Recovery on Firmer Ground, Both in Hungary and Worldwide

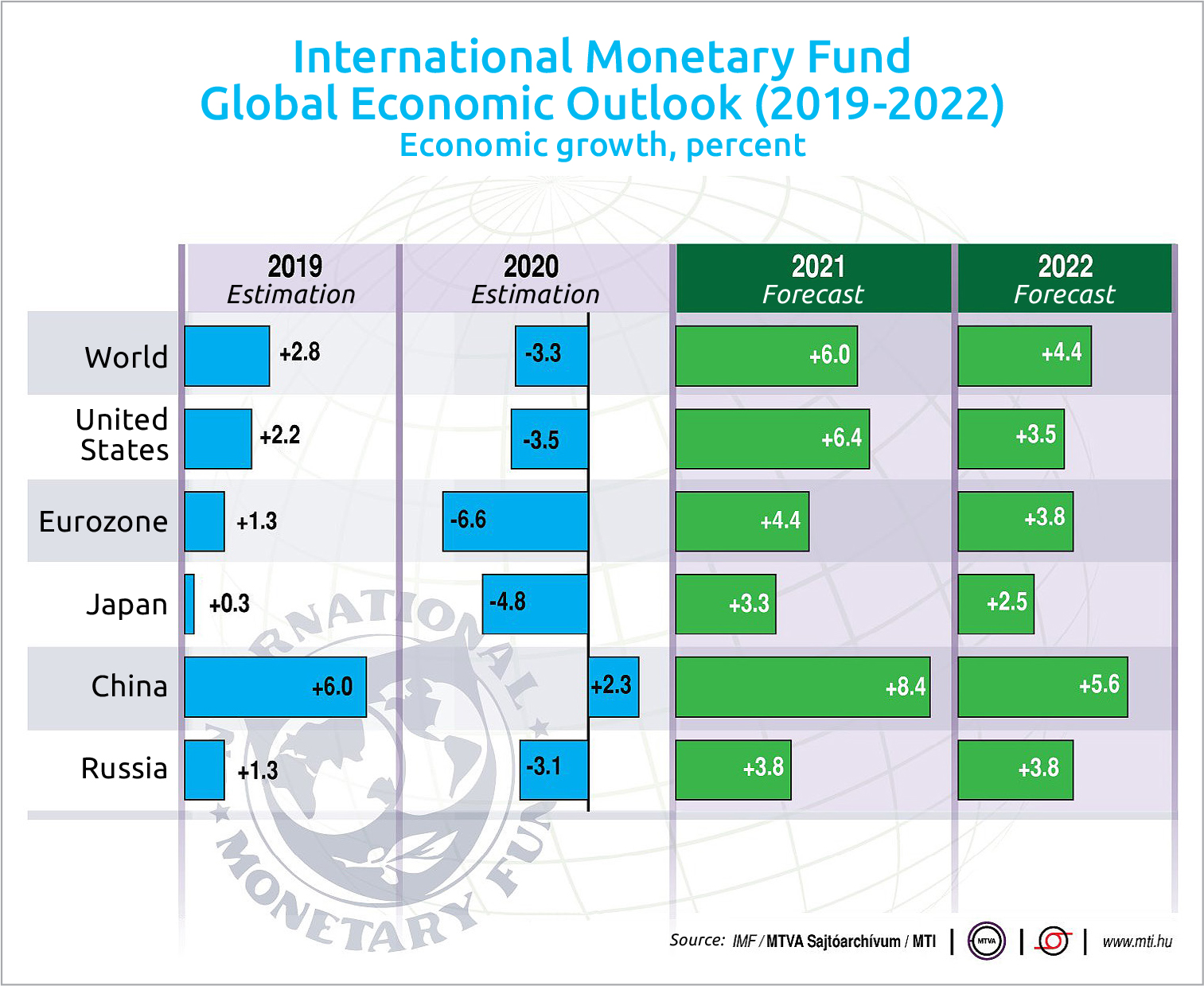

In spite of the ongoing third wave of the coronavirus pandemic, the International Monetary Fund (IMF) improved its projections for the Hungarian economy in its latest report, issued after Easter. Across the region, the IMF upgraded its forecast only for two other countries: Romania and Bulgaria. As for the global economy, it raised its growth projection to 6%, a level unseen since the 1970s.

Global prospects remain highly uncertain one year into the pandemic; however, the global economy is on firmer ground now, the International Monetary Fund (IMF) states in its latest World Economy Report, released on April 6.

The fund says that the upward revision reflects additional fiscal support in a few large economies, the anticipated vaccine-powered recovery in the second half of 2021, and continued adaptation of economic activity to subdued mobility.

High uncertainty surrounds this outlook, related to the path of the pandemic, the effectiveness of policy support to provide a bridge to vaccine-powered normalization, and the evolution of financial conditions, the IMF writes.

The fund forecasts worldwide output could rise 6% this year, a rate unseen since the 1970s, thanks largely to the unprecedented policy responses to the COVID-19 pandemic. Less than three months ago, the IMF projected that global economy would expand by 5.5%.

The recent upgrade mainly reflects a rapidly brightening outlook for the U.S. economy, which the IMF now sees growing by 6.4% in 2021, the fastest there since the early 1980s. That’s up 1.3 percentage points from the IMF’s 5.1% projection in late January and nearly double the rate it estimated in October. The fund said the world economy contracted 3.3% in 2020, a modest upgrade from an estimated contraction of 3.5% in its January update.

U.S. Heft

The outlooks for other advanced economy heavyweights, such as Germany, France and Japan, have hardly improved at all since January; however, with the heft of the U.S. outlook improvement as the main driver, the IMF marked up its advanced economy growth estimate to 5.1% from 4.3%.

Among the emerging economies, the IMF raised its forecast by just 0.4 of a percentage point (half of the advanced economy mark-up) to 6.7% from the view in January.

As for Hungary, the fund raised its GDP growth projection this year to 4.3%, up from 3.9% in the previous forecast released last October. In 2020, the Hungarian economy contracted by 5%. For 2022, the IMF projects GDP growth rising to 5.9%. Average annual inflation will pick up to 3.6% this year and will slow to 3.5% in 2022, the IMF says. The projection is up from its 3.4% forecast in October. Last year, annual average inflation came to 3.3%. The IMF sees the unemployment rate dropping to 3.8% in 2021 and to 3.5% in 2022. In 2020, unemployment was at 4.3%.

The latest forecast by the IMF is more or less in line with the market consensus for Hungary. The National Bank of Hungary (MNB) expects the Hungarian economy to expand by 4-6% this year, according to its Inflation Report issued at the end of March.

Downward Risk

The Budapest-based GKI economic research company also raised its economic forecast, up by 0.6 of a percentage point to 4.3% in its March outlook. It noted that this would bring Hungarian GDP close to, but not yet at, its 2019 level. The main downward risks are that the substantive restrictions caused by the pandemic will persist for a while into the second half of the year, either in Hungary or in its main trading partners.

However, next year’s general election might motivate the government to further loosen its fiscal policy, GKI speculated. According to the research company, employment and unemployment will remain broadly unchanged on an annual average but will improve over the course of the year. Real earnings will increase by 2%, consumption by 3.5% and investments by 6%.

GKI sees inflation as rising to 3.9% this year, up from 3.3% in 2020. Average forint/euro exchange rate might reach HUF 365 this year, following an average of HUF 351 in 2020. If so, it cannot be ruled out that the MNB will be forced to tighten monetary policy, the GKI notes.

The OECD is less optimistic for both Hungary and the global economic expansion. In its interim report in March, it says global GDP growth is now projected to be 5.6% this year, an upward revision of more than one percentage point from its December OECD Economic Outlook. World output is expected to reach pre-pandemic levels by mid-2021 but much will depend on the race between vaccines and emerging variants of the virus.

As for Hungary, the OECD projected an average of 3% growth for both 2021 and 2022 in its December Economic Outlook, and has not changed its projection since.

Numbers to Watch in the Coming Weeks

On April 9, the day this paper is published, the Central Statistical Office (KSH) will release March consumer prices, along with retail trade data for February. On April 14, the second estimate of February industrial output will be out (the first estimate was released on April 8). The next day, February construction data is published.

This article was first published in the Budapest Business Journal print issue of April 9, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.