MNB puts fiscal impact of pandemic measures at 7.3% of GDP

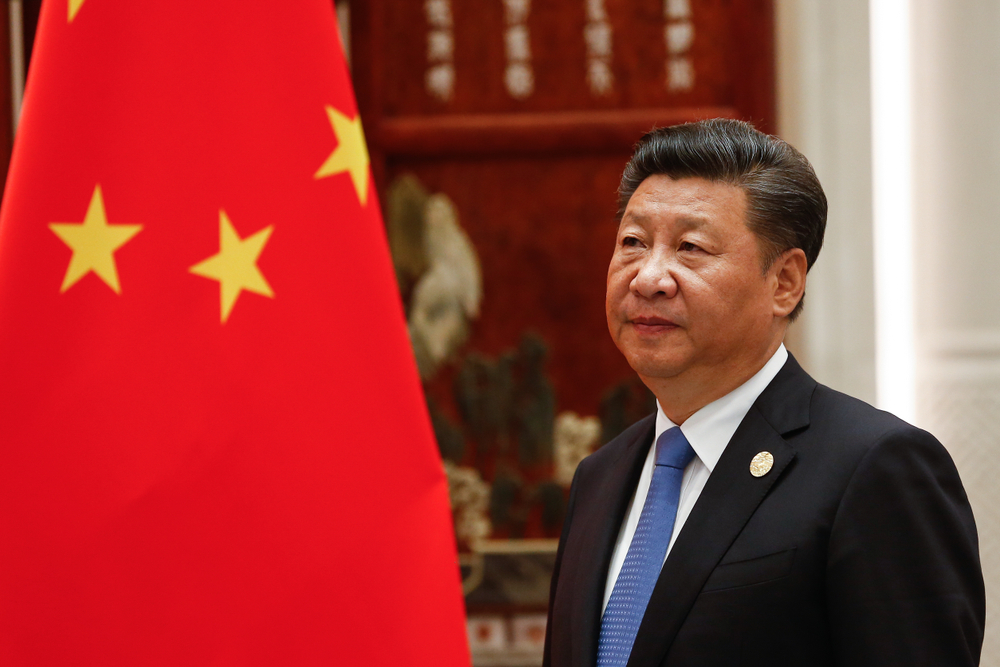

Photo by Adriana Iacob/Shutterstock.com

The National Bank of Hungary (MNB) estimates the direct cost of government measures to manage the impact of the pandemic on Hungariansʼ health and the economy will add up to the equivalent of 7.3% of GDP this year, according to a report by state news wire MTI.

Photo by Adriana Iacob/Shutterstock.com

MNB said in a biannual assessment of budget trends that reallocations, fiscal reserves, tax increases - such as the sectoral tax on retailers and the boosted bank levy - and rechannelled European Union funding could cover a "significant part" of the pandemic expenditures, reducing their net fiscal impact to 3.2% of GDP.

A breakdown of the HUF 3.405 trillion of pandemic expenditures in the report shows healthcare defense measures reaching HUF 801 bln, or 1.7% of GDP, tax cuts and subsidies for families HUF 409 bln, or 0.9% of GDP, economic defense programs HUF 1.86 tln, or 4% of GDP, and workplace preservation and creation as well as development spending HUF 335 bln, or 0.7% of GDP.

Covering those additional costs are HUF 1.911 tln in revenue, equivalent to 4.1% of GDP, including HUF 1.451 tln, or 3.1% of GDP, in reallocations, HUF 125 bln, or 0.3% of GDP, in revenue-boosting measures, and HUF 335 bln, or 0.7% of GDP, in rechannelled EU money.

The economic slowdown could reduce this yearʼs tax revenue by HUF 1.16 tln-1.3 tln, equivalent to 2.5-2.8% of GDP, according to the report.

MNB estimates the general government deficit will reach 7-7.5% of GDP this year and said the scale is "average" in EU comparison.

Governmentsʼ own projections show deficits in the EU as a whole reaching 8.4% of GDP this year. Deficits in the other Visegrád Group countries - the Czech Republic, Poland, and Slovakia - are expected to average 9.8% of GDP.

MNB said the fiscal impact of pandemic expenditures is likely to raise Hungaryʼs state debt relative to GDP to 76% this year from 65.4% at the end of 2019. That increase is still well under the average 16-percentage-point rise expected across the EU, it added.

State debt relative to GDP could start falling again from 2021, the report shows.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.