Investment Shows Signs of Uplift

GTC Green Heart in Belgrade.

Global commercial real estate firm Avison Young has traced EUR 4.2 billion in investment volume for the first half-year in the Czech Republic, Hungary, Poland, Romania, and Slovakia. The consultancy recorded EUR 2 bln in Poland alone.

This follows the established pattern with Poland as the dominant investment market in Central and Eastern Europe, followed by the Czech Republic, Hungary, and Romania.

In a recent transaction already reported by the Budapest Business Journal, the Hungarian investor Indotek Group decided to purchase the GTC Belgrade office portfolio for EUR 267.6 million. The agreement will cover the sale of 11 buildings with a combined total of 122,000 sqm in five business parks.

According to analysts, once completed in this third quarter, the deal will become one of the CEE market’s most significant real estate transactions in the last five years.

Volumes should be relatively similar to 2020 at around EUR 10 bln for CEE and some EUR 1.1 bln in Hungary, according to Avison Young.

“After a quiet period in mid-2021, there is good momentum and a significant number of deals in the pipeline. I am confident on the activity level in the coming months,” comments Benjamin Perez-Ellischewitz, principal at Avison Young Hungary.

Domestic investors are particularly active in Hungary and the Czech Republic: in H1 2021, the share of domestic investors in Hungary stood at 80% and 44% in the Czech market. Across the whole year in 2020, the proportion of domestic investors was 52% in Hungary.

Local Capital

“On top of the usual Austrian and German capital active in the Hungarian, Czech, and Romanian markets, those countries have seen a real development of local capital pools in the last few years,” Perez-Ellischewitz notes.

“Evolution of the legislation and the financing and tax framework have allowed for those developments,” he adds.

These domestic investors are also looking at possibilities in other parts of the region, given the lack of opportunities in their markets, and are, in effect, becoming regional players. Perez-Ellischewitz points to Futureal, Indotek, and Wing are Hungarian examples of this phenomenon.

Looking at the performance of various sectors concerning investment grade stock and pipeline, Perez-Ellischewitz argues that what he calls the “doom scenario” for office will not happen, and he is confident of its performance in the long run.

“Obviously, as always, you have to be selective and different assets will fair differently. I think that the end of the debt moratorium will trigger an adjustment of prices in the hospitality sector. The logistics market is, of course, very hot currently.”

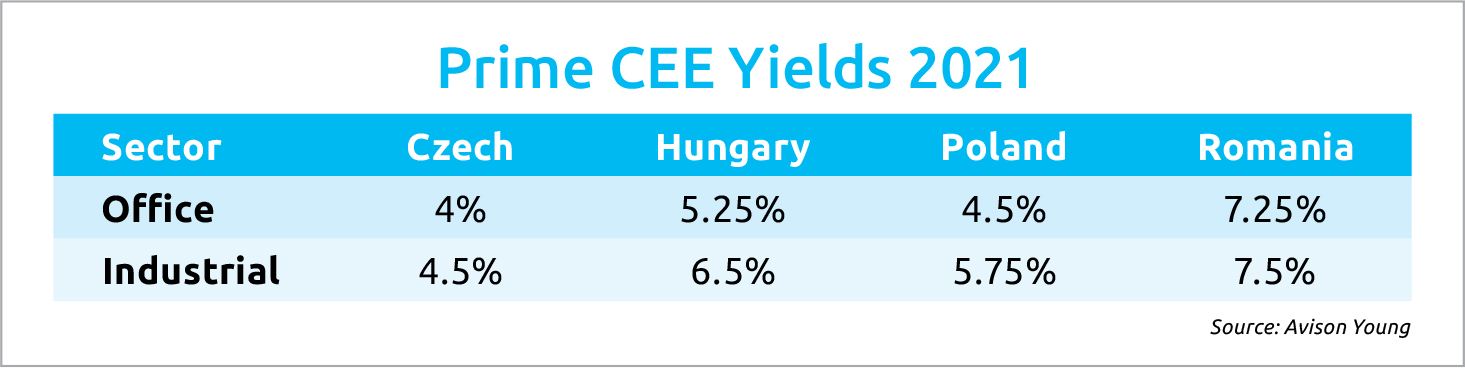

Yields are expected to remain stable for now in all assets classes, but a sizeable compression on logistics in the coming months to below 6% is predicted. A significant differential of 100-150 basis points continues between Hungary, the Czech Republic, and Poland reflecting investor preferences.

This article was first published in the Budapest Business Journal print issue of October 22, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.