January Industrial Production Disappoints Analysts

Industrial output fell by 6.7% on a year-on-year basis in January, which is a greater decline than expected. Industrial production was up, however, from the previous month. Inflation in February was 3.1%, but analysts expect higher CPI in March and April.

In January 2021, the volume of industrial production fell by 6.7% year-on-year; based on working-day adjusted data, production declined by 2.8% according to the latest figures released by the Central Statistical Office (KSH).

Compared to crude data, the significant difference is due to the fact that there were two less working days in January 2021 than in January 2020. Industrial output was 0.2% higher, compared to the previous month, according to seasonally and working-day adjusted data.

The majority of the manufacturing subsections contributed to the fall. The manufacture of transport equipment, representing the largest weight, dropped significantly, while the manufacture of food products, beverages and tobacco declined to a lesser extent. The manufacture of computer, electronic and optical products grew.

Industrial output in January, according to both seasonally- and working-day adjusted indices, was 0.2% above the level of the previous month, and had grown by 57% compared to the nadir of April, KSH said.

Analysts gave mixed reactions to the January data. Takarékbank head analyst Gergely Suppan said that the year-on-year decline in January was bigger than he expected.

At the same time, the fact that production was able to grow from December surprised him, as car manufacturers had suffered from a narrowing capacity of microchips and many were forced to reduce or halt production.

Extra Push

According to Suppan, we will see further stabilization in the industry in the coming months, and as car makers resumed production in February, that might also give an extra push to the sector. He thinks that 2021 might see an annual growth of 15-16%, and industrial production might contribute to the GDP by more than three percentage points.

Industrial output was a positive surprise at the beginning of the year; however, the big picture is far from rosy at the moment, ING Bank head analyst Péter Virovácz commented on the data.

He is not so optimistic regarding the near future: according to him, vehicle manufacturing is still not able to utilize its full capacity, and supply chains are still in trouble, while further restricitions introduced in March might cause additional problems.

Industry might even hold back the country’s economic performance in the first quarter of the year. The optimism caused by the better than expected Q4 GDP data has therefore diminished, he noted.

The Hungarian industrial recovery came to a halt at the beginning of the year, Századvég analyst Dániel Molnár agreed. The global shortage of microchips has negatively affected Hungary’s vehicle manufacturing, and as for the outlook, external demand is vital. It is also a question whether vehicle manufacturing can make up for the lost production.

This year could be hectic in terms of industrial production, K&H Bank head analyst Dávid Németh commented on the data. Industrial performance will greatly depend on when the uncertainties caused by the pandemic disappear and how strong internal and external demand will be during the year, he emphasized.

Big Jumps

Due to the low base effects, he expects notable jumps in industrial production data in April and May, and for the whole year, he believes that the sector might be able to produce a 5-10% growth following a 6% decline in 2020.

The KSH also published inflation figures for February. According to this, consumer prices were 3.1% higher on average in February 2021 than a year earlier. Relatively significant price rises were measured over the year for alcoholic beverages and tobacco, with price rises slightly exceeding the average for food and consumer durables.

Core inflation, which excludes volatile food and fuel prices, was at 4.1%. Compared to February 2020, food prices were up by 3.4%, while alcoholic beverages and tobacco grew by an average of 9.9% (within which tobacco was 16.5% more expensive).

Shoppers paid 3.8% more for consumer durables, within which new passenger autos had risen by 12.1%. Consumer prices went up 0.7% compared to January. Food became 1% more expensive, motor fuel prices became 3.8% higher.

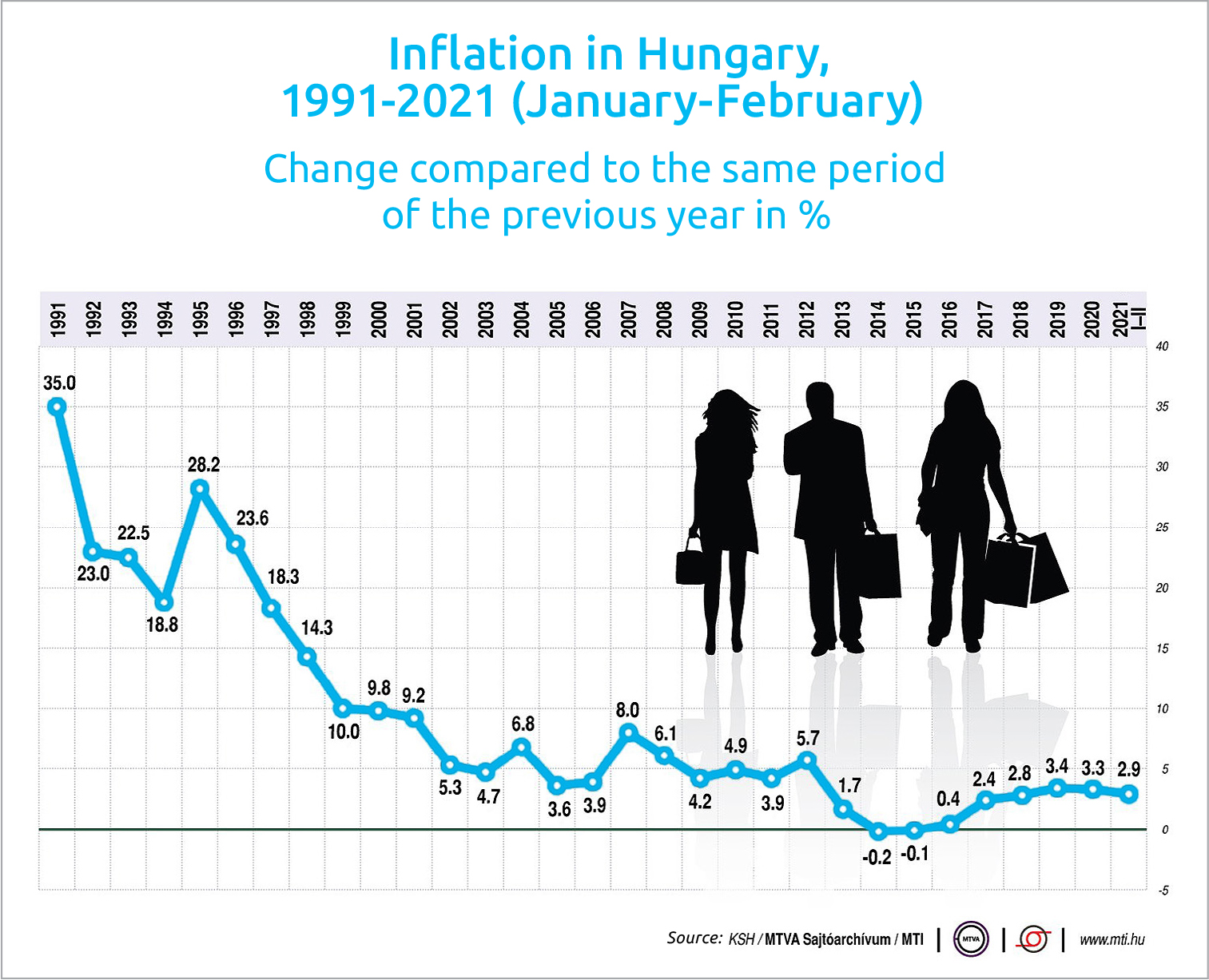

In January-February 2021, consumer prices were up by 2.9% for all households on average, and by 3% among pensioners, compared to the same period of 2020.

According to analysts, February inflation data matched forecasts. They also said a further uptick was likely due to the rising fuel prices and a higher excise tax. Takarékbank’s Suppan said he expected 4% inflation for March, and fuel prices might lead inflation to go above 5% in April, he added.

Numbers to Watch in the Coming Weeks

The macroeconomic calendar is relatively calm in the next two weeks. The second estimates of January’s industrial data are due out today (Friday, March 12). In the middle of the next week, the KSH will publish January construction industry data, and on March 18, it will detail how commercial accommodation establishments performed in January.

This article was first published in the Budapest Business Journal print issue of March 12, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.