U.S. Government Default not the Scariest Thing in the ‘Jungle’

Graphic by Rawpixel.com / Shutterstock.com

Finance Matters columnist Les Nemethy looks at the threat of the United States defaulting on its debt and the more significant dangers he believes lie hidden beneath that.

U.S. Government debt has already surpassed the legislated debt ceiling of USD 31.4 trillion, with the Treasury relying on “extraordinary measures” to stave off default. U.S. Secretary of the Treasury Janet Yellen stated that a default could happen as soon as early June, at which time the government could run out of cash to fund day-to-day operations.

Financial markets seem to blithely ignore the risk, figuring that, as the debt ceiling was raised 29 times over the last 45 years, 2023 will be no exception. But the political divide is greater than ever.

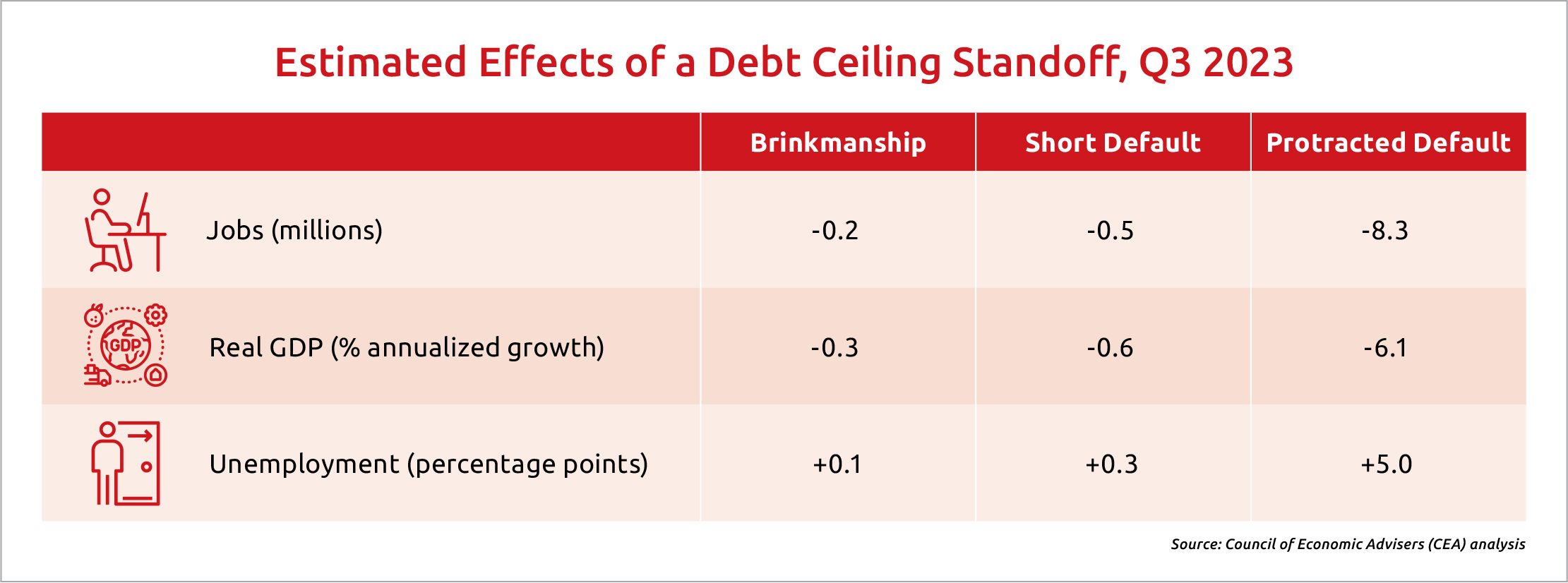

Few people are aware of the damage a default might cause. It would almost certainly unleash a significant recession and a big rise in interest rates to compensate for higher risk (and not just on U.S. Government debt). The U.S. Congressional Budget Office recently offered the following impact assessment of default for America.

We are already paying the price of brinkmanship. And the problem could get much worse very quickly.

From the above, one would think that the default is THE big issue that will determine our financial future. I would argue there are much bigger issues.

Bestselling author Stephen Covey once wrote, “We’re often so busy cutting through the undergrowth, we don’t even realize we are in the wrong jungle.”

“Wrong jungle” is the perfect phrase to describe the tempest surrounding a default caused by a failure to raise the debt limit. The fact that there is such a massive debt in the first place and that it is increasing so quickly is a much bigger issue. Let me give you some more context on why this is the wrong jungle.

1) De facto, the debt ceiling does nothing to curtail debt: The debt ceiling is an artificial construct. The U.S. Congress legislates it, and it has been reset so many times it has no credibility as a limit to indebtedness. It has done little or nothing to keep government debt from going out of control other than providing an opportunity for horse trading between politicians as a precondition for raising the limit each time.

2) U.S. Government spending going off the rails is a much bigger issue than the level of debt itself: Debt levels need to be addressed by reducing spending, not capping debt. The U.S. deficit is currently in the range of 4-5% of GDP, but it is likely to increase to 6-7% due mainly to:

(a) Unfunded U.S. Government liabilities. These now exceed USD 123 billion, roughly quadruple the level of U.S. national debt, more than USD 900,000 per U.S. household. These reflect the inadequate levels of money being set aside to fund future Medicare, social security, and the like. These will dictate deficit increases and, at some point, tax increases.

(b) Higher interest costs. With long-term government debt gradually rolling over and refinancing at ever higher rates and new debt being raised to fund the deficit, interest costs are increasing rapidly. Interest expenses increased from USD 329 bln to USD 828 bln between May 2013 and December 2022, respectively. With the compounding effect of interest on interest, interest expenses could soon become the single largest expense item on the U.S. budget.

3) The debt overhang will be with us long after the debt ceiling crisis is over: There is so much drama and media attention surrounding the debt ceiling. In my humble opinion, this detracts attention from the real issues (deficit spending and national debts careening out of control), which makes the “wrong jungle” aphorism particularly apt.

A much better solution than the debt ceiling would be the “debt brake” enshrined in the Swiss constitution: Swiss Government receipts and expenditures must be balanced over the long term. Surpluses must be generated during a boom to pay for deficits during a recession. It has helped them trim the national debt to below 30% of GDP.

The chart above shows the extremely negative impact of a default. Yet the disruption from a full-blown debt crisis could be much greater. The world can ill afford such a crisis. It’s typically the proverbial man on the street and the poor who pay the price.

But the “price” will reverberate at multiple levels. For example, if the world economy were to decline by 8-10 or more percent, this would also impact our ability to combat global warming as well as potentially affect the balance of power between the United States and China. The higher debt levels go, the more systemic risk in our financial system. The stakes of not addressing excess deficit spending and government debt are simply too high to ignore.

Les Nemethy is CEO of Euro-Phoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www.businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

This article was first published in the Budapest Business Journal print issue of May 19, 2023.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.