Analysts Warn Core Inflation Remains High

While the significant acceleration of core inflation indicates considerable inflationary pressure, the March figure was somewhat lower than analysts’ expectations. The data reflects the government’s price cap on certain food products, as well as the high fuel prices seen last year, analysts say.

Consumer prices were 8.5% higher on average in March than a year earlier, accelerating from 8.3% in February. According to the latest data released by the Central Statistical Office (KSH), the last time inflation was this high was in June 2007. The highest price rises in the previous 12 months were measured for food. In one month, consumer prices increased by 1% on average.

Food prices increased by 13% as the cost of bread jumped 27.9% and poultry prices rose by 21.4%. In the category of goods that includes vehicle fuel, prices increased by 8.9%, with vehicle fuel prices up 11.4%. Prices of spirits and tobacco products increased by 7%.

The harmonized consumer price index, a measure of inflation that is adjusted for better comparison with other European Union member states, was 8.6%. Core inflation, which excludes volatile fuel and food prices, was 9.1%.

According to ING Bank chief analyst Péter Virovácz, the good news is that the annual inflation rate has been lower than expected, but the bad news is that the pace of price increases has continued to accelerate. It is not the soaring price of a single product or service that is responsible for high inflation, but inflationary pressures are extremely widespread.

The last time core inflation was over 9% was in the summer of 2001, more than 20 years ago, he said. He forecasts that, even with a possible extension of the government-mandated fixed prices, inflation will peak above 9% sometime in June or July. This year’s average annual inflation is expected to be in the range of 8-9%.

The MNB’s cycle of interest rate hikes may continue in the coming months, with the effective interest rate rising to 8-8.25% by the middle of the year. According to ING Bank, it is becoming less and less likely that inflation will return to the 3% target in 2023.

The Ukraine Effect

Dániel Molnár, a macroeconomic analyst at research company Századvég, said that compared to the previous month, the rise in fuel prices slowed down substantially, which can be traced back to the higher base last year in addition to the price cap. Although double-digit inflation is not likely to occur in Hungary, if the conflict in Ukraine is not resolved in the short term, inflation could be expected to rise further, Molnár claimed.

According to Gergely Suppan, a senior analyst at Takarékbank, inflation accelerated in March despite the fact that the jump in fuel prices a year ago and the price cap introduced in the second half of November alone could have reduced inflation by 0.3-0.4 of a percentage point.

The surge in core inflation has exceeded expectations, which indicates growing inflationary pressure. Since the outbreak of the war in Ukraine, gas, electricity and oil prices have rocketed, causing economic hardship to the whole economy. A 50-60% increase in wheat prices could have a severe impact.

Another upside risk is the second-round effects of commodity prices and the expected surge in wages due to labor shortages, so the MNB may continue the cycle of raising interest rates, the analyst said.

Takarékbank has raised its inflation expectations for this year to 8.2% due to much wider-than-expected and steeper price increases, but Suppan noted that inflation could be much higher than this due to global shortages of raw materials and spare parts and the global energy crisis.

The Price Cap Effect

According to K&H Bank chief economist Dávid Németh, the development of inflation in Hungary also largely depends on how long official price caps remain in force. Based on the current outlook, the average annual inflation could be 9%; at the end of the year, the indicator may still be above 7%, he said.

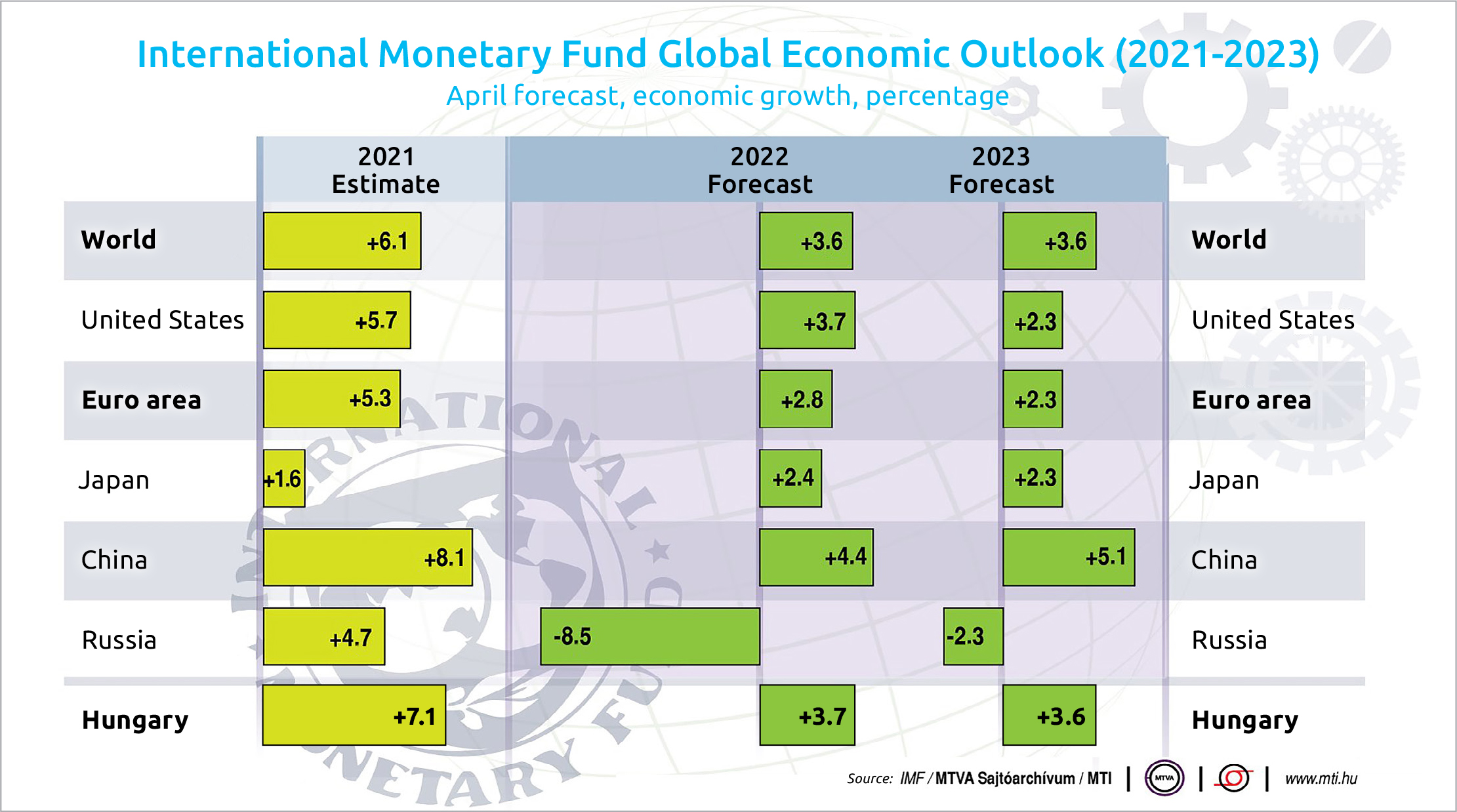

Hungary is far from being alone in struggling with high inflation and an economic slowdown. According to the International Monetary Fund, the outlook for the global economy in 2022 has deteriorated significantly since its previous forecast in January. According to the IMF’s latest assessment released on Tuesday, the global economy will grow by 3.6 % this year, down from the 4.4% expected in January, with next year’s GDP growth figure cut from 3.8% to 3.6%.

As for Hungary, the IMF estimates that gross domestic product will grow by 3.7% this year and 3.6% next year. In its October report for Hungary, the IMF expected 5.1% growth in 2022 after last year’s 7.1% expansion.

The IMF predicts 5.7% inflation in developed countries this year and 2.5% next year. This year’s inflation forecast has been revised upwards by 1.8 percentage points and by 0.4 of a percentage point next year. The IMF expects inflation in the eurozone to be 5.3% this year and 2.3% next year, 0.8% this year and next in Japan, and 7.7% and 2.9% in the United States in 2022 and 2023, respectively. The IMF expects inflation to be 8.7% this year and 6.5% next in developing countries.

Numbers to Watch in the Coming Weeks

A relatively light period ahead, with February earnings data to be released on April 26, followed by the March labor market figures on March 28.

This article was first published in the Budapest Business Journal print issue of April 22, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.