From Rubble to PetroRuble: Towards the Birth of a New Monetary Order?

The recent sanctions against Russia catalyzed a sudden fall of the Russian currency from 81 rubles to the U.S. dollar to 150. Although the invasion of Ukraine has started badly for the Russians, and the sanctions continued to take their toll, between March 7 and April 3, the ruble miraculously recovered to 85 rubles to the dollar. Les Nemethy looks at what happened.

Very simply put, Russia declared that, from April 1, gas deliveries to “unfriendly” countries must be paid in rubles or gold. The Russian central bank also agreed to buy gold at 5,000 rubles per gram, effectively linking the ruble to both gold and oil.

The Russians were able to strengthen their currency by (a) increasing demand for rubles (gas importers had to buy rubles to buy gas) and (b) tying it to gold. Russia has announced that this will be the prototype for other commodities in the future (for example, wheat, fertilizer, etc.) Terms of trade also shifted massively to Russia’s advantage (the prices of energy and food-related commodities, Russia’s main exports, have soared).

In this financial war, each side played to its strength: the United States to its control of the U.S. dollar payment system, the Russians to their strength in energy (being the world’s largest gas exporter and third largest oil exporter).

Zoltan Pozsar, a well-known Credit Suisse analyst and former U.S. Treasury official, stated that we are entering a new monetary order, which he calls Bretton Woods III: “Commodities are real resources [….] and resource inequality cannot be addressed by QE [.…] you can print money, but not oil to heat or wheat to eat.”

For Pozsar, Bretton Woods I was the post-World War II agreement that established a gold-backed U.S. dollar as a global reserve currency. Bretton Woods II began in 1971 when Nixon “temporarily” suspended the gold backing of the U.S. dollar.

New World Order

“We are [now] witnessing the birth of Bretton Woods III, a new world [monetary] order centered on commodity-based currencies in the East that will probably weaken the eurodollar system and contribute to inflationary forces in the West. [.…] It used to be as simple as ‘our currency, your problem.’ Now it’s ‘our commodity, your problem,’” Pozsar says.

Pozsar believes that the Bretton Woods III era will be characterized by higher inflation and interest rates. Governments will substitute foreign currency reserves for commodity reserves. Demand for dollars will be lower, as fewer will be held in reserves, and more trade will be made in other currencies.

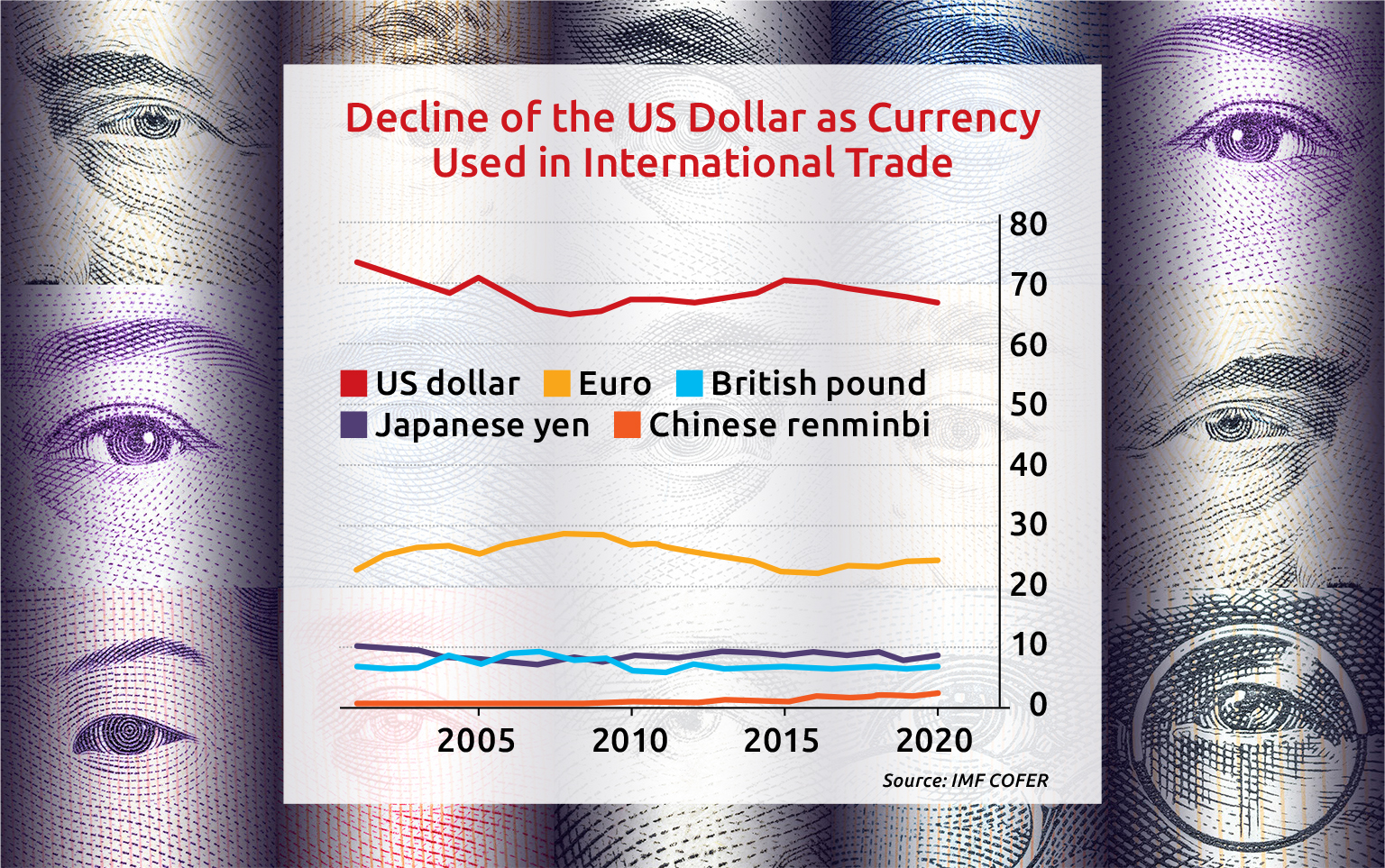

The chart above illustrates the gradual decline in past years of the U.S. dollar as a currency used in international trade:

According to “The Stealth Erosion of Dollar Dominance,” a very recent IMF Working Paper, “reserve managers have moved out of dollars in two directions, with one quarter headed into the renminbi and three quarters into currencies of smaller countries that have traditionally played a limited role as reserve assets.”

There is a fear that the seizure of Russian reserve assets may accelerate the trend.

According to Pozsar, “When this crisis (and war) is over, the U.S. dollar should be much weaker and, on the flip side, the renminbi much stronger, backed by a basket of commodities.”

Natural Allies

In my opinion, the Chinese are much more natural allies with Russia in this form of monetary/commodity warfare than allies in the military sense. You may recall that, in February, Putin and Xi signed a joint statement calling for a new world order. The Chinese have made no secret of their desire to carve out a global role for the yuan.

If Bretton Woods III were to emerge over time, it would undermine the exorbitant privilege of the U.S. dollar’s current status as the world’s reserve currency. Furthermore, if Pozsar is correct, the deflationary impulse of Bretton Woods II (globalization, free trade, etc.) will turn into an inflationary one (autarky, duplication of supply chains, etc.)

In no way should this article be interpreted as predicting the sudden collapse of the U.S. dollar in the short- to medium-term. The dollar remains extremely dominant, both in trade and reserve currency functions; a more likely scenario is long-term erosion.

Currently, the Chinese and Russians seem to be playing the currency game more creatively than the Americans. The Fed has painted itself into a corner on inflation. We are still in the early stages of a long-term decline of the U.S. dollar. While the trend is inescapable, it is not irreversible: an economic implosion in Russia or a real estate crisis in China, for example, could slow or reverse it.

Think of the world monetary order today as a game, where the rules are changing all the time, not suddenly but gradually, and where there is no referee. You have to figure out how the practices evolve as you go along, adding to the game’s challenge.

Les Nemethy is CEO of Euro-Phoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www.businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

This article was first published in the Budapest Business Journal print issue of April 8, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.