Inflation Breaches Target, but Thought Only Temporary

Although industrial production was weaker in October than previous months, analysts remain optimistic about the fourth quarter performance. The same can be said of the inflation rate; although it exceeded the 3% mark in November, market players think it only temporary.

Hungary’s industrial production growth slowed in October after a strong acceleration of 9% in the previous month, data from the Hungarian Central Statistical Office (KSH) shows. Industrial production rose a working-day adjusted 6.4% year-on-year in October, after a 9% increase in September. In August, industrial production rose 2.7%.

On a non-adjusted basis, industrial production climbed 6.1% annually in October, after an 11.1% rise in the preceding month. On a seasonally adjusted basis, industrial production fell 0.4% in October, after a 3.1% rise in the previous month.

According to analysts, the October figures suggest that the industrial growth will still be dynamic in the fourth quarter of the year, and will support the overall economic growth of Hungary, in spite of the not so good news that arrived from Germany, where industrial output fell back by 1.7% in October from the previous month, and a massive 5.3% decline was registered on an annual basis.

In Hungary, investments that were launched in the previous years resulted in extra capacity, and this was clearly seen in the October data, says Dávid Németh, head analyst with K&H Bank.

The next few month will reveal whether there will be a slowdown in Hungary or not, the analyst said. As for the full year, Németh expects a growth rate of around 6%.

No Setback

The fresh industrial data, together with the strong retail figures released recently suggest that there are no sign of a setback so far, says Péter Virovácz, head analyst at ING Bank. He is even more optimistic than Németh and says that industrial growth might be as high as 6.5% in 2019. However, a narrowing order stock might result in a slower pace next year: Virovácz expects an annual growth rate of 4.5% in 2020.

The slowdown detected in October from the previous month was mainly caused by the high base in 2018, but the Hungarian industry still notably outperforms others in the European Union, especially that of Germany.

The high rate of foreign direct investment also contributed to the still strong industrial figures, says Gergely Suppan of Takarékbank. He identifies, however, downward risks such as the slowdown of the Chinese and U.S. economies, and the recession in Europe, and also uncertainties about Brexit. He expects a growth rate of above 6% this year, which might slow to 4.8% in 2020.

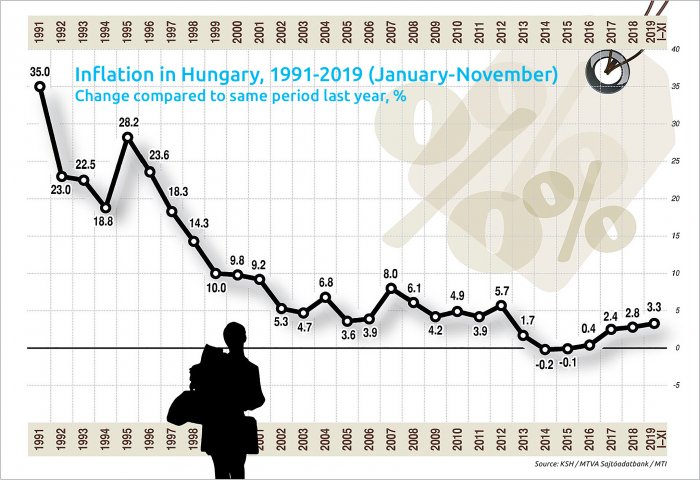

Consumer prices were 3.4% higher on average in November than a year earlier. Significant price rises were measured over the past year for alcoholic beverages and tobacco as well as food.

The November figure is higher than analysts’ expectations; however, it is thought likely to be only temporary. As for the next year, the National Bank of Hungary (MNB) still expects the inflation rate to be around 3%, which is the central bank’s medium-term target.

Acceleration

Inflation accelerated by 0.5% from the previous month, the KSH data reveals. The MNB explains the higher prices with low fuel prices at the end of last year; therefore, it is not a long-lasting effect, according to the bank.

Food prices went up by 5.5% in November on a year-on-year basis. The price of alcoholic beverages and tobacco rose by 8.3% on average, within which tobacco prices were up by 12.1%. Consumers paid 3.4% more for services; electricity, gas and other fuels became 0.7% more expensive.

The MNB has been communicating for a while that a higher inflation rate is only temporary, and the consumer price index will return to the 3% level next year. The explanation for this is that, although the massive wage raises and increased consumer purchasing power generates inflation, the deteriorating external economic situation will push down the index. Also, the MNB believes that this latter effect is stronger than those elevating the inflation rate.

However, an increasing number of optimistic economic forecasts have been released lately, and more and more analysts think that economic slowdown will not be permanent. The reason for this is probably the fact that central banks have reacted fast, and got engaged in loose monetary conditions again, which increases liquidity and, therefore, an economic setback can be nipped in the bud.

If the global economy is indeed in a better shape, it will minimize downward risks, which alone could increase the consumer price index in 2020. After the rate setting meeting of the MNB in December, we’ll find out whether the rate-setters perceive changes in the external factors and modify their forecast for next year accordingly.

Numbers to Watch in the Coming Weeks

The Central Statistical Office (KSH) will publish fresh data on the October performance of Hungary’s construction sector on December 13. On December 23, KSH will release the second estimate of external trade of goods. Between the two dates, on December 17, the Monetary Council of the National Bank of Hungary will hold its last rate-setting meeting of 2019.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.