Sun Still Shines on Hungarian Economy, but Clouds Gather

In its latest economic survey of Hungary, the Organization of Economic Cooperation and Development (OECD) paints a very positive picture of the country’s recent economic performance, though it warns of pitfalls and serious challenges ahead.

When it comes to praise for Hungary’s economic performance and policies, it doesn’t get much better than that from Alvaro Pereira, Director of Country Studies in the OECD Economics Department.

“It’s fair to say that Hungary stands out as one of the best performing economies in the OECD in 2018,” he said when presenting the Paris-based institution’s latest assessment of Hungary in Budapest on January 31.

“If you want a headline for this survey, Hungary has been outstanding in terms of performance in the OECD, so well done!” he effused.

The Portuguese economist, forecasting 3.9% GDP growth this year, went on to “congratulate the government for continuing to take action to tackle some important issues”, noting the administration’s efforts to broaden the tax base while introducing a flat-rate, personal income tax of 15% and slashing the corporate levy to a single-digit 9%.

Inevitably, given the nature of economic developments, there are potential pitfalls ahead.

“Watch out!” Pereira warned, because the slowing world economy is likely to lead to weaker export demand. Rising wages within Hungary are also adding to inflationary pressures, and if not matched by productivity improvements, could damage the country’s competitiveness.

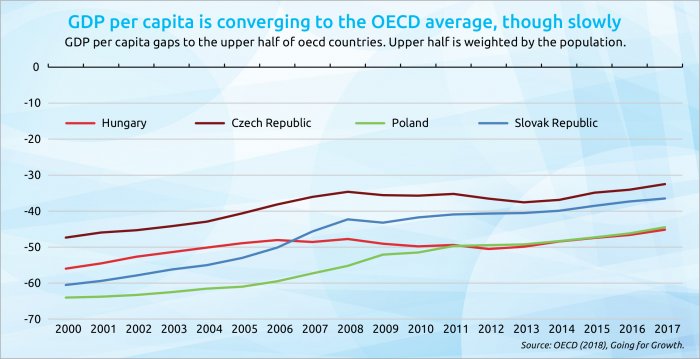

“Wages have been growing at double-digits for the last two years, and it’s important because there is still way to catch up compared to the other Visegrád countries, [….] but if they grow too fast for too long, they might affect external developments, and they might have an impact on your whole economy,” he cautioned.

Left Behind

Some areas and income groups have also missed out on the economic recovery.

As an example, Pereira pointed to the success of Budapest and northwestern Hungary in attracting foreign direct investment, but as a result of this concentration, “many poorer, rural regions, have been left behind, as their economic activity does not allow them to integrate into local or national supply chains”.

Indeed, this process has led to a two-speed economy and a widening divide between the “have” and “have-not” regions, and the government needs to boost what he termed the “spill overs”, meaning the transfer of skills, know-how and technology from efficient, productive foreign-owned companies to domestic operations.

“Making the domestic producers stronger, with a comprehensive SME strategy, is very important for Hungary, and it’s very important for boosting productivity [country-wide],” he said.

Along with the need for more inclusive growth policies, Pereira emphasized that the survey dealt in depth with the issues of ageing and the problem of funding healthcare and pensions.

Hungary faces “at least a 50% increase” in ageing costs, he warned, declaring that without reform policies the current system “is not sustainable”.

An overview of the 2019 OECD survey on Hungary is available at the OECD website (oecd.org).

Independent Domestic Economists More Downbeat Than OECD

In line with the OECD findings, a panel of domestic economists and financial experts, speaking to foreign journalists on February 11, hailed the recent success of the Hungarian economy and noted some of the same resulting weaknesses and disparities.

However, in contrast to the Paris-based institution and its envoy, Alvaro Pereira, the panel attributed this success more to external factors rather than government policies, and, in the wake of the 18% wage award to Audi workers at the end of January, expressed more concern about the resulting inflationary pressures and loss of competitiveness.

“The Germany economy, so long as it holds up, underpins the Hungarian export sector; credit growth is strong, household consumption is strong, wage growth is strong and, first and foremost, EU funds are flooding into Hungary,” Tamás Simonyi, senior director and head of CEE Financial Institutions M&A Advisory with KPMG in Budapest, said, adding: “I can’t really recall such extremely advantageous and comfortable external conditions for the Hungarian economy in my lifetime, which didn’t start yesterday.”

Zoltán Török, head of research at Raiffeisen Bank, stressed that, good as it is, the recent Hungarian economic performance is far from unique across the region.

“Not only the Visegrád countries, but also [in] Serbia, Croatia and Bulgaria, Romania, you see very similar developments. So, relatively strong growth, the external accounts are mainly positive, and unemployment rates are also at record low levels,” he noted.

Indeed, given that from around 2005 to 2014 wages generally stagnated in Hungary, growth in recent years has been long overdue.

“Hungary does not [only] need to converge to Western European wages, but first to Central European and Visegrad countries,” he said.

EU Role

András Vértes, chairman of the GKI Economic Research Institute, returned to the issue of European Union funding, stressing its importance in bolstering the economic recovery in Hungary. (Surprisingly, the OECD survey barely mentions the role of EU funding.)

“Hungary got from the European Union in net terms EUR 3 billion per annum over the current seven-year [EU funding] period,” Vertes said, adding: “This is 2.5% of GDP. Very high numbers. Practically, Hungary got more EU funding than all other Visegrad countries on a per capita and GDP basis.”

But this is set to be cut to between EUR 1.5 bln-1.7 bln net per annum for the next funding period, beginning in 2021.

While the final figures have yet to be agreed, according to Vértes, the transfers “will not be too much from these numbers, ... so, [just] 1.5% of GDP”.

This will result in “important questions for the Hungarian economy”, he said.

Vértes also had blunt words on recent wage trends. “There are problems with very high wage increases in Hungary; 8-10% real wage increases based on 4% GDP growth is too much, it’s impossible to maintain this long-term,” he said.

Both Török and Vértes are more pessimistic on GDP projections than the OECD, with Raiffeisen forecasting 3.5% growth this year and 2.2% in 2020 – versus the OECD’s 3.9% and 3.3%.

As Vértes put it: “After 2020, growth will be lower. Nobody knows exactly, but the situation will worsen very strongly.”

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.