Central Bank Heats up Inflation Battle, Modifies Outlook

Soaring inflation paired with slowing or even stagnating economic growth; that’s the scenario for most of the world’s economies in the coming years, and Hungary is no exception. The central bank ramped up its rate hikes to combat rising prices, but inflation might still climb above 10% in some months in 2022 before, hopefully, returning to the tolerance band at the end of next year at the earliest.

Stagflation is a term that most economists do not like to hear but is likely to characterize most economies in the world in the coming months or years. It occurs when slow economic growth is paired with a high inflation rate. Like crisis-hit economies worldwide, Hungary also faces such tendencies, and the ongoing Russo-Ukrainian war could further deteriorate the situation.

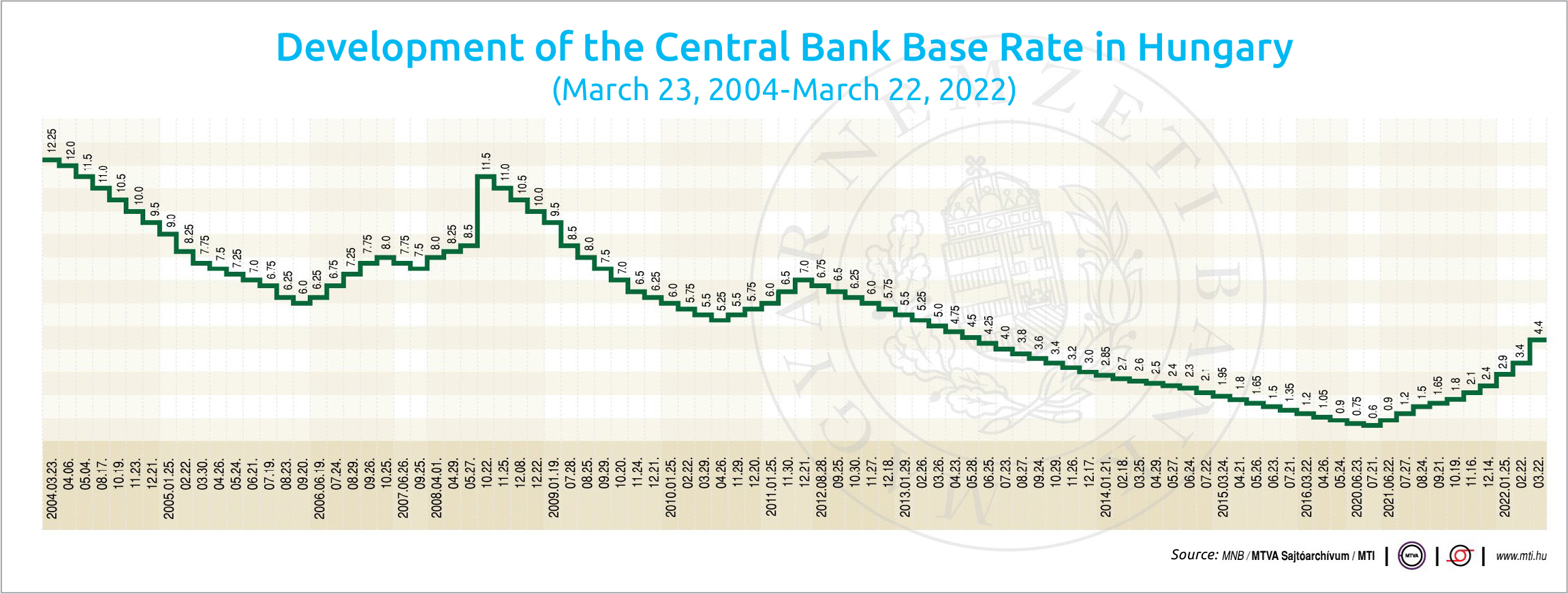

In a move that marks the most significant hike since 2008, the National Bank of Hungary (MNB) raised its key rate by 100 basis points to 4.4% at its rate-setting meeting on March 22. The decision aims to fight high inflation due to rising energy costs and the war in Ukraine and was in line with analysts’ expectations.

The MNB also raised its inflation forecasts for both 2022 and 2023, saying that average inflation could rise to 7.5%-9.8% this year and would come back to the bank’s 2-4% target range only in the first half of 2024.

“The Russia-Ukraine war has posed a much higher risk than usual to the outlook for inflation. The increase in inflation risks warrants a further tightening of monetary conditions,” the Monetary Council said in a statement following its meeting.

Inflation Targeted

According to the assessments of financial analysts based in London, the MNB has made it clear that it will continue to focus its monetary policy on curbing inflation.

Capital Economics analyst Liam Peach forecasts that the rate-setting monetary council will raise the base rate by 100 basis points in the next interest rate decision-making meetings. He believes that the base rate, together with short-term interbank interest rates, will rise to close to 8% this year.

According to Morgan Stanley’s analysts, the national bank has adjusted its base position and made it clear that core inflation risks and higher inflation expectations call for further tightening of monetary conditions, including higher base rate hikes.

They said this could be interpreted as an indication that both the one-week deposit rate and the central bank’s base rate would continue to rise, but the base rate would catch up faster than thought earlier.

Morgan Stanley now expects the MNB to raise its one-week deposit rate to 6.85%. The company emphasizes that it sees upside risks to this forecast, depending on the weekly development of the forint exchange rate.

Traditional Tools may not Work

Gergely Suppan, senior analyst at Takarékbank, said that the base rate could rise to 7% by the middle of the year due to a significant increase in inflation risks, gradually catching up with the one-week deposit rate, which is expected to reach 7% in May. The analyst does not expect the one-week deposit rate and the base rate to be reduced until the second half of 2023 at the earliest, if forecasts suggest that inflation may return to the tolerance band after 2023.

According to Péter Kiss, investments director at fund manager Amundi, all central banks, including the MNB, are in a very difficult situation right now, as the traditional instruments of monetary policy do not provide an effective solution to the surge in inflation caused by the supply crisis, which the war has worsened.

Some analyst sees decisive government intervention as the best solution. That, however, will cost a great deal; there may be a resumption of central bank government securities purchases, he said.

Gábor Regős of economic think-tank Századvég also said that the supply-side inflation shock could only be moderately balanced by monetary policy, as it cannot fundamentally influence factors. He noted that the outbreak of the Russo-Ukrainian war poses a significant risk to inflation through further increases in energy prices and disruption of supply chains. In the longer run, interest rates may stabilize at higher levels than before; a further increase in the one-week deposit and base rate will likely be required, the analyst predicted.

Forecast Ranges

The war in Ukraine and the consequent sanctions policies that have been introduced, as well as the newer wave of the coronavirus epidemic, cause significantly higher uncertainty in macroeconomic outlook than usual, the MNB wrote in its latest Inflation Report published on March 22. Given this situation, the central bank has prepared forecast ranges. As for inflation, following a 5.1% rate in 2021, the MNB now forecasts a 7.5-9.8% rise in consumer prices this year. The range is 3.3-5% in 2023 and 2.5- 3.5% in 2024. The economic growth rate will slow to 2.5-4.5% this year from 7.1% in 2021. As for 2023 and 2024, the MNB predicts GDP growth of 4-5% and 3-4%, respectively.

Numbers to Watch in the Coming Weeks

The Central Statistical Office (KSH) will publish the latest data on the labor market the day this issue is published, March 25. On March 28, January earnings figures will be released, and the balance of the general government sector for the full year 2021 and the 4th quarter of 2021 will be out on April 1.

This article was first published in the Budapest Business Journal print issue of March 25, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.