Return of Greenfield Investments Augurs Well for FDI in 2022

Róbert Ésik

In an exclusive, in-depth interview, Hungarian Investment Promotion Agency CEO Róbert Ésik talks to the Budapest Business Journal about another record-breaking year for FDI, investment trends, expectations for 2022, and involving Hungarian SMEs in the multinational value chain.

BBJ: What are the final figures for 2021?

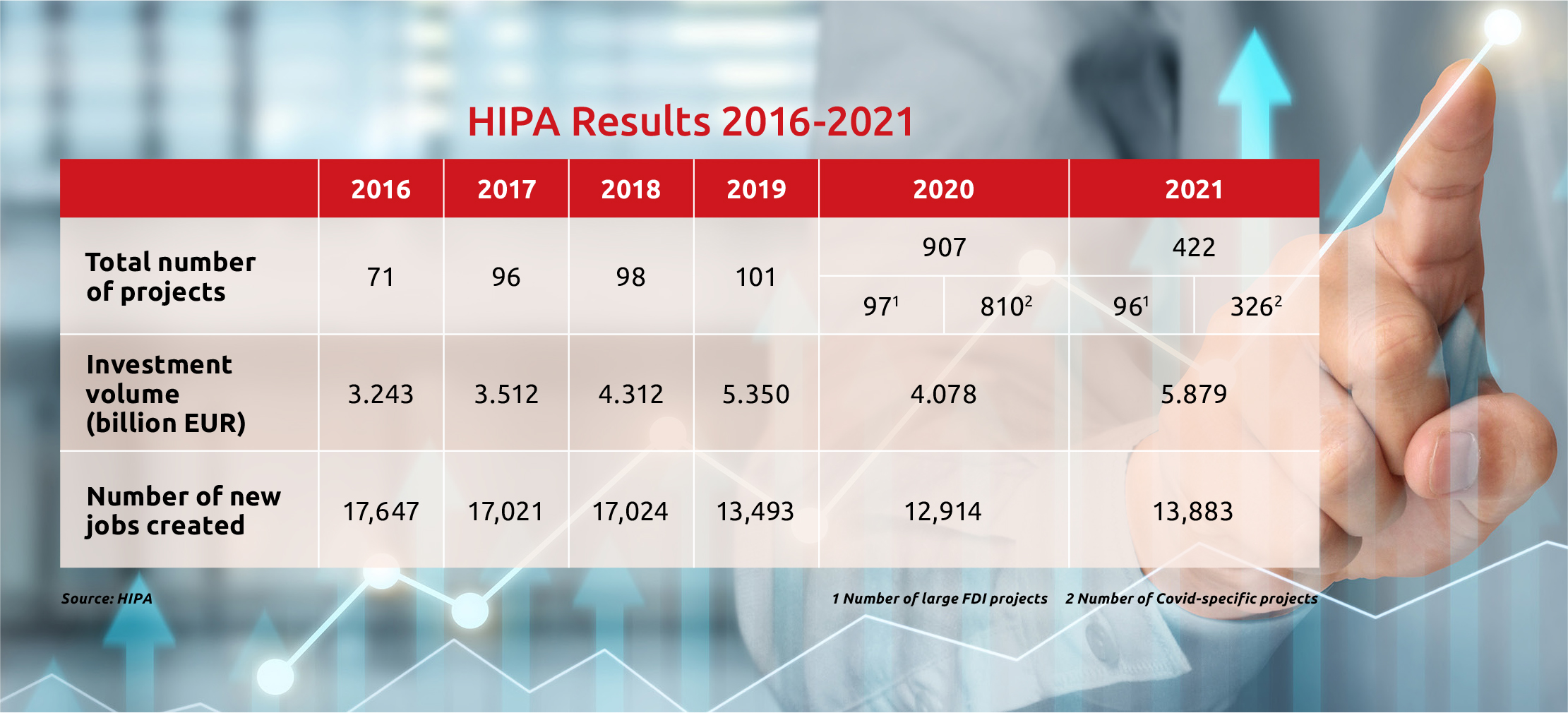

Róbert Ésik: We have yet again had a record-breaking year. It was historic for two reasons. Number one, we have been able to break the record of the overall investment volume, which was the equivalent of EUR 5.9 billion. Secondly, we’ve made an agreement with SK Innovation to carry out Hungary’s largest greenfield FDI project ever, worth EUR 1.9 bln. These two things make the year very special.

Like 2020, the projects we have dealt with can be put into two categories. On the one hand, we were actively working on large FDI deals, which is the core business of HIPA. And on the other hand, we were still active with our COVID-specific subsidy programs.

Relative to the relaunch of the economy, we started to welcome back investors with large greenfield project plans. In 2021, we closed eight deals that each had an investment volume of more than EUR 100 million. And just to give you an indication of the trends, we currently have 27 large projects where we are still in discussion with investors, which have a value in excess of EUR 100 mln. We’ve also been able to close 326 smaller COVID-specific investment projects and the corresponding investment value of these is approximately EUR 600 mln in total.

BBJ: Tell us more about the SK project

RÉ: It is a battery factory in Iváncsa [a village of 2,900 people, 50 km southwest of Budapest], with 2,500 jobs planned and a yearly output of 30-gigawatt hours in terms of capacity. The company has purchased 80 hectares of land, 800,000 sqm. This investment is important because of its volume but also because of its strategic fit in strengthening our role as one of the leaders in electric mobility in Europe. Right now, Hungary is clearly within the top three in EV battery manufacturing, and we possibly have the highest current annual output of batteries, amounting to approximately 50-gigawatt hours. We expect to reach 150-gigawatt hours by 2025.

BBJ: Which were the top nations in terms of FDI into Hungary?

RÉ: Following 2019, Korea was number one for the second time in 2021. And the investment volume from Korea represented more than half of the large FDI deals. In fact, if we add up all the investments coming from the East, they represent more than 60% of the investment.

So, the first conclusion that we can draw from this is that the Asian investors were in the lead again. But parallel to this, the highest number of projects we dealt with were coming from Germany: 24, altogether. So, we continue to have an active, growing cooperation with Germany and other European investors.

BBJ: What were the top business sectors?

RÉ: I would like to highlight maybe three points. Firstly, the electronics sector, including battery manufacturing, represented more than half of the investment volume. Secondly, I’m really pleased that we were able to make agreements with 19 companies in the area of high value-added service activities, including business services, engineering, software R&D, and infocommunication, representing more than 2,600 jobs. Last but not least, the automotive industry and the food industry have also been significant contributors, representing close to one-third of the newly created jobs.

For us, the geographic distribution of investments also matters. One of our roles is to try to reduce regional differences. Except for one county, we have been able to bring at least two new, large projects to every county of the country. And among the top performers, we have, for example, Szabolcs-Szatmár-Bereg County [at the eastern tip of Hungary], which, from a GDP per capita point of view, is typically not in the lead when it comes to the revenue of the counties.

BBJ: Is it fair to say these figures show that the “Opening to the East” was not about replacing Western partners but supplementing them. It’s not either-or; it’s both.

RÉ: Absolutely. And if you think about it, having an open economy means that you must be open to opportunities from both the West and the East. Globally, there has been a shift within the composition of FDI volumes. In the past, more investments were of Western origin; currently, there are more of Eastern origin. If we don’t want to miss out on opportunities, we must be open to these projects. But it’s not a strategy that everyone can follow successfully. If you look at South Korean investments, according to the data of the Korean Exim Bank, Hungary was the second most favored investment location for Korean investors within the European Union in the past three years. And we’ve been clearly number one in the region. So, the fact that more investments are coming from the East doesn’t mean that all countries have been able to take advantage.

BBJ: What are your expectations for 2022? Does the pipeline of future FDI projects look good? Do you anticipate any impact from the General Election in the spring, perhaps a delay to investments until the election is over?

RÉ: Well, as opposed to COVID, what I can tell you is that the upcoming parliamentary elections have, to my knowledge, absolutely no influence on companies’ long-term FDI decisions. And what we can see in our pipeline is that we have 141 firms that we are in discussion with. This, I believe, is one of the strongest pipelines we have ever had from an investment volume point of view, which also means that we have a relatively high concentration. So, the outlook is quite positive. But, of course, it’s always a competition. We can never be sure that these large deals will end up in Hungary. But this is one of the things which makes it so interesting to deal with these projects.

BBJ: Are those 141 projects following the established investment trends, or do you see anything potentially new on the horizon?

RÉ: I think we can say that we see a continuation of the existing trends, focused on e-mobility, with a relatively large share of Eastern investors. We also see some trends partly related to COVID, like the strengthening of the food industry or the pharmaceutical industry. And we again see Business Services projects that potentially target not only the capital but also the countryside university cities, which is a trend that we’d like to encourage.

BBJ: Do you see the countryside cities growing as destinations? Are investors more open to going to Szeged, say, instead of just looking at Budapest?

RÉ: I think there’s an increased interest in the university cities in Hungary. A company that has already established operations here, for example, partly because of the tight labor market, partly because they want to take advantage of a labor pool that is more or less untapped, or partly because of the additional flexibility they would like to offer to employees, yes, they are thinking about opening offices in the countryside. Either in one of the university cities, or we even have some companies looking at the Balaton area for a secondary office, to improve their offering to their employees.

When it comes to greenfield investments, I think it depends on the size. If somebody is thinking about a highly complex, large-scale project of more than 500 people, they will most likely focus on Budapest. If it’s an operational hub with a smaller scale or size, then they might decide to focus on a tier two city from the beginning. We try to advise the clients on what would be most suitable for them and, if and when possible, try to promote those university cities in the countryside.

BBJ: Are the municipalities also getting better at marketing themselves. Debrecen, for example, has a lot of experience now, and it’s got good results.

RÉ: There’s definitely a learning curve; the more you do it, the better you become. And because of some successful examples, we see there’s a growing interest from the leadership of municipalities to emphasize economic development. The important thing, in my opinion, is to have a few dedicated experts who have this as a primary target, thinking about economic development and focusing on formulating the right messages for investors.

BBJ: Subsidies also help. Are you able to offer specific subsidies to large companies to go to areas with less employment?

RÉ: If you talk about state subsidies, then within the European Union, we always have to find a valid legal title for financial support. This has four categories at the moment: regional aid, training subsidy, R&D grants, and COVID-specific subsidy programs. We deal with all four of them as an organization.

There are two significant changes that are probably worthwhile mentioning. One is that 2021 was the first full year we took care of the training subsidy program. We have been able to make 25 different agreements with companies regarding the training of their employees, always asking for some additional investment from them in return for the financial support. In these 25 training programs, close to 15,000 employees are taking part in the upcoming period.

The other important change became effective on Jan. 1 this year. This is the regional aid intensity map that applies to Hungary for 2022-27. The Central Hungary region has been divided into two parts, from a state aid point of view: to Budapest and to Pest County. In other words, Pest County is now treated separately from Budapest, which has two significant consequences. On the one hand, we can now offer a maximum intensity of 50% throughout the territory of Pest County, which was not previously the case. And secondly, and maybe even more importantly, we are now also able to financially support capacity extension type projects; before, we could only support the launch of new economic activity in the area. We have already given information on this to some of our major clients, and there’s additional information that you can find on our website for details.

And maybe, last but not least, for us, it is always important to make sure that we are delivering a service that has the right quality and based on which we have a higher chance of winning an FDI project. That’s why we also follow international rankings and recognition closely. Site Selection Magazine did not publish its investment promotion agency ranking in 2021, but Hungary did perform very well in all categories. We came out first in the best to invest top metros category, we were second in the best to invest per capita, and second in the overall best to invest category when it comes to Central and Eastern Europe. We were ahead of all the other Visegrád Four countries, which shows that Hungary continues to be a favorable investment destination. So, I think, all in all, we can be happy with the results achieved during 2021. And based on the pipeline, we are looking forward to an exciting first half of this year because some of the major deals will come to a decision, according to our expectations, before summer.

BBJ: Is there anything else you would like to add?

RÉ: In addition to positioning Hungary as a favorable investment location for foreign investors, we also try to make sure that, once a foreign investor decides in favor of Hungary, this opens up additional opportunities for Hungarian, small- and mid-size enterprises. That’s one of the reasons why we are running supplier development programs, which help SMEs get integrated into the value chain of these international investors. And during 2021, have recommended close to 2,700 mid-size corporations to integrator companies, which means that, hopefully, several companies will get new orders from these integrators.

One program I would like to highlight from the last year was the HIPA Innovation Boot Camp that we ran together with Design Terminal. The goal was to identify those Hungarian startups that could offer solutions to the existing and real challenges of the automotive industry. That’s why we also involved four large automotive companies in the program. The startups had several workshops with these companies and even had the opportunity to present their results and projects during the demo day, which we held together at our traditional HIPA Automotive Conference.

So, in other words, our supplier development team was also very active in 2021 in opening up new opportunities for Hungarian SMEs and has been able to expand the portfolio in an interesting direction.

BBJ: Will that continue into this year?

RÉ: We will continue to work on this, but probably in a different format, having maybe more bilateral activities with individual integrators, focusing on their existing supplier network, and also trying to follow up with some of the startups that we have been able to get in touch with last year.

This article was first published in the Budapest Business Journal print issue of January 14, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.