Budapest office market vacancies hit record low

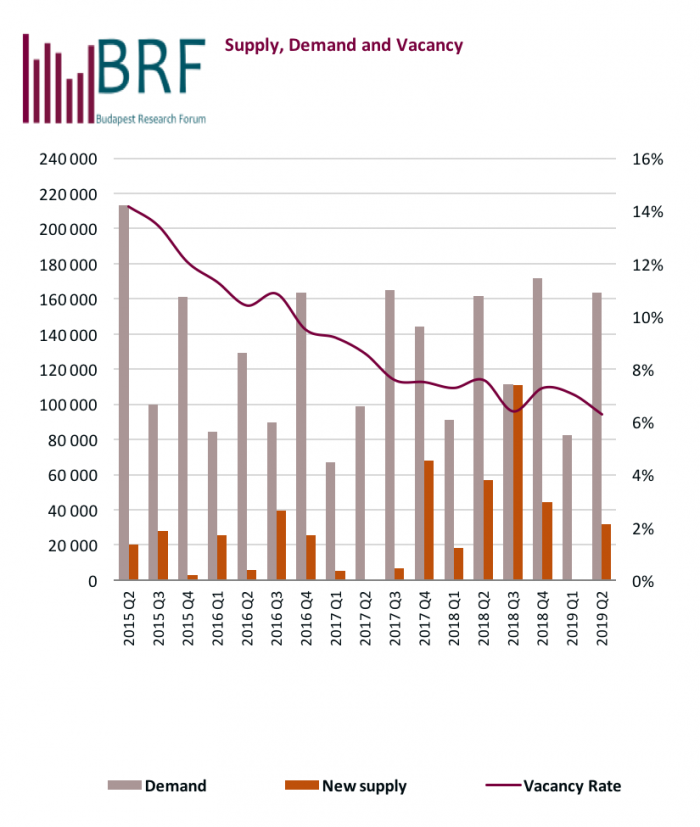

The vacancy rate on the Budapest office market fell to a record low of 6.3% in Q2 2019, with the Non-Central Pest submarket (2.1%) leading the way but the Periphery still suffering from a high, 36.7% rate, shows the latest office market summary of the Budapest Research Forum (BRF).

Four office buildings were delivered to the Budapest market in the second quarter: while the Ferrum office building (3,380 square meters) and both phases of the Corvin Technology & Science Park (12,180 sqm and 11,570 sqm) were new developments, Molnár 19 (4,560 sqm) was also added to the modern office stock following its complete refurbishment.

The total modern office stock in Budapest currently adds up to 3,654,180 sqm, consisting of 3,049,610 sqm of category "A" and "B" speculative office space, as well as 604,570 sqm of owner-occupied space. The fall of the office vacancy rate to 6.3% represents a 0.8 percentage-point reduction quarter-on-quarter on the capitalʼs office market. According to the report, net absorption in this quarter amounted to 52,180 sqm.

Total demand in Q2 2019 reached 163,390 sqm, representing an almost equal amount of take-up compared to the corresponding period of last year (161,550 sqm). New leases accounted for 42.7% of total leasing activity, followed by pre-leases with 25.5%, while renewals represented a 22% share. Expansions accounted for 9.8%.

As during the previous quarter, the strongest occupational activity was recorded in the Váci Corridor submarket (32% of total demand). In second place was South Buda, followed by the CBD submarket, with shares of 22% and 13% of total demand, respectively.

The BRF says that 207 lease agreements were signed during the quarter, with an average deal size of 789 sqm, which exceeds the first quarter’s average by 34%. The forum registered ten transactions larger than 3,000 sqm, made up of two new leases in the existing stock, four pre-leases in ongoing developments, three lease renewals and an expansion.

Two of the three largest transactions were signed in the Váci Corridor submarket, both being pre-lease agreements. BP signed for 22,060 sqm in Agora Budapest, while the other transaction covered more than 5,000 sqm in Balance Hall. The largest new deal was concluded in one of the office buildings of the South Buda submarket, while the largest renewal was in Graphisoft Park, for 4,000 sqm. The largest expansion was signed in the Corner6 office building, for 3,240 sqm.

The Budapest Research Forum comprises CBRE, Colliers International, Cushman & Wakefield, Eston International, JLL, and Robertson Hungary.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.