Prepare for Monetary Climate Change: Is This the end of Pax Americana?

Monetary climate change (to borrow a phrase from author and columnist Ron Stoeferle) is happening far faster than environmental climate change. Les Nemethy looks at some of the forces in action.

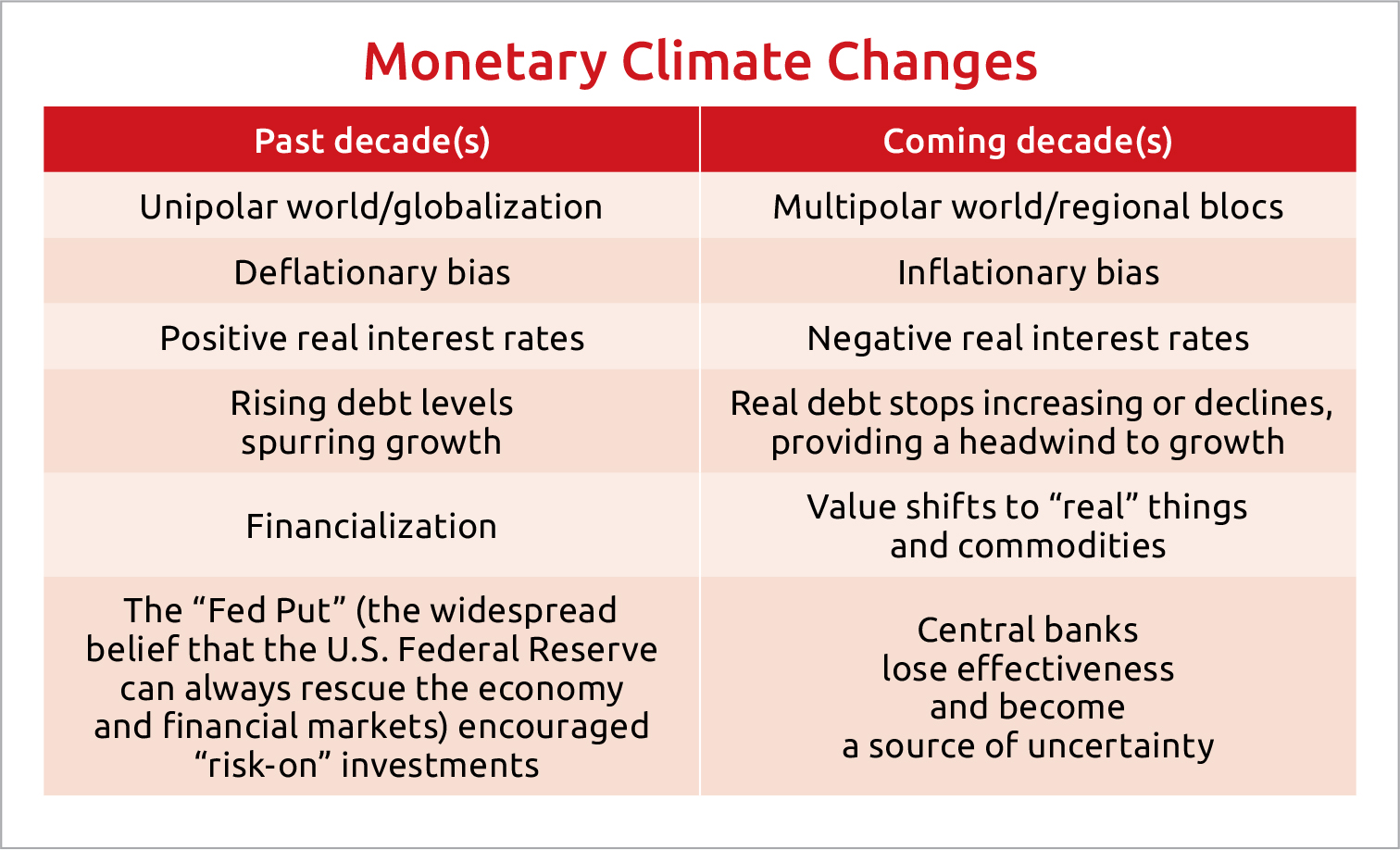

In the past decades, we have had an enormously positive economic tailwind from globalization. There was a seemingly infinite low labor cost manufacturing base in China, which became the “world’s factory,” creating a global deflationary bias. This process is now reversing, providing a tailwind to global inflation.

In the post-World War II era, the United States’ percentage of global GDP, imports, exports, and so on has been steadily declining, whereas similar indicators for China have been steadily increasing, even overtaking America on some measures. The world is no longer unipolar; Pax Americana can no longer be taken for granted.

Globalization seems to have reversed gear as the world moves towards trade blocs. To list a few recent events:

• Dozens of multinationals recently withdrew from Russia;

• Trade between Russia and China is becoming closer;

• Threats of sanctions are leading Chinese companies (most recently Sinopec) to divest assets in the West;

• Chipmakers are now investing heavily into U.S. production;

• Everyone is seeking food and energy security.

Supply chain security and duplication of supply chains are inflationary. This reorganization accentuates hoarding, supply bottlenecks, and the like. While I don’t believe we will see hyperinflation (defined as prices rising by 50% per month), I do think we will see superinflation (prices rising at 10% per annum).

Since Paul Volcker squeezed inflation out of the U.S. economy with 16% interest rates in the early 1980s, nominal interest rates have steadily declined over the past 40 years. In most developed countries, they reached the “zero bound”; a sizeable portion of global sovereign debt had zero percent or lower nominal interest rates.

This is a trend that has reversed over the past months, with nominal interest rates moving marginally higher, but there is a limit to how high rates can increase (given the USD 360 trillion of global debt). Inflation is likely to remain far higher than interest rates. In my opinion, year treasuries at 4-5% could already trigger a recession. Official inflation could well remain over 7% in the EU and United States, perpetuating negative interest rates for most of the coming decade.

Negative real interest rates are a form of hidden taxation and represent the only politically viable way most countries can reduce real indebtedness by inflating it away. That’s a disaster for anyone who is a saver, bondholder, retiree, etc. America had a similar period of negative real interest rates in the decade following World War II.

The Paper Gold Trail

Over the past decades, there has been a trend towards financialization (much more rapid growth of the financial economy than the real economy). For example, there is more than USD 100 trillion of “paper” gold (futures contracts, exchange-traded funds, etc.) and only some USD 7 tln of actual gold. Bullion banks and others have made fortunes via factional reserve trading of paper gold, but if there were a run on gold, there would not be enough real gold to back all the paper gold.

Whereas today global equities are estimated at about USD 115 tln, the pendulum may swing back towards the 1980 crisis situation, where equities and gold were at comparable levels (each capitalized at approximately USD 2.5 tln). Historically, the commodities to equities ratio is at an all-time low.

Holders of fiat currencies may lose confidence due to money printing – 40% of U.S. dollars were “printed” over the last two years – and there are early indications of a trend whereby central banks and investors alike seek refuge in tangible stores of value (for example, gold and other commodities).

In summary, we are entering a new monetary era characterized by inflation, negative real interest rates, and the re-emergence of “real” assets, likely a long-term commodity cycle.

Sadly, there is an increasingly common view that central banks are becoming part of the problem rather than the solution. Economist Russell Napier believes central banks are irrelevant because the primary method of monetary expansion is through government guarantees of bank lending.

Financial markets expert Mohammed El Erian believes the Fed, after several mistakes, has lost control of the inflation agenda: Delayed action against inflation means that the Fed will have to slam on the monetary brakes, causing a significant recession or allow inflation to accelerate out of control. The proverbial “soft landing” is becoming increasingly elusive.

Disclaimer: This article is intended for educational and (hopefully) entertainment purposes, not investment advice. Conduct your own due diligence before any investment decision.

Les Nemethy is CEO of Euro-Phoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www.businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

This article was first published in the Budapest Business Journal print issue of April 22, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.