Gedeon Richter Looks to Build Specialist Future After Esmya Travails

Gedeon Richter, Hungary’s flagship drugs maker, has seen some tough times of late. Shares hit an all-time closing record of HUF 7,250 in June 2017, but have since fallen to around HUF 5,600 after sales of key drug Esmya were hit by fears of possible liver damage for users. But the company, and analysts, have hopes for renewed growth.

For the man in the street, Gedeon Richter is probably the least known of the four “blue-chip” companies on the Budapest Stock Exchange. Unlike OTP Bank, MOL and Magyar Telekom, each with numerous customer facing outlets, Richter, its headquarters located in unfashionable, industrial Kőbánya (District X), unassumingly gets on with business: making medicines.

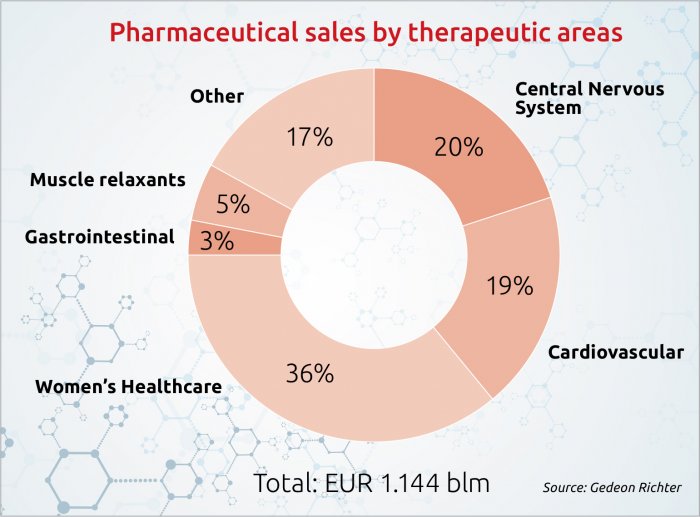

But with total revenues last year of EUR 1.4 billion, and employees numbering almost 12,700 (including 1,000 involved in research and development), Richter is a major Hungarian company, and one of the most important pharma businesses in Central and Eastern Europe.

Boasting a market capitalization of some EUR 3.3 bln and with a 25% stake held by the state holding company, Richter shares comprise almost one fifth of the BUX, the BSE’s principal share index, ranking it the third most important corporate on the exchange, behind OTP and MOL.

Long a favorite stock on the BSE, Richter’s recent troubles began in 2017, with reports of a small number of patients suffering liver failure when taking Esmya, a drug to treat non-cancerous tumors of the womb. The reports triggered an investigation by the European Medicines Agency (EMA), the continent’s pharmaceutical regulator, and the temporary suspension of sales in Europe. (See separate story in box.)

Revenues Flat

The hit from regulatory suspension of Esmya left total revenues last year flat in forint terms (at HUF 445.5 bln) and down 2.7% in euro, at EUR 1.4 bln. True, the relaunch of Esmya resulted in reduced impairment costs, which produced net income for 2018 of EUR 98 million, more than triple the EUR 28.8 mln booked the previous year.

But this was less than half the EUR 213 mln recorded in 2016, the year before the Esmya tribulations began.

Perhaps in part because of the upheavals over Esmya, chief executive Gábor Orbán was guarded regarding the immediate outlook for the company, predicting sales growth of just 2-3% for this year when presenting the latest results in February.

Somewhat in contrast, Attila Vágó, senior equity analyst with Concorde Securities, is cautiously bullish on Richter.

“The Esmya story dominated the headlines last year, but this year will be more about Vraylar,” says Vágó, pointing to the success in North America of a drug created to treat central nervous system disorders such as schizophrenia.

Partnership

Based on the active ingredient cariprazine, an original compound developed by Richter, Vraylar was launched in partnership with Allergan on the U.S. market in 2016.

“The turnover of this drug was, roughly speaking, USD 500 mln last year,” Vágó said, of which USD 90 mln was transferred to Richter in royalty payments.

“This income falls straight into [Richter’s] bottom line. This is a great success so far,” he enthuses.

Further, an application has been made to the U.S. Federal Drug Agency to license Vraylar for the treatment of bipolar depression in addition to schizophrenia. If granted, this could result in significant sales growth, especially since there are fewer rival players in the bipolar depression segment, Vágó argues.

While Vraylar (and it’s European equivalent, Reagila) are expensive drugs, and thus sales depend very much on the reimbursements granted on prescriptions, Vágó believes U.S. sales could triple to USD 1.5 mln in the next five years, yielding some USD 300 mln in royalties crucial for Richter’s development.

“Richter is in a transition phase, from a branded generic pharma towards a specialty [producer], focusing more on high added value [products] such as novel drugs, oral contraceptives, CNS treatments, and also bio-similars,” he says. But this transition needs money for investment into new research and marketing.

“That’s why it’s important to have income from novel drugs on the market to finance this,” Vágó says. “That’s why we are saying the success of Vrylar is a potential game-changing story for Richter,” he adds.

Richter Left to Pick up Pieces After Regulatory Issues Cripple Esmya Sales

The decision by the regulator to suspend European sales of Esmya was a blow to both the Hungarian drug maker and investors, both of whom had had high hopes for Esmya, a drug launched by Richter in 2012-13.

The European Medicines Agency investigation ultimately cleared Esmya for use in May 2018 (albeit under medical restrictions to “minimize the risk of rare but serious liver injury”) and Richter announced a “focused relaunch” of Esmya in Europe last September.

However, the damage had been done. Sales of Esmya slumped from EUR 93 mln in 2017 to just EUR 25.9 mln in 2018, a 72% decline

“This hit the market of the drug, definitely,” Attila Vágó, senior equity analyst with Concorde Securities in Budapest, told the Budapest Business Journal.

“This year, the expectations for sales are EUR 35 mln globally, and in the best case, sales could go to EUR 50 mln, perhaps. But competition is getting tougher, and there will be other names coming on the market.”

Furthermore, the troubles in Europe raised regulatory concerns and costs for launching the drug in the United States, dashing plans to launch Esmya in North America, Vágó said.

All this forced Richter to book impairments – losses in the book value of the drug – in 2017-18.

“Once this drug was worth about HUF 100 bln, a little bit less on the balance sheet, and now it’s about a quarter of this,” Vágó said.

Esmya is, of course, still on the market, and theoretically, if the outlook changes, it could regain its former value. But as Vágó puts it: “It’s hard to imagine; it’s a sad story for Richter.”

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.