How Might Invasion of Ukraine Impact Western Economies?

While the world is experiencing a humanitarian crisis and approaching Armageddon, some observers have focused on how much damage sanctions have caused to Russia. They will have devastating effects there, but for this article, Les Nemethy focuses on how they are also shaking the very foundations of our own economic houses.

The Russian and Ukrainian economies together account for only 2% of global GDP; one may be tempted to dismiss the significance of events going on just to our east.

Already before the Russian invasion of Ukraine and sanctions, the world was facing:

• a record amount of debt (USD 360 trillion and growing);

• stratospheric valuations on equity markets; and

• the highest levels of inflation since the early 1980s.

Cumulatively, these have taken us to the edge of a vast economic abyss, concerning which sanctions represent another huge step forward.

The primary mechanism by which the West is likely to be affected is via energy prices. Analyst Luke Groman recently stated that the United States could not sanction Russian energy without itself risking systemic collapse. Russia is simply too important in the oil and gas market and supplies roughly half of the EU’s gas.

European gas prices have more than quadrupled over the last year alone, and the trend is still practically vertical. Europeans currently pay 13 times more for gas than Americans.

Gas Taps

Gas is still flowing through Ukraine, although a Ukrainian pipeline was recently accidentally hit. Further north, gas has stopped flowing through the Yamal pipeline, accounting for approximately 15% of Russian gas to Europe. Russian gas flow to Europe could well be more seriously interrupted or stopped by sanctions.

A more than 50% increase in energy prices has resulted in a recession every single time since 1970. At the date of writing, the Brent oil price was over USD 130, which leads to a prediction of recession over the coming months.

Energy is perhaps the most significant contributor to inflation, but the war disrupts supply chains and acts as a catalyst to global inflation at so many other levels as well:

• Russia and Ukraine account for 25% of global grain exports. Wheat prices have catapulted by about 50% over the past month.

• Russia provides some 42% of global palladium, which is necessary for catalytic converters. Prices have skyrocketed.

• Several weeks ago, Russia cut off its fertilizer exports, contributing to a worldwide spike in fertilizer prices. The Fertilizer Price Index has almost doubled in the past year, leading to across-the-board increases in agricultural commodity prices.

High inflation leads to the impoverishment of anyone on a fixed income and the rise of populist parties. I’ll give you just two historical examples: increases in wheat prices triggered the Arab spring, and hyperinflation helped sweep Hitler to power.

We may unwittingly further increase damage upon ourselves by restricting trade. Hungary, for example, has decided to stop grain exports. Such bans may provide some price relief at home but ultimately lead to retaliatory actions and supply chain disruptions.

Banking Breakdown

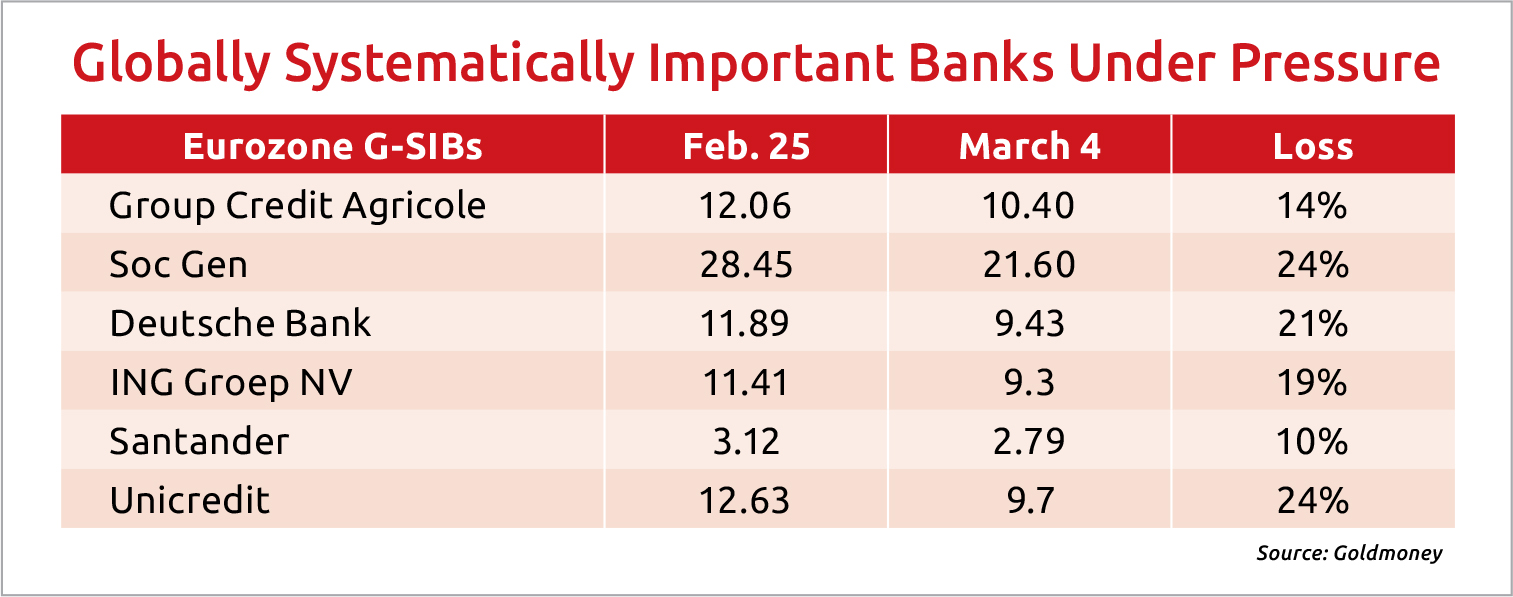

Another area where the Ukrainian invasion may impact the West is through banks. The share prices of a handful of Globally Systematically Important Banks have fallen by double-digit percentages just in the past week.

The European banking system is under unprecedented stress. Société Générale owns one of the largest private banks in Russia. OTP Bank of Hungary has also seen its share price plummet due to Russian and Ukrainian exposure. Sberbank’s Central European subsidiaries are facing default and liquidation.

Several major European banks had 30x asset to equity ratios even prior to the Ukrainian crisis, meaning that a 3-4% decrease in asset values has the potential to eliminate equity value.

There are also thousands of investment funds, fund managers and corporations in North America and Europe that will need to write off or markdown assets. Because Russian financial markets are closed, this process has been slow to begin but will inevitably accelerate over the coming months.

Although the dollar is currently experiencing relative strength to the euro (as Europe bears the brunt of energy supply vulnerability, bank fears, etc.), the dollar may also be a casualty in the long term. The Chinese no doubt took note of how easily Russian dollar-denominated central bank reserves were seized. China and other countries may be expected to reduce dollar reserves and U.S. dollar-denominated trading further, in turn lowering demand for U.S. bonds and U.S. dollars.

In conclusion, the economic impact of sanctions is only beginning to be felt. As their effects play out, we will likely experience rising debt levels, spiraling inflation, bank failures and recession. A combination of high inflation and low or negative growth may lead to a lethal brew of stagflation. Not a rosy picture.

Les Nemethy is CEO of Euro-Phoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www.businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

This article was first published in the Budapest Business Journal print issue of March 11, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.