Hungary and CEE Attracting Further Hotel Investors

Artist’s rendering of the Holiday Inn & Suites Budapest Centrale, due to open in late 2026.

The Central and Eastern European markets are seeing a growth in hotel occupation in their average daily rates, although they are not quite back to the 2019 pre-coronavirus levels. Budapest has the second-highest ADR and revenue per available room rates in the region after Vienna, according to the hotel and hospitality consultant Horwath HTL Budapest.

“The recovery is already underway and has surpassed most expectations. Hotels across the CEE region are showing robust performance, already exceeding pre-pandemic levels on the markets,” says Cushman & Wakefield and law firm CMS in their Hotel Investment Scene in CEE report for 2023.

“This has attracted the attention of investors, and we are starting to see a rebound in transactional activity despite the high cost of financing and the ongoing economic and geopolitical challenges. Investors are attracted by the anti-inflationary nature of hotel real estate and the long-term growth in the tourism sector in CEE,” the report notes.

In a new Budapest project, IHG Hotels & Resorts has announced its first 170-room Holiday Inn & Suites property in Europe. Set to open in late 2026, the Holiday Inn & Suites Budapest Centrale will be part of a mixed-use development located directly above the Puskás Ferenc Stadion metro station and intermodal transport hub.

Long-term Agreement

The location is adjacent to the Puskás Aréna national soccer stadium and the Papp László Budapest SportArena. The developers of the new project, Chain Bridge Ventures, and hotel lease operators Mogotel Hotel Group have entered into a long-term franchise agreement with IHG.

“IHG has a long-term and growing portfolio of properties in Hungary, including InterContinental Budapest, Holiday Inn Budapest Budaörs, Crowne Plaza Budapest, Vignette Collection Verno House Budapest and the 27-key Kimpton Budapest, which is expected to open later this year,” said Willemijn Geels, VP for development in Europe at IHG Hotels & Resorts.

Budapest hotel supply reached a record 224 properties with a total capacity of more than 50,000 beds, according to Horwath HTL Budapest. The new supply last year exceeded 1,200 rooms.

“Limited financing availability for hotel developments, coupled with rising development costs (now nearly equivalent to Western European standards), suggests that projects not yet started are likely to be postponed or reassessed. The shift will maintain the balance between supply and demand, avoiding market saturation,” comments Attila Radvánszki, director of Horwath HTL Hungary.

Popular Destination

According to Colliers figures, EUR 0.26 billion was invested in the CEE hotel sector for 2023 as it becomes a popular hotel destination in what is currently a challenging investment environment.

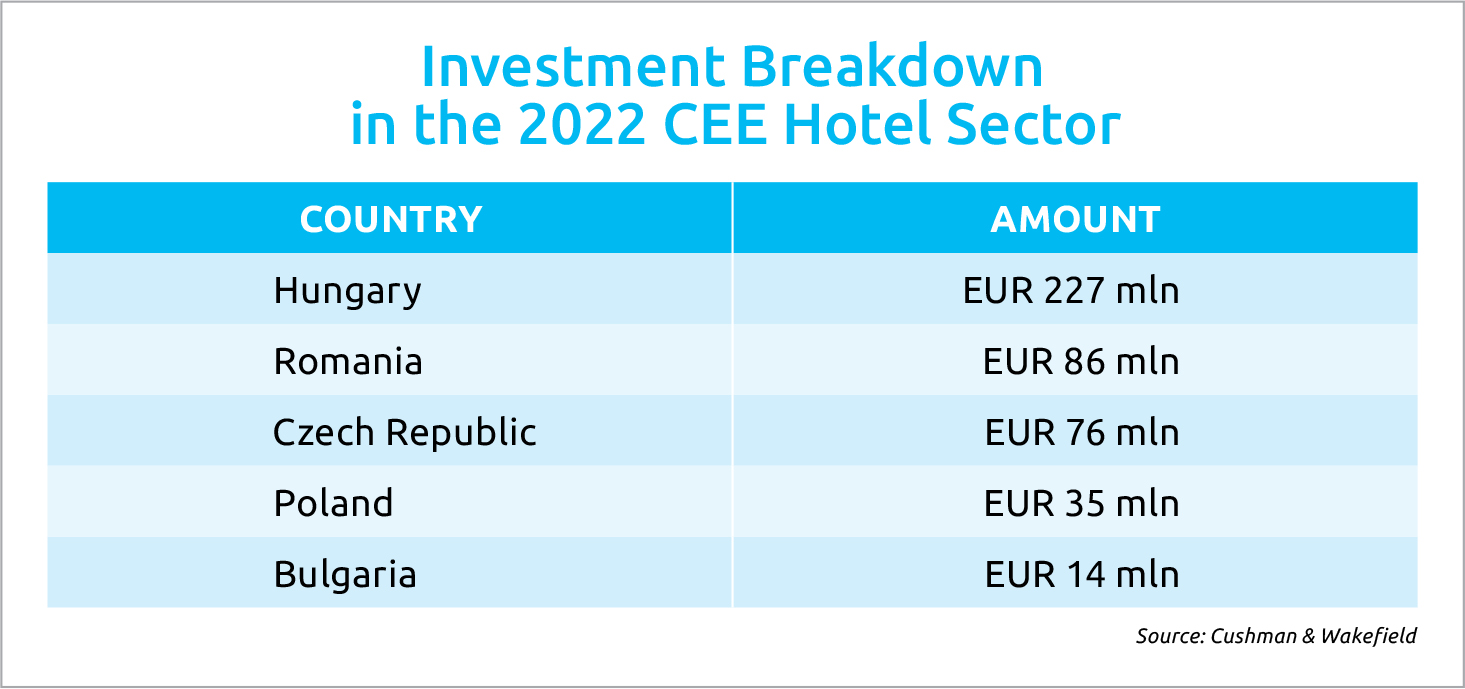

For 2022, EUR 227 mln was invested in Hungary, EUR 86 mln in Romania, EUR 76 mln in the Czech Republic, EUR 35 mln in Poland and EUR 14 mln in Bulgaria, according to Cushman & Wakefield figures.

More than EUR 3 billion has been invested in hotels in the CEE-6 (Bulgaria, the Czech Republic, Hungary, Poland, Romania, and Slovakia) over the last five years. The majority of this, 86%, was in the Czech Republic, Poland and Hungary, with 70% invested in capital cities and 89% sourced from European and domestic investors.

“To sustain overall profit stability, strategic ADR-driven segmentation is vital. A thoughtful re-evaluation of the F&B offers, focusing on flexibility to enhance uptake, control staffing costs, and improve profitability, is imperative. As cost escalation intensifies, meticulous expenditure management is crucial for preserving GOP margins through 2024,” the Hotco 2024 Hotel Investment Conference in Vienna concluded.

As much as EUR 63 mln is expected to be transacted by the yearend, the majority of which will be in the Czech Republic, Poland and Hungary. In all, 2,650 hotel rooms are expected to be transacted, according to Cushman & Wakefield.

This article was first published in the Budapest Business Journal print issue of February 23, 2024.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.