Weak Forint, Sluggish Industrial Performance Only Temporary

Hungary’s industry barely expanded in May, while the June consumer price index exceeded the central bank’s mid-term goal of 3%. In the meantime, the Hungarian currency has experienced all-time exchange rates high against the euro in the past few days.

Hungary’s industrial output rose 0.4% year-on-year in May, the Central Statistical Office (KSH) said in a first reading of data on Friday. If adjusted for the number of working days – of which there was one more in the base period –, output climbed 3.8%. The weaker data comes after a strong few months: In April, output rose by 7.8% according to unadjusted data, and by 2.9% according to adjusted data. In a month-on-month comparison, output in May was up a seasonally and working day-adjusted 1.9%. For the January-May period, output rose 3.1% year-on-year.

The low output growth comes from a higher base, Miklós Paczari, a KSH department head said in a comment reacting to the data.

But there is no need to worry: analysts unanimously say that the weakening of the industrial performance is only temporary. Industrial output growth could become stronger again in the coming months on the installation of new production capacities and the favorable outlook.

The government has also argued that the economic output does not explain the depreciation of the forint.

“We do not exclude that speculative processes are behind this,” said government spokesman Zoltán Kovács, without giving details, index.hu reported. That is a view the central bank has openly disagreed with.

Péter Virovácz of ING Bank noted that the month-on-month output growth has seen the strongest increase this year. He emphasized that if segments with a relatively low contribution to the GDP can maintain their currently strong growth rate and the automotive industry can shift into a higher gear, then industry will not be a drag on a full-year GDP growth of more than 4%. Such a positive scenario is further strengthened by the fact that German industry has finally produced better figures.

Stronger Performance

András Horváth of TakarékBank also predicts stronger performance for industry in the coming months, noting that the low base of the second half of the last year can also add to the growth, in addition to the new capacities. Due to the strong domestic demand, domestic sales within industry has an ever growing role, and this tendency is supported by the recent boom in the construction sector, he added.

According to the analyst, working day-adjusted industrial output growth could accelerate to 6.5% this year, from 5.6% in 2017, and unadjusted growth to 6%, from 4.8% in 2017. TakarékBank therefore predicts GDP growth of 4.6% for the full year, and with some upward risks, this figure can even be higher.

According to Erste Bank analyst Orsolya Nyest, the May performance of industry was actually a positive surprise, taking the 3.8% working-day adjusted annual growth rate into consideration.

She added that the latest data shows how uneven the performance of industry is. She, however, does not expect the positive trend to change, although she also does not rule out the possibility of a lower-than-expected growth rate for the full year.

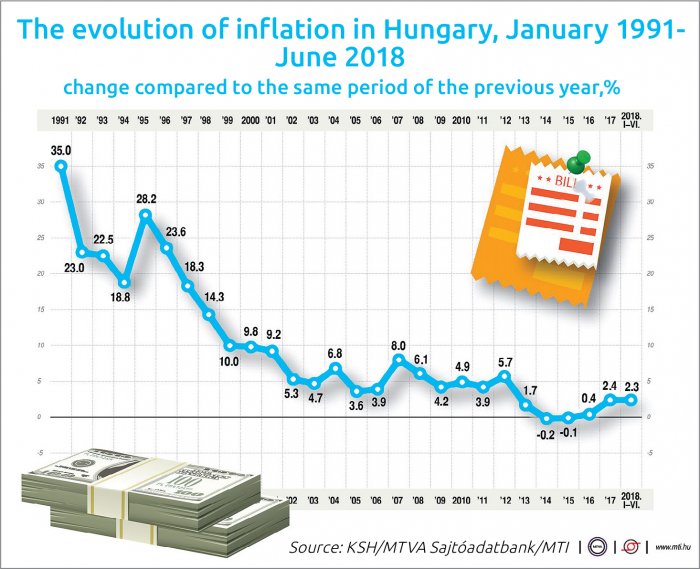

The KSH has also published its consumer price index for last month. Figures show that annual inflation was 3.1% in June 2018, a 0.3 percentage-point increase on the previous month.

Core inflation stood unchanged at 2.4%, while core inflation adjusted for the effects of indirect taxes was up 0.1 of a percentage point to 2.3%.

The swing is only temporary here, too, as according to the projection in the MNB’s June “Inflation Report”, inflation has temporarily risen slightly above 3% driven by the sharp increase in oil prices. Nevertheless, it added, the 3% inflation target will be achieved in a sustainable manner by mid-2019.

Passing Phase

Analysts questioned by state news agency MTI also see it a passing phase. Péter Virovácz of ING Bank said inflation could rise higher than 3% over the summer, and the weakening of the forint and higher oil prices pose a risk. However, inflation could still average 2.8% for the entire year, he added.

Gergely Suppan of TakarékBank said inflation could be around 2.7% for the full year. Inflation could fluctuate around 3% next year and average 2.8% for the year as a whole, he added.

K&H Bank chief analyst Dávid Németh noted how fuels and tobacco products had pushed inflation higher in June, adding that without these products inflation would have been unchanged from the 2.8% rate recorded in May. He predicted that CPI could stay above 3% for the remainder of the year and even reach 3.3-3.4% by December, but concurred that it should still average 2.8% for the year as a whole.

In the meantime, the Hungarian currency has been depreciated to record lows recently, even hitting the 330 mark against the euro. Analysts and the government agree that there are no macroeconomic reasons for the weakening forint, as the fundamentals of the Hungarian economy are stable.

At the end of June, National Bank of Hungary (MNB) governor György Matolcsy was summoned to appear before the Parliamentary Budget Committee on July 4 in order to provide an explanation for the depreciation of the currency. In a response issued by the MNB, it said it is only the Parliamentary Economic Committee that, under the law, has the right to hear the governor of the MNB, and therefore Matolcsy did not show up before the committee.

As reported by MTI, the MNB claimed in its statement that László Varjú, chairman of the Budget Committee and an MP of the opposition DK party, had initiated the hearing “without knowing the central bank act, solely for political gain, while the central bank act clearly states that the primary goal of the MNB is reaching and maintaining price stability.”

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.