Equilor Predicts Calmer 2023 for Economy, but Energy Prices Could Still Surprise

From left, Dániel R. Kovács, managing director, Front Page Communications, Bálint Szécsény, chairman of Equilor Asset Management Ltd., senior analyst Lajos Török, and Szilárd Buró, head of online trading at Equilor Investment Ltd.

The milder-than-usual winter has so far had a positive impact on gas prices, bringing relief to the whole European economy, including Hungary, but this does not mean the end of the economic crisis triggered by the Russo-Ukrainian war, Equilor analysts warn.

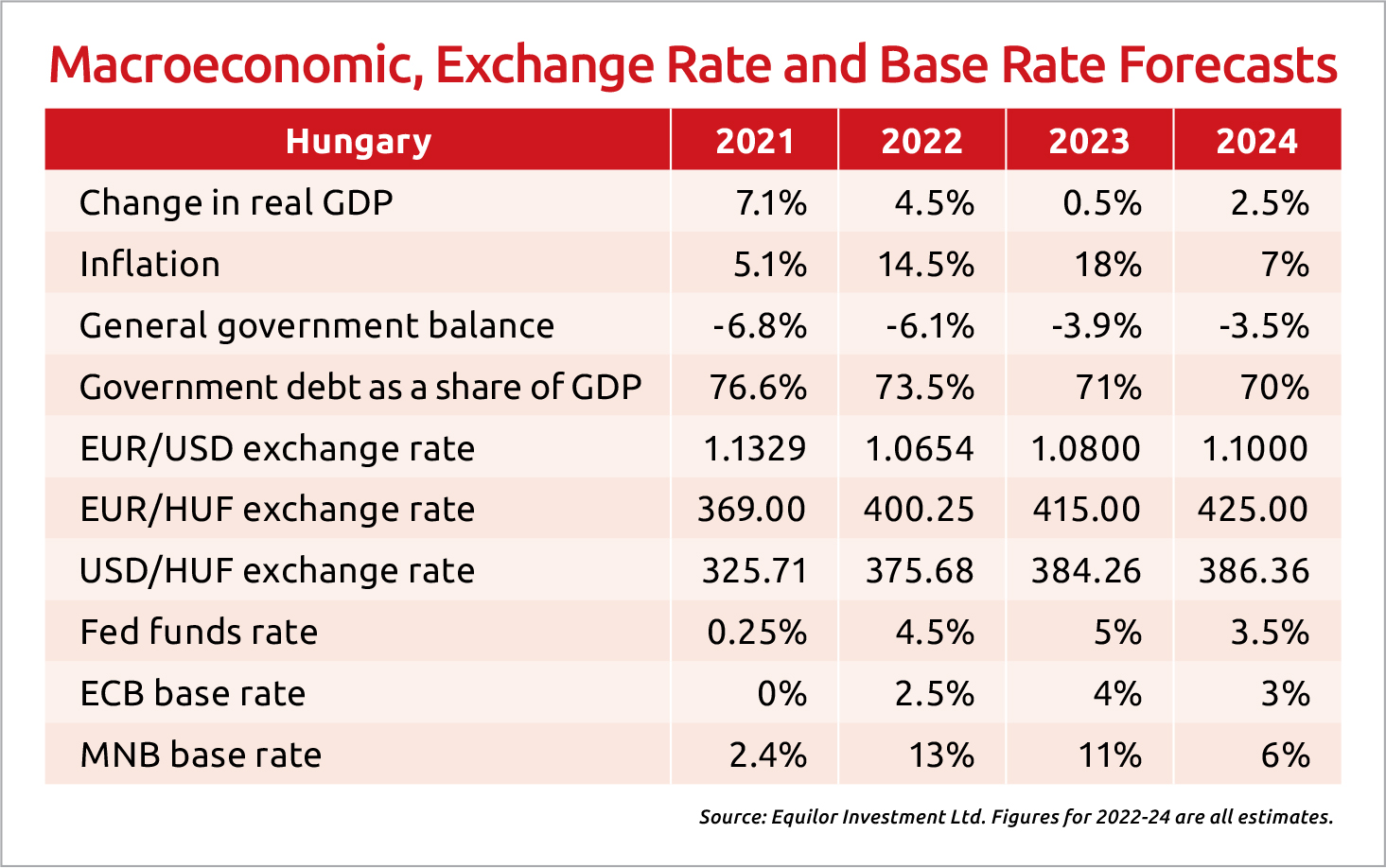

According to Equilor Investment’s annual outlook, the Hungarian economy is likely to show low growth of 0.5% this year; annual inflation could reach 18%. At the same time, the forint could return to a slightly weaker path after strengthening and stabilizing in recent weeks, and the euro return to around HUF 415. At the same time, energy price developments will remain a key determinant of inflation rates, which economies fall into recession, and how quickly they recover.

For all that 2023 might see a calmer economy than last year, the first and second halves could differ significantly. One of the critical questions remains the gas price evolution, which is a crucial determinant of inflation, especially for European economies. In addition to the warm winter, subdued energy demand from industrial consumers has helped to keep reservoirs at levels well above the five-year average, contributing to the TTF-listed gas price falling from a peak of close to EUR 300 to close to EUR 50.

According to Equilor, unless there is a drastic change in the weather, we could turn to the new filling season without any supply problems. Another critical question is which economies could sink into recession this year and how quickly they will recover. Equilor believes H1 will see hardship and recession in most European economies, including Hungary, while H2 could see growth resume.

Europe could avoid recession in 2023 thanks to the mild winter, but rising financing costs and energy shortages could lead to a restructuring of the economy, with entire industries transformed.

Slow Growth

Equilor expects GDP growth of around half a percent this year in Hungary. Domestic consumption may fall due to the general rise in prices, many corporate investments could be postponed due to higher financing costs, public investment may be cut back, and the uncertainty surrounding EU funding has not been resolved.

Inflation is likely to be around 18% this year due to imported inflation and the stickiness of the price-wage spiral but could ease to about 7% in 2024, according to senior analyst Lajos Török. Further restraint in government spending and a reduction in the import ratio will be essential to halt the rise in the current account and budget deficits.

Labor shortages are growing in several sectors and occupations, leading to a dynamic upward trend in average wages, but the unemployment rate is expected to remain below 4% for a sustained period.

The tightening policies of the major central banks could reach their interest rate peak in the second quarter and remain in place throughout the year, adversely affecting capital market movements, the analysts note.

The National Bank of Hungary (MNB) completed its cycle of base rate hikes at the end of September, but the intense weakening of the forint led it to continue monetary tightening through unconventional means. Since then, the benchmark rate has been the overnight deposit rate, which remains unchanged at 18%.

Key Conditions

The MNB has set six key conditions for the start of the rate cut, which has not been fully met so far. Török says he does not expect a rate cut until the second quarter at the earliest, although it may come before inflation peaks.

He adds that it is worth keeping an eye on credit rating agencies, as downgrades are expected. The first scheduled rating review came from Fitch Ratings on January 20, and while Hungary’s “BBB” sovereign rating was affirmed, the outlook was changed to “negative” from “stable.”

At the end of January, S&P Global Ratings is expected to warn of existing risks but hold off on downgrading due to new deadlines for European Union funds. If a full agreement with the EU is not reached in March, a downgrade (to BBB-, which is still investment grade) could be expected at the following review in July.

At the moment, the forint is being squeezed by opposite influences. Among the risks, the January ratings, continued conflicts with the European Union, disagreements between the MNB and the government, and the fragility of favorable international investor sentiment are all worth highlighting.

The forint could be supported by high-interest rates, a possible further weakening of the dollar, and any positive news on EU funding. Overall, though, the Hungarian currency could be on a slightly weakening path in the second half of the year, and the euro could return to the previously seen high of 415 HUF/EUR.

Investment Opportunities in 2023: Equilor’s Long-term Portfolio Recommendations

In terms of investments, this year could be a good time to build long-term portfolios, according to Equilor. Last year’s bear market has improved equity pricing, and a significant yield rise has opened up the space for bond investments again.

According to senior analyst Lajos Török, it is worth building a long-term portfolio this year, with the HUF and EUR versions of the premium Hungarian government bond and the newly issued dollar-denominated Hungarian government bond being important building blocks.

Higher risk takers could consider value stocks in developed markets, and Indian and Chinese equity markets could also perform relatively well in the period ahead. In China, the squeeze on the corporate sector may ease following the relaxation of the zero-COVID policy. Restoring stability in the property market has fueled a rally in Chinese technology stocks in recent weeks.

India could overtake China as the world’s most populous country and attract increasing attention from investors. The country’s economy could expand by 6.1% this year, and inflation could fall to 5.1%, making it the globe’s fifth-largest economy. India could benefit from cheap Russian energy supplies, and a more pro-Western leadership compared to China could also encourage foreign investment and factory relocations. A favorable age profile could also help the Indian economy to perform relatively well over the next decade.

This article was first published in the Budapest Business Journal print issue of January 27, 2023.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.