Debt Financing of Acquisitions

In their latest Investor Column, Les Nemethy and Sergey Glekov look at the arguments in favor of taking out a loan to execute an M&A deal.

There are many reasons for using debt to finance an acquisition. Some buyers simply do not have enough cash. Others want to improve their return on equity by using low cost debt (see our earlier article “Optimizing Company Valuation via Cost of Capital”).

Still other investors prefer to take advantage of the tax write-offs permitted by deductibility of interest costs in most jurisdictions. Quantitative easing has also made debt cheap over the past decade, by historic standards. Debt financing may help avoid the need to raise equity financing, hence dilution of equity and control.

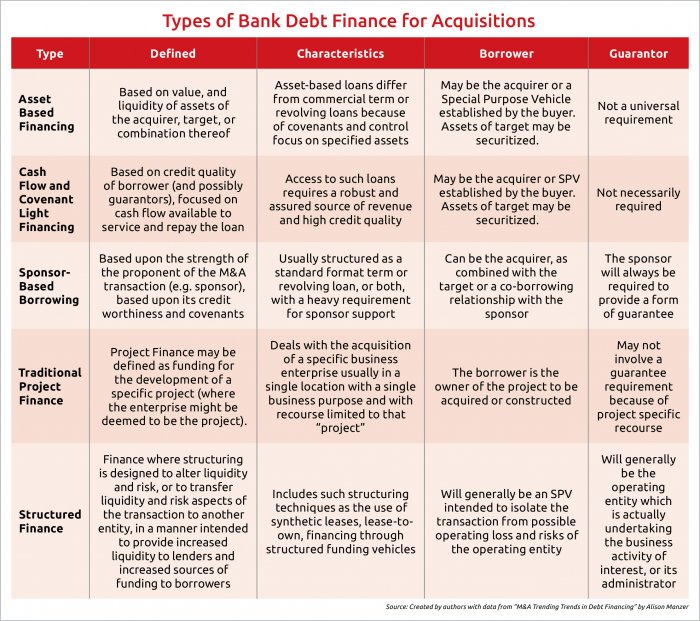

In most cases, mid-sized companies have limited access to public capital markets (equity or bonds), hence there may not be that many alternatives to financing an acquisition by bank debt. The table summarizes some of the basic types of bank debt to finance an acquisition.

When an acquirer considers financing options, the potential to raise debt based on assets and cash flow of the target are usually taken into consideration, but the synergies between acquirer and target are sometimes neglected.

Demonstrating Synergies

Years ago, we were representing Hungarian Telephone and Cable Corporation (HTCC) in its acquisition of PanTel, a Central European data communications company, where we constructed a financial model that persuasively demonstrated synergies resulting from the acquisition in excess of EUR 20 million a year.

This provided HTCC with the additional cash flow to service the additional acquisition financing, and calculating company valuation at 6x EBITDA, an additional EUR 120 million in valuation. (Care must be taken with synergy analysis, as synergies often prove to be a mirage.)

In conclusion: debt financing is a flexible and relatively low-cost option for financing acquisitions, particularly in today’s competitive and liquid market environment. However, leverage is a significant risk which may contribute to or cause business failure, especially during recessions or financial crises.

An acquiring firm’s financing decision should be strongly influenced by its debt capacity, existing leverage and target leverage ratio; in short, on shareholders’ appetite for risk versus reward. A balance must be struck.

Les Nemethy is CEO of Euro-Phoenix (www.europhoenix.com), a Central European corporate finance firm, author of Business Exit Planning (www.businessexitplanningbook.com) and a former president of the American Chamber of Commerce in Hungary.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.