Construction sector shows bettering, despite lower activity

EBI Construction Activity Report Q2

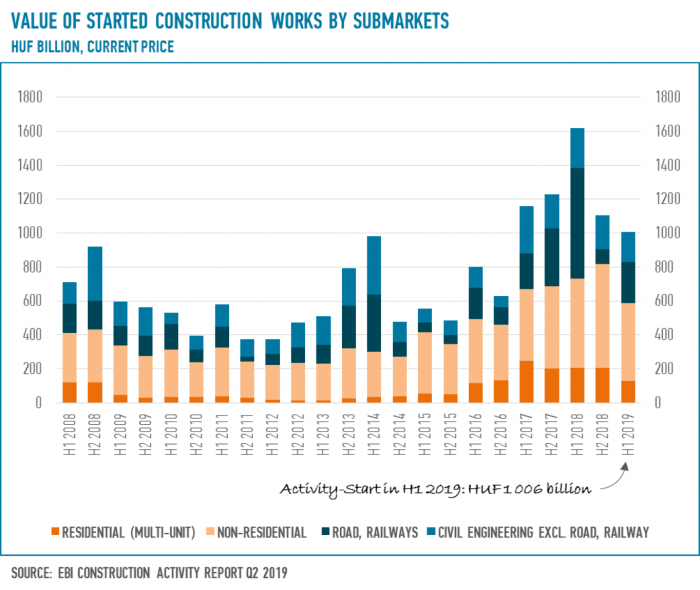

Even though the previous quarters saw a decline in the value of newly started construction works in Hungary, in Q2 2019 the sector showed some bettering, according to the latest EBI Construction Activity Report.

The report’s Activity Start Indicator surpassed the level of the previous three quarters. Despite the better numbers in Q2, the projects entering the construction phase in H1 2019 were much lower in value, amounting to around HUF 1 trillion, the lowest since 2016.

Building construction inferior to level of previous years

The half-yearly figure was far below that of previous years, with projects starting between January and June at less than HUF 600 bln, according to ibuild.info project information database. Looking at the whole building construction sector, the drop against recent years has affected both multi-unit residential construction and non-residential construction, although the latter has seen a more moderate loss in momentum.

The report says that the H1 2019 value of launched construction works fell behind both H1 and H2 of 2018 (a record-breaking year), but the picture is different than in the same period of 2017. In April-June 2019, non-residential construction works commenced worth a combined HUF 231 bln. For instance, the SK Innovation battery factory (Komárom) and the Doosan copper foil factory (Környe, Tatabánya Industrial Park) both saw construction start. Also, work started on the Pillar office building and BudaPart City office building (Budapest), along with several sports-related projects like a new swimming pool in Sopron, Phase 2 of Illés Academy (Szombathely) and Bozsik Stadium (Budapest).

Stronger quarter for civil engineering

The report says that its Civil Engineering Activity Start Indicator, which has been weaker in recent quarters, improved in Q2 2019, resulting in a 46% higher value of started construction works than in H2 2018. Overall, in the first half of the year, commenced construction works in this segment were HUF 174 bln. Big-league projects include mainly road and railway developments (Miskolc-Tornyosnémeti stretch of M30, the Debrecen-Nyírábrány section of Road 48), but also other civil engineering projects such as the Tisza-Túr Emergency Reserve, started in Q2.

East Hungary still at the forefront

The report adds that many of the construction projects that started in Q2 2019 continued to be concentrated in East Hungary. Overall, nearly half of new constructions in H1 started in the eastern regions - a high share compared to the 33% in previous years. Central Hungary continues to receive a lower share of projects than in 2014-2018, similarly to West Hungary, whose share further shrank in Q2 2019.

Fewer multi-unit housing projects

The EBI Construction Activity Report Q1 2019 had already reported a great momentum loss in multi-unit housing projects over previous periods. Although construction works in the segment started at a slightly higher value in Q2, they were still behind the figures of previous quarters. Activity Start totalled HUF 127 bln in H1 2019, a 40% drop from both H1 and H2 2018. Many projects did not have a final building permit before November 1, 2018, meaning these dwellings can only be sold at a 27% VAT rate. The report argues that with a higher price level, it is questionable whether buyers can be found as developers are unlikely to be able to stomach much of the VAT rate increase and many might abandon their plans. Some investors have started to execute their projects despite the 27% VAT rate and are trying to complete as much construction as possible, encouraging buyers to pay higher upfront payments this year.

However, as time progresses, there seems to be less likelihood for the latter, so the second half of the year might see construction start to an even lower value, the report says. Central Hungary continues to be the region with the highest value of started multi-unit housing construction works, although its share was below the level of previous years. It is followed by the western regions where relatively more multi-unit constructions started than in previous years. The increase in the Activity Completion Indicator has long been expected in the segment. Despite reaching a substantially higher level in H2 2018, no surge took place in the value of completed projects in H1 2019. In addition, the total value of completed projects in H1 2019 was lower than between July and December 2018. Factors behind this phenomenon include the skilled labor shortages that is delaying construction projects, and the fact that these projects can be sold at 5% VAT rate until 2023 thus their completion is not so urgent. In the first six months of 2019, completed multi-unit housing projects were worth HUF 124 bln.

Road constructions

The report also reveals that in recent quarters rather fewer road and railway projects entered the construction phase, but the segment picked up in Q2 2019. New construction works were launched at more than HUF 200 bln, the fourth highest value in recent years. However, the high Activity Start of Q2 2019 could not offset the weaker Q1 2019 figures, so overall, H1 2019 has not turned out to be so outstanding. However, there has been a considerable difference between road and railway construction works in Activity Start: newly started road constructions saw an expansion, while railway construction remained very modest. This was especially true in Q2, when the total value of started road projects amounted to more than HUF 200 bln, while railway projects started at less than HUF 2 bln.

A major part of road and railway works began in the eastern regions whose share accounted for 86% in Activity Start, whereas that of the western regions was only 5%. Road and railway constructions witnessed relatively low completion rate in H1 2019, being just under HUF 47 bln. In Q3, though, a hike is predicted in Activity Completion due to the completion of several large-scale projects such as the electrification of Mezőzombor-Sátoraljaújhely railway line, the quadrupling of Tar-Mátraverebély stretch of Road 21, Phase 2 of the M4 motorway between Berettyóújfalu and Nagykereki, the section of the M44 speedway between Tiszakürt and Kondoros, and the R67 speedway connecting Mernyeszentmiklós and Somogybabod.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.