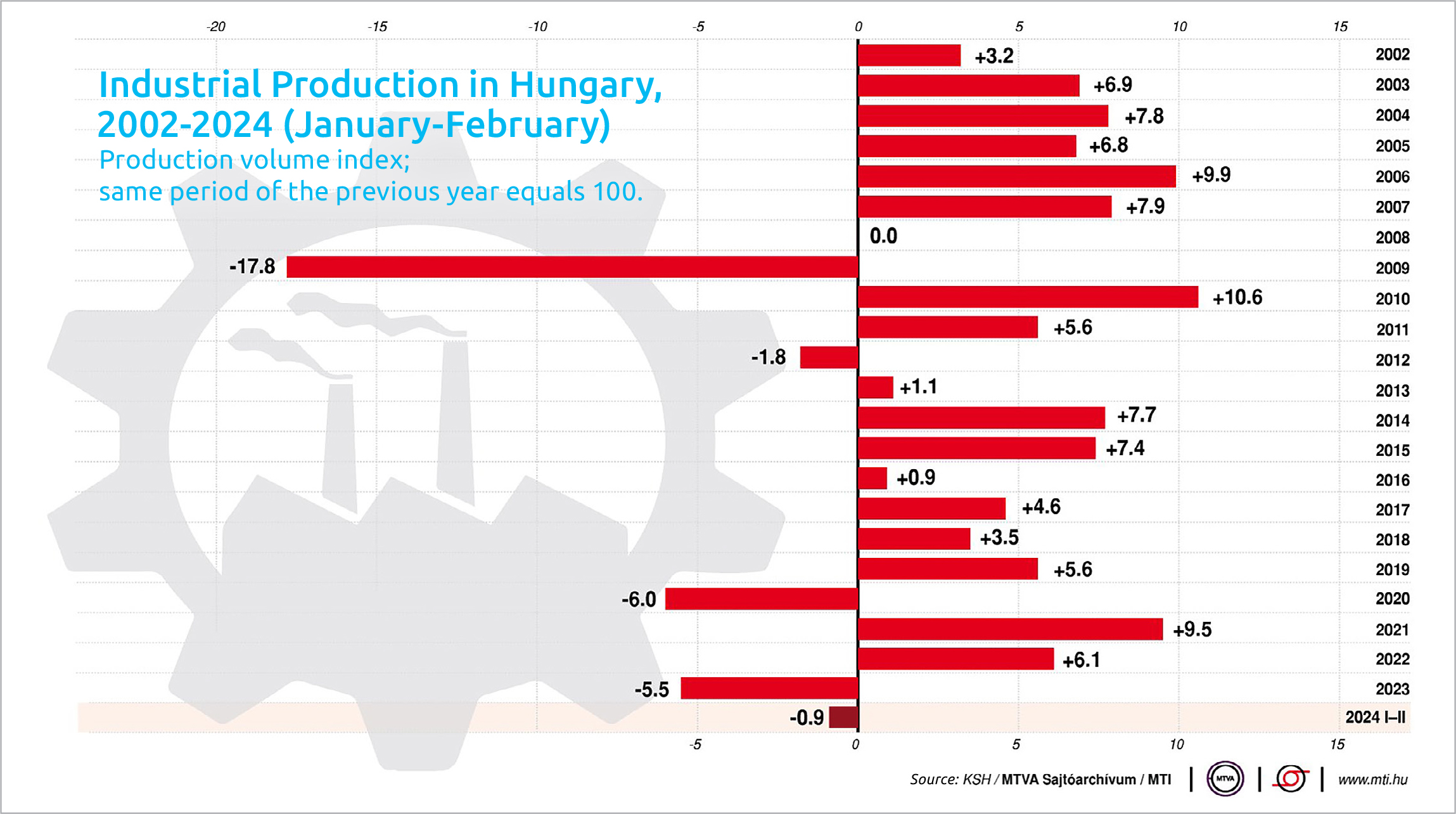

The volume of industrial production increased significantly in February by 3.5% compared to the previous month, KSH has reported. This is the first really meaningful indication in a long time that there is growth potential in the industry, but the detailed data confirms that one-off factors may also have contributed to the rise.

The outlook for the industry, however, remains mixed. Even during the investment downturn of the past year and a half, the sector was in an active capacity expansion phase. But it seems that, for the time being, performance is much more affected by the weakening of external demand, where no signs of recovery are visible yet.

With the latest data, the downward trend of industrial production has not yet been broken, although there is a chance that the trend will become more stagnant in the coming months. In any case, the rebound in February was significant in that the average performance of the first two months of the year is the same as that seen in the fourth quarter of last year.

This means that if the March data does not bring a significant decline, the industry will probably not contribute negatively to the GDP growth in the first quarter.

The performance of the construction sector, meanwhile, more closely resembles a rollercoaster: the volume of production decreased by 8.5% in February compared to the previous month, following a massive rise of 10.1% in January.

According to the most recent data released by the KSH, construction output volume, based on raw data, surpassed the previous year’s level by 3.2% in February 2024. Of the main construction groups, buildings increased by 2.8%, while civil engineering grew by 4.4%. However, based on seasonally and working day adjusted indices, construction output was 8.5% lower than in January.

According to analysts, after the substantial jump in January, even the decline in February does not seem so bad. The first quarter of this year is expected to be stronger than the last quarter of last year.

This article was first published in the Budapest Business Journal print issue of April 19, 2024.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.