As Green Loans Surge, MNB Launches Eco-Friendly Product Finder

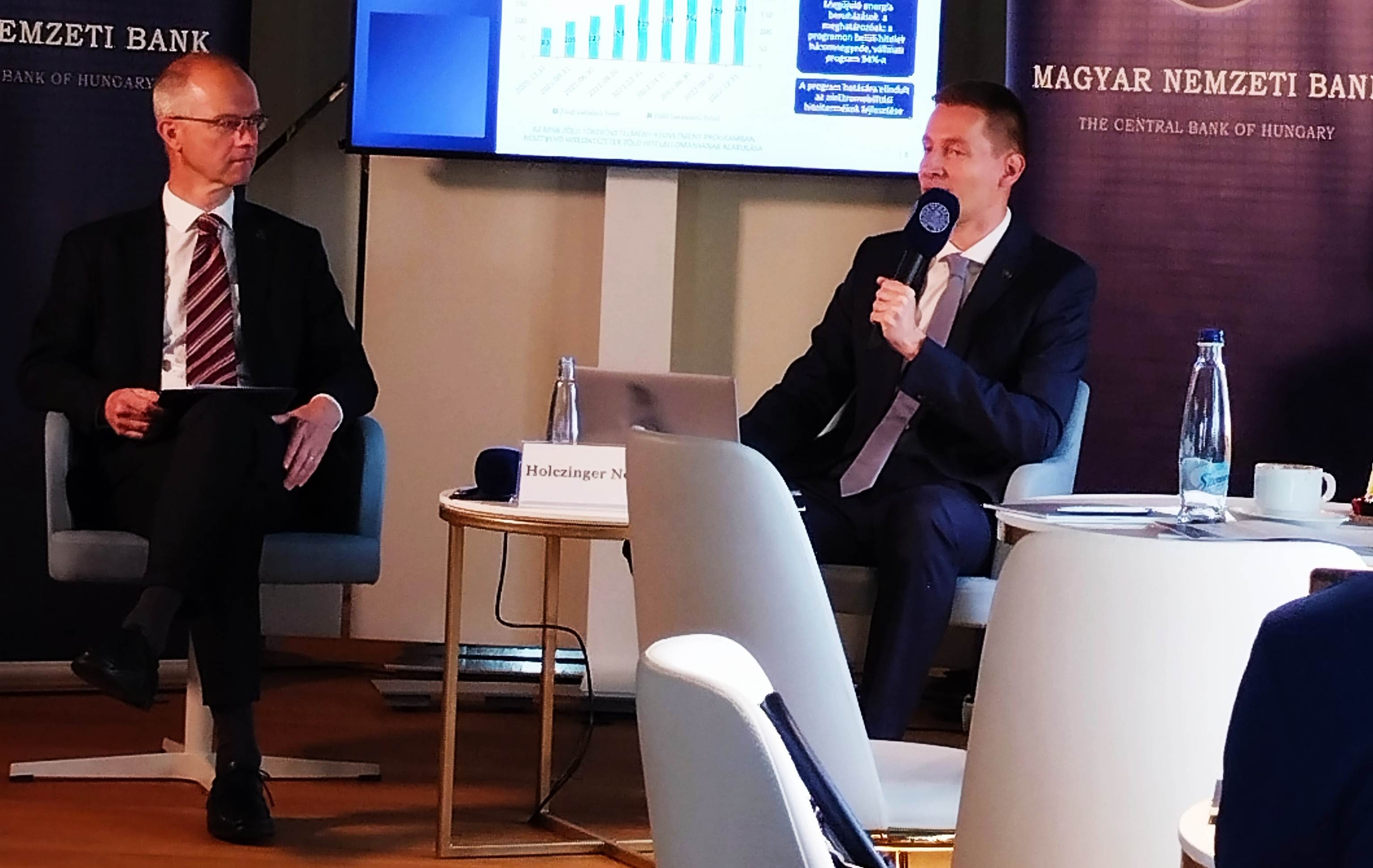

MNB deputy governor Norbert Holczinger (right) and director of sustainable finance Zoltán Kocsis.

The National Bank of Hungary (MNB) has published a report on the state of green finance in the country, highlighting the robust growth of climate-friendly loans and announcing the launch of a green financial product finder tool.

The report, “Green Finance in Hungary 2022,” was presented at a press conference on April 26 by MNB deputy governor Norbert Holczinger and director of sustainable finance Zoltán Kocsis.

According to the report, so-called green loans, which support projects or activities with positive environmental or climate impacts, increased by 46% in 2022, reaching HUF 1.4 trillion (EUR 3.9 billion) by the end of the year. This accounted for 5.6% of total loans in Hungary, up from 4.2% in 2021.

The report also revealed that green bonds, which are debt instruments that raise funds for environmentally friendly projects or activities, grew by 28% in 2022, reaching HUF 1.1 tln (EUR 3.1 bln) by the end of the year. That represented 7.4% of total bonds in Hungary, up from 6.4% in 2021.

The MNB said these figures show that Hungary is on track to meet its targets under the National Energy and Climate Plan (NECP) submitted to the EU, under which it aims to reduce greenhouse gas emissions by 40% by 2030 compared to 1990 levels and achieve climate neutrality by 2050.

To support the development of green finance further in Hungary, the MNB announced the launch of a green financial product finder, which is available on its website.

The tool allows users to search for and compare various green financial products offered by banks and other financial institutions in Hungary, such as loans, mortgages, deposits, funds, insurance and pensions.

It also provides information on the environmental or climate benefits of each product, as well as the criteria and standards used to define them as green.

Increasing Transparency

The MNB said that the search function aims to increase the transparency and awareness of green finance among consumers and investors and to encourage financial institutions to offer more and better green products.

“Green Finance in Hungary 2022” also emphasizes the urgency of accelerating the transition to a green economy, as climate change and other environmental challenges pose significant ecological, economic, and social risks for Hungary and the world. The report warns that, without adequate action, these risks could negatively impact growth, competitiveness, employment, inflation, financial stability and public health.

The central bank calls for more cooperation and coordination among all stakeholders, including the government, private sector, civic society, and the international community, to implement effective policies and measures to mitigate and adapt to climate change.

The MNB also stresses the importance of increasing the financial literacy and awareness of consumers and businesses on environmental sustainability issues, as well as providing them with adequate incentives and information to make green choices.

“The MNB’s Green Program is not only a social responsibility initiative but also a strategic priority for our monetary policy and financial stability objectives,” Holczinger, the head of the national bank’s sustainable finance department as well as deputy governor, told the press conference.

“We believe that green finance can help us achieve our inflation target, reduce systemic risks, and support economic growth and competitiveness. We also see green finance as an opportunity for innovation and development in the Hungarian financial sector,” he explained.

Room for Improvement

“We are proud of our achievements so far, but we also recognize that there is still room for improvement and further action. One of the main challenges we face is the lack of reliable and comparable data on environmental performance, which hampers the development of green finance products and services,” Holczinger warned.

“That is why we have launched a new online tool, the green financial product finder, which will help consumers and businesses find the best green financial products for their needs,” he added.

Despite the positive developments in green finance in Hungary, some challenges and barriers still need to be overcome to achieve a more sustainable financial system. One of the most significant is the lack of common definitions and standards for green finance products and activities. The MNB has proposed a taxonomy for green loans based on international best practices, but it is not yet mandatory for banks to use it. The EU taxonomy regulation is expected to provide more clarity and harmonization in this regard.

Another challenge is the low level of awareness and demand for green finance among customers and investors. The MNB has conducted several surveys and studies to assess the attitudes and preferences of various market segments toward green finance. The results show a need for more education and information on the benefits and opportunities of green finance, as well as on the risks associated with climate change and environmental degradation.

This article was first published in the Budapest Business Journal print issue of May 5, 2023.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.