Black Friday Sales: Better Than Expected, but Barely

Graphic by Lauritta / Shutterstock.com

While the odds may have been (mainly) against retailers, sales were not so bad during Black Friday. But prolonged high inflation and new waves of the pandemic may hurt deeper sales next year. Barabás Balázs embarks on some data mining to evaluate the pre-Christmas deals.

For years, Black Friday was a much anticipated and mass-marketed period of the year for retailers. Time and again, it has brought increasingly higher sales and new customers. Discounts were not so significant as in the United States, but the promotion was ideal for buying Christmas presents at lower prices, while there was still enough time to return the products and pick others, if necessary. Logistics got better, and stocks were sufficient to satisfy more clients with low-priced products.

The pandemic brought this frenetic trend to a halt. Many shoppers lost their jobs, and there were fears they would spend less, and the supply chain from Asia to Europe narrowed significantly, which made accurate forecasts in the retail sector hard this year.

It was not all bad news on the customer spending side, though; indeed, outlooks were promising. According to data released by the Central Statistical Office (KSH), the average net salary per month in Hungary in September was HUF 293,400 with state benefits, around EUR 830, and a 9% increase compared to the previous year. Inflation in September was 4.4% year-on-year.

Purchasing Power

A more accurate picture of the spending possibilities is outlined in the GfK Purchasing Power Europe 2021 study. Purchasing power is a measure of disposable income after the deduction of taxes and including any received state benefits. The study indicates purchasing power levels per person per year in euros and is based on the population’s nominal disposable income, not adjusted for inflation.

The European average is EUR 15,055 per capita. The highest figures were registered in Liechtenstein, Switzerland and Luxembourg, at above EUR 35,000. At the tail end is Ukraine, with a purchasing power of only EUR 1,892 per person per year.

Among the 42 countries surveyed, Hungary ranks 30th, the same as last year, with a purchasing power of EUR 7,643 (EUR 636 per month). Compared to this, the Czech Republic and Poland performed better, with EUR 10,667 and EUR 8,294 respectively. Romania ranked immediately behind Hungary, with EUR 7,453.

It is worth noting that the figures above are medians, and regional disparities can be very broad within countries. For example, in the Czech Republic, the difference between the region with the highest purchasing power (the capital city of Prague) and the lowest is EUR 5,000. In Poland the difference is EUR 8,000, in Romania, it is no less than EUR 9,600. In Hungary, the difference is less dramatic, at EUR 3,800. On the other hand, the strongest region in Hungary, according to purchasing power (Budapest, at EUR 9,722), is much lower than the regional peers.

The Predictions

So, the average net salary per month in Hungary in September was HUF 293,400 (according to KSH), while the average purchasing power per person per month in Hungary is about HUF 225,780 (so says GfK). As expected, countless pieces of markets research and polls had attempted to predict how much of this Hungarians were prepared to spend and whether Black Friday would continue to be attractive this year.

Here are some of those predictions and findings:

• Spending will be somewhat higher than last year, HUF 59,000 (Telenor);

• While the majority of Hungarians are price sensitive, only 20% indicated that Black Friday would be important for buying the Christmas presents (Impetus Research);

• The peak of Black Friday popularity in Hungary was in 2017. Last year, many respondents said they would not participate in the promotion for various reasons: 13% did not need anything, 37% found the price cuts unattractive, and 19% were not interested in the products discounted (picodi.com);

• This year customers will spend more than HUF 60,000 on Christmas presents, on average for seven persons, up from five last year (GKI Digital/arukereso.hu).

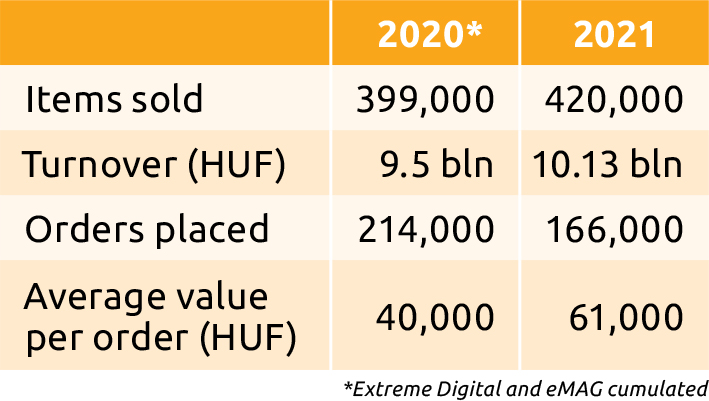

By now, all retailers have closed their Black Friday promotions, and we are able to look at the figures. Online retailers Extreme Digital and eMAG merged in 2019 but held Black Fridays separately until last year. The average spending per person in 2020 was HUF 34,000 on eMAG and HUF 40,000 on Extreme Digital. This year, the two companies held a joint promotion on the eMAG platform. Looking at the forecasts above, the retailers adopted a more cautious approach of a focused sale, together with a unified stock and logistics. It seems that the strategy worked, but the growth was probably not at the expected rate.

Best Sellers

Sales barely grew 5% both in terms of the items sold and turnover, while customers spent significantly more compared to the previous year, which means that they concentrated on products they needed, rather than those that were expensive.

The “most sold” top list by categories is relevant:

1. Household items and cleaning products: 79,000 pcs

2. Childcare and toys: 57,000 pcs

3. Laptops and other IT products: 34,000 pcs

4. Small household appliances: 28,000 pcs TV sets, consumer electronics, smartphones and wearables ranked lower in sales compared to previous years.

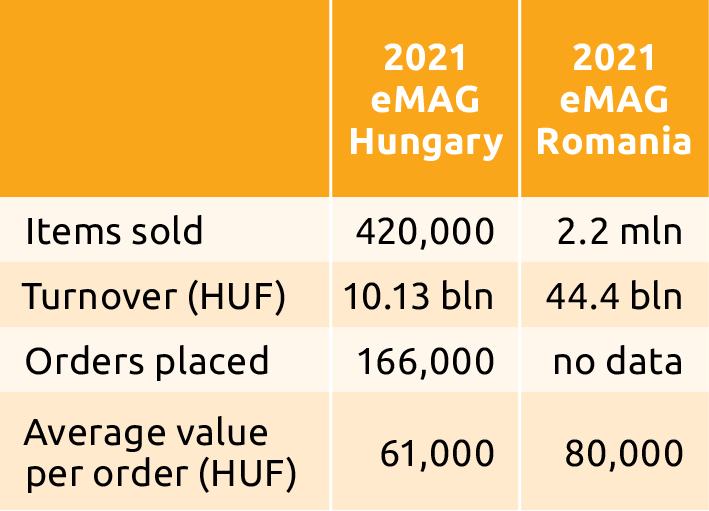

We began this article with a regional comparison of purchasing powers, noting that the Hungarian average is slightly above Romania’s. For a more detailed picture, it is worth comparing the Black Friday sales at eMAG, a company that runs businesses in both countries. For better understanding, we have converted values in RON into HUF. While the exchange rates change daily, the differences are noticeable.

The best sellers in Romania were:

1. Household items and cleaning products.

2. Beauty and self-care.

3. Alcoholic beverages and coffee.

4. Small household appliances.

Like Hungary, TV sets and smartphones ranked lower, with laptops and IT products not even in the top 10 list.

So, why are the differences in sales so much higher, both in volume and value, between Romania and Hungary if the purchasing power is higher in the latter country? The answer lies in the irrelevance of the median figures. In Hungary, the highest purchasing power by region is in Budapest at EUR 9,722. However, in Romania, there are five counties with purchasing power at this level or higher.

To conclude, this year’s Black Friday sales were better than forecast in the polls, but not significantly so. Attention will now switch to the Christmas season proper and the hope, for bricks and mortar retailers especially, that shops can remain open.

This article was first published in the Budapest Business Journal print issue of December 3, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.