NIIP: Important but Seldom Used Metric

The Net International Investment Position (“NIIP”) is an ever-so-important, but ever-so-seldom used indicator of a country’s financial health, asLes Nemethy exploresin his latest Corporate Finance Column.

NIIP is the difference between a country’s external financial assets (including assets held abroad by its residents and corporate affiliates) and its liabilities (including government and private debt and corporate shares by foreign nationals).

You might say NIIP expresses the net financial worth of a country. A positive balance indicates the country is a creditor nation; a negative balance indicates it is a debtor nation. It is often expressed as a percentage of a country’s GDP.

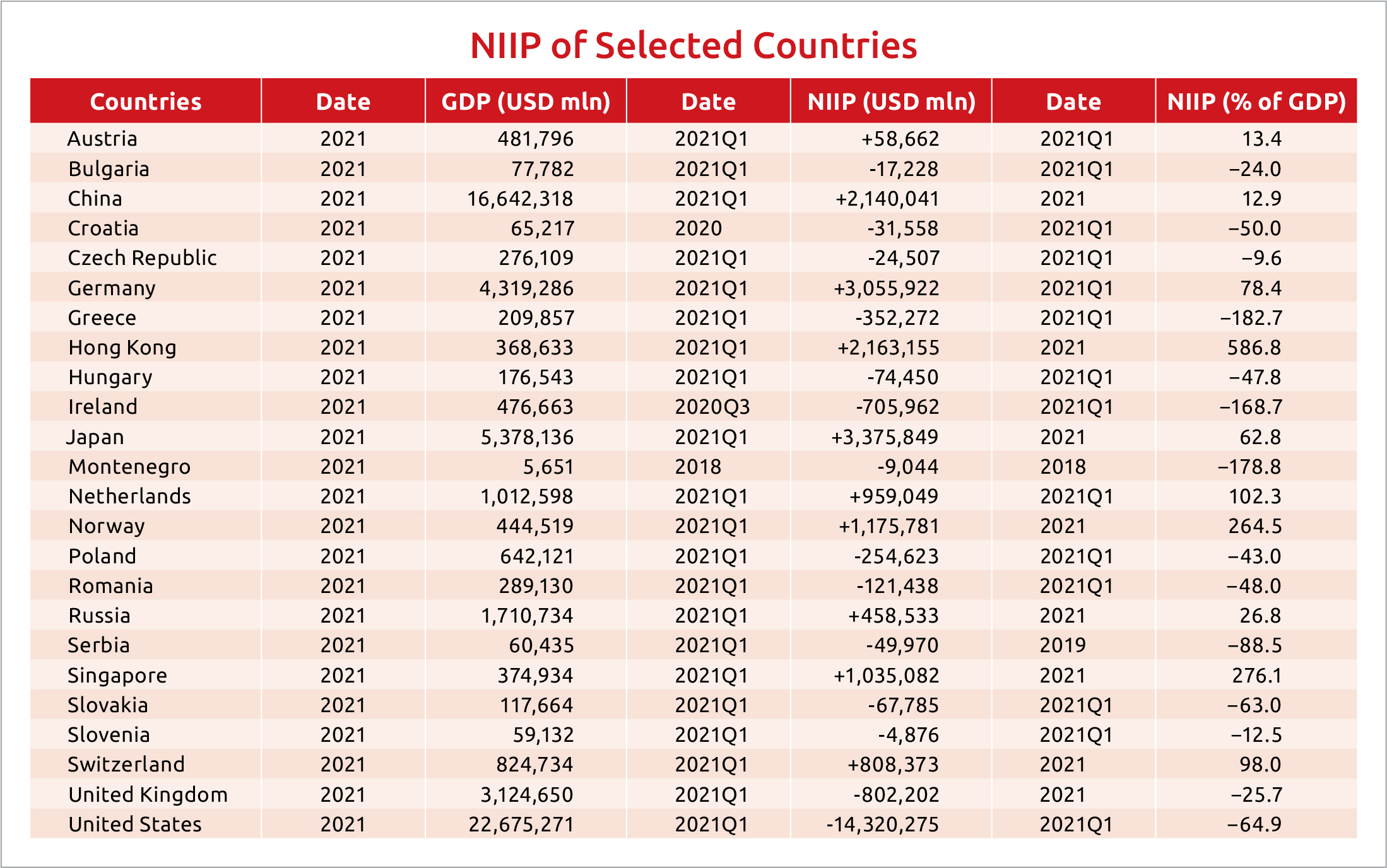

The chart sets out the NIIP of countries readers may find interesting. So what does a scan of these numbers tell us?

There are several NIIP superstars, countries that have NIIP’s in excess of 100%. These include Hong Kong, Singapore, Norway, Netherlands, etc. These countries are not only affluent; high NIIP also provides resilience to weather crises.

Then there are the NIIP stragglers, like Montenegro, Greece, and, surprisingly, Ireland, that have NIIP’s of less than -100%. (Ireland is a special case, driven by the decisions of multinationals to domicile intellectual property there.) In times of crisis, especially if foreigners were to liquidate their positions in those countries’ assets, those countries could fare quite negatively.

CEE Placings

It is interesting to note that Central European countries are typically found at the mid- to lower-end of the table, with Austria slightly positive (13.4%), the Czech Republic and Slovenia slightly negative (-9.6% and -12.5%, respectively), then Hungary, Poland and Croatia (in the -40 to -50% range), with Bulgaria and Romania further behind.

While Japan has a respectable NIIP as a percentage of GDP (62.8%), the substantial size of its economy gives it the single largest NIIP in absolute terms (USD 3.376 trillion).

It is also interesting to note the position of the major powers: China, Russia, and the United States. Both Russia and China have positive NIIP’s, while the USA has a whopping -64.9% NIIP.

This may be considered surprising, given the vast debt and equity holding of U.S. institutions (including multinationals) abroad, but the level of U.S. debt held by foreigners, and holdings in U.S. shares by foreigners, is even more significant.

While substantially negative U.S. NIIP is not likely to be a cause for concern in the short-term, thanks to a positive spread between what American investors earn abroad compared to what foreign investors earn in the States, the country could be put into a very tough spot if interest rates were to experience a major rise suddenly.

Also, the trend in U.S. NIIP has been negative over time. If the trend continues, there may come a point where foreign investors lose confidence. If you look at the chart, the absolute number of U.S. NIIP is so overwhelming (some USD 14 tln) that a loss of confidence would have global ramifications.

NIIP could be an interesting tool or metric for the future. For example, when making an acquisition or investment, it could be helpful to know the NIIP of the country you are investing in, from a risk management perspective. A measure of government performance is debt as a percentage of GDP; perhaps NIIP would be at least as useful a metric.

Les Nemethy is CEO of Euro-Phoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www.businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

This article was first published in the Budapest Business Journal print issue of October 8, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.