Quiet Year in Real Estate Investment Market Expected

.jpg)

The Green Court Office complex in Budapest. It was acquired by Groupama Gan REIM on behalf of French investor SCPI Affinités Pierre from Belgian developer Codic Hungary and its partners Picton Group and Pesti Házak for EUR 77.1 mln in late November 2022. It was one of the most recent significant office deals in Hungary.

A quiet summer and a subdued year are predicted for the investment market by commentators, reflecting the cautious wait-and-see strategy being adopted by investors toward Hungary and, indeed, the broader CEE region and Europe as a whole. This reflects the unstable geo-political environment and the resulting economic and financial uncertainty.

“We are seeing a sharp downturn in activity and a longer period of ‘price discovery’ during which the expectations of sellers and buyers are not matching,” comments Benjamin Perez-Ellischewitz, principal at Avison Young Hungary.

“I don’t think we will witness a serious improvement in volume traded before the end of the year. We are going through a market correction in CEE and Hungary. Some deals are in discussions at a different price point than earlier, but the transactions are taking longer to materialize, and the attrition-stroke-failure rate is much higher than before due to the difficulty with regard to ‘price’ and the lack of debt finance,” he adds.

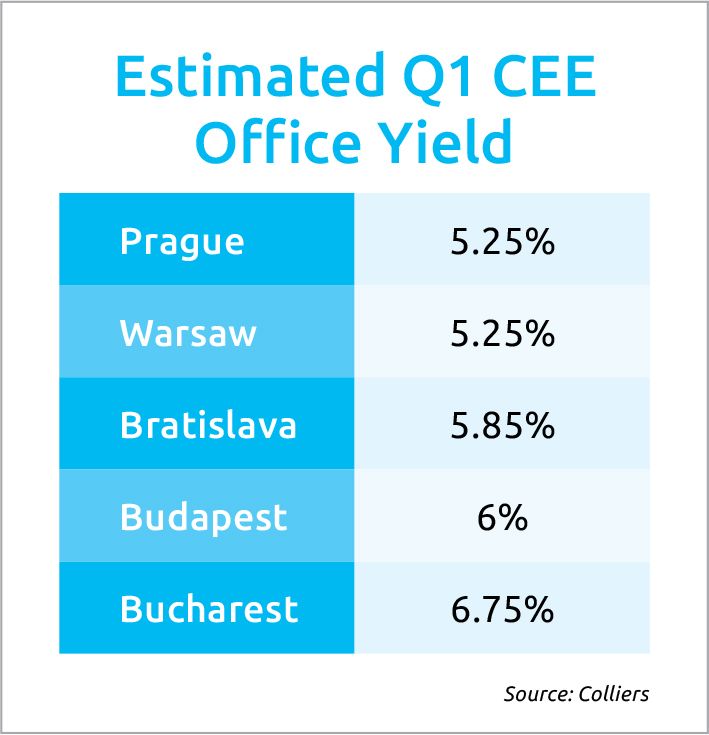

In this situation, vendors and investors are exercising caution in anticipation of more predictable yields and pricing levels. Earlier in summer, Colliers put prime Budapest office yields at 5.75%, industrial at 6% and shopping centers at 6.5%. Office and shopping center yields are expected to move out, with industrial remaining constant. This provides a yield differential of around 100 basis points compared to Prague, where prime office yields stand at 5%, industrial at 4.75% and shopping centers at 5.75%.

Perez-Ellischewitz estimates that the market has already digested a move out of yields by 100 basis points on the prime segment and 200-300 basis points on anything less core.

“We have seen a significant price change with the outward shift of yields; in some cases, it is more drastic than in others, but, generally speaking, the current market bodes well for opportunistic investors. This is a good time to buy, but not the best year to sell,” comments Máté Galambos, director of leasing at Atenor Hungary. The developer has office projects that are possibly available to investors.

“The fact that new foreign capital keeps showing up on our market is promising. I envisage multiple significant office transactions this year. Office yields are moving in the range of 6.5-8.5%, depending on the location, age, and technical features of the building,” he says.

Billion-euro Market?

Kevin Turpin, head of CEE at Colliers, estimates the CEE investment total for 2023 to be in the range of EUR 7 billion-10 bln. Hungary is expected to be between EUR 750 million-1 bln.

“Everybody is nervous as there are no deals. We expect a quiet summer and possibly a turn in the market in the fourth quarter of the year or the first quarter of 2024. A total investment of up to EUR 1 bln for the year would be a [plausable] figure,” comments Gábor Borbély, director of research and business development at CBRE Hungary. That pause provides opportunities for investment consultants to take an extended break and consider investment strategies for when the markets do pick up.

Perez-Ellischewitz considers that, realistically, the total volume in the Hungarian investment market will remain below EUR 400 mln if arm’s length transactions are accounted for.

“The major problems facing the investment market are, firstly, a lack of debt finance from senior banks and a lack of debt on the alternative debt market, and, secondly, the difficulty of pricing the risk in this period of uncertainty and deteriorating fundamentals,” he says.

Despite the dominance of domestic capital, he expects more transactions involving international money to materialize towards the end of the year and early 2024.

This article was first published in the Budapest Business Journal print issue of July 28, 2023.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.