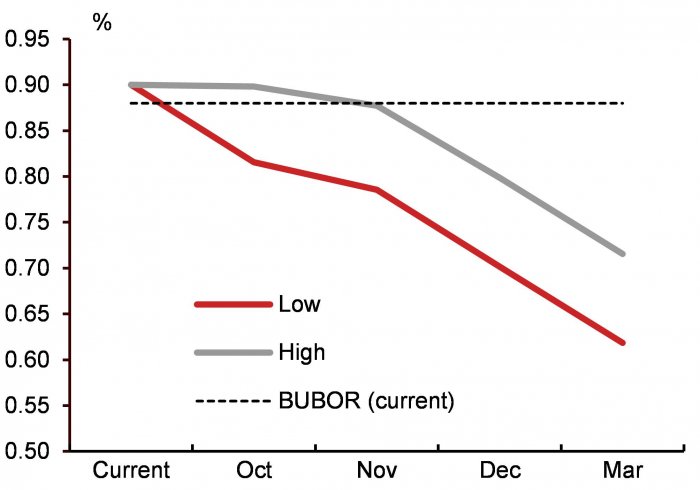

Nomura analysts expect BUBOR at 0.7% this year

While many factors and a number of scenarios should be considered when trying to forecast where the BUBOR rate of the National Bank of Hungary (MNB) will trade within the new liquidity framework the central bank is setting out, a 0.7% BUBOR is what analysts at Nomura expect for this year, according to an analysis sent to the Budapest Business Journal on Friday.

(Source: Nomura)

“We think something around 0.70% makes sense through the end of December, with downside risks from possible policy changes to reserve requirements and rates, a possible policy rate cut and because the MNB’s fine-tuning facility has yet to be announced,” analysts of Nomura say in the report.

Immediately after the MNB’s Monetary Council made its decision to put a cap on 3M depos at HUF 900 billion, Nomura’s analysts said the ultimate ‘core’ of policy of the central bank was to provide further easing through lowering BUBOR.

According to Nomura, the Hungarian central bank is seeking to maximize growth in nominal output, both as an inflation targeter with the aim of higher inflation and as a growth targeter, the latest report says.

“To achieve this, you can change the pace of money growth or you can change its velocity. In a fractional reserve banking system, money growth occurs naturally with more loan growth (the MNB wants to achieve greater output growth) and velocity growth occurs through using excess liquidity from the central bank’s facilities to provide new loans instead, ending up in a closed banking system back in the MNB as O/N deposits, or in the MNB’s specific case in the preferential depo facility and then the reserve account as well,” Nomura’s analysts say.

“BUBOR will likely trade around the blended access rate or slightly below it, with market expectations of future drops in this blended rate. Indeed, because liquidity spikes in future will pass through BUBOR, ending up in the O/N window, the skew in risks around BUBOR is to the downside of the blended access rate,” analysts at Nomura expect.

While analysts at Nomura note that the cap will be kept in place by December, so BUBOR rates should glide down until then, with the cap possibly set to be lowered to HUF 750 bln for March, a decision which could be made as early as this October.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.