2022: Reading the tea Leaves for the Year Ahead

What will 2022 hold in store for Hungary? Well, an election is certain in the spring and promises to be more interesting than most in a very lop-sided past decade. We will cover that in more depth nearer the time. Of more direct interest to a business publication is the economic picture. The Budapest Business Journal has been sifting through announcements and reports to try and glimpse what might lie ahead. Here is our reading of the tea leaves.

The Economy

The economy will continue to perform well, the government has insisted to the surprise of absolutely no one. Minister of Finance Mihály Varga said government decisions to reschedule some state investments in 2021 and 2022 would not dampen this year’s GDP growth in an interview published in the Dec. 31, 2021 issue of pro-government daily Magyar Nemzet (Hungarian Nation).

In December, the government decided to reschedule HUF 350 billion of investments due that year and HUF 755 bln this year. The savings allowed the government to cut the 2022 deficit target a full percentage point to 4.9% of GDP.

Asked whether postponing the investments could slow GDP growth, Varga said, “We don’t think so. We continue to count on growth well over 5% in 2022.” The ministry’s official forecast for 2021-2025, released earlier in the week, puts next year’s GDP growth at 5.9%.

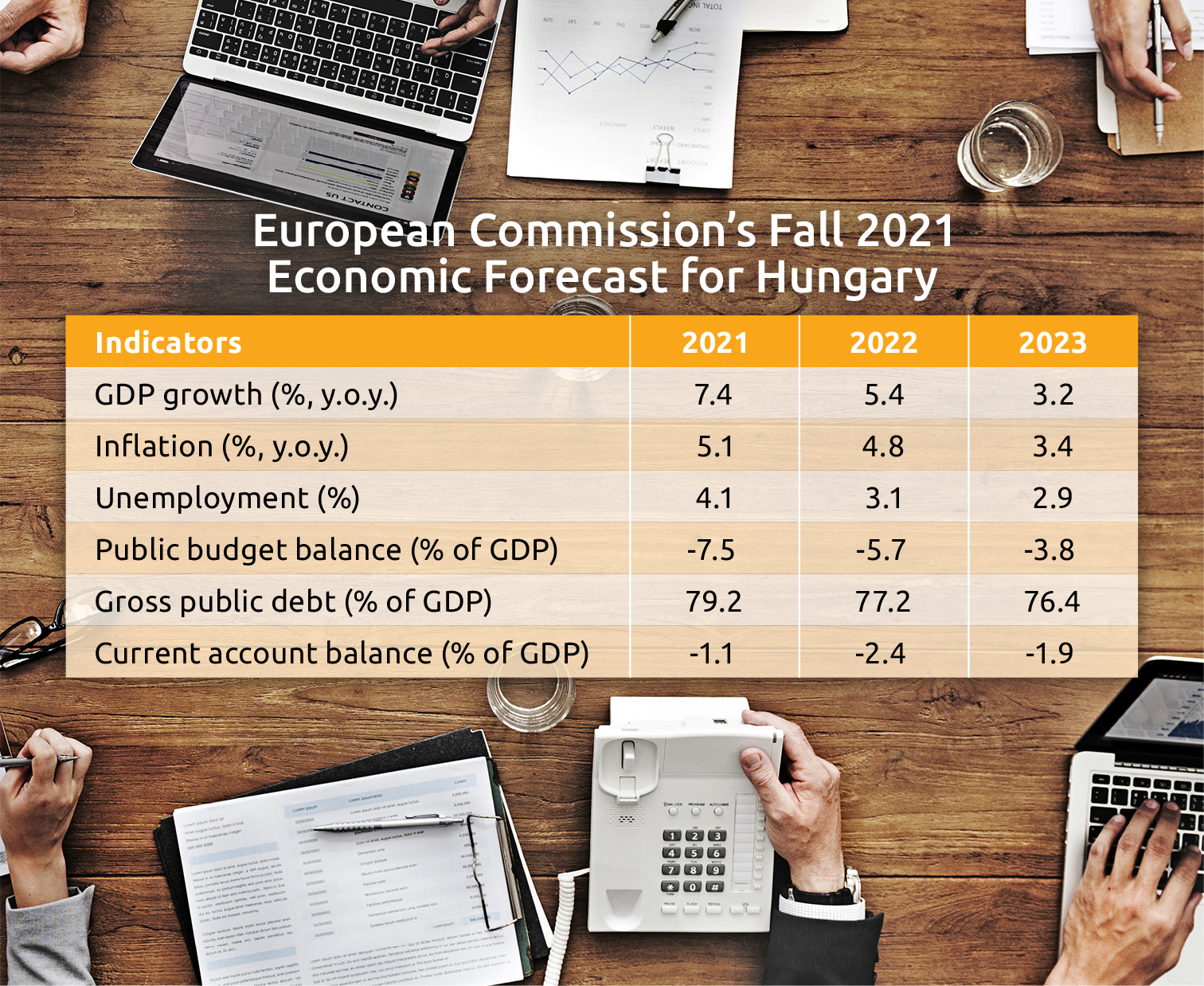

That’s broadly in line with European Union expectations for Hungary. The European Commission will make its next projection for Hungary’s economy in February. Its most recent figures are from the Autumn 2021 Economic Forecast, published on Nov. 11, 2021, and that puts 2022 GDP growth at 5.4%. See the chart for the full breakdown of the EC’s expectations for the Hungarian economy.

Government Spending

Related to the state of the economy is the government’s role in targeting funding to what it identifies as core areas, and significant sums have already been announced for spring tenders.

The Ministry for Innovation and Technology on Jan. 5 announced the start of pre-registration for a tender for HUF 10 bln in conditional grants for technology developments at green economy companies, according to state news agency MTI. The European Union and state funding, disbursed under the Green National Champions Program, may be used to make more efficient use of energy and water, support electromobility, get feedstock from secondary sources, and replace single-use plastics.

Grants are available for amounts between HUF 20 mln and HUF 1.5 bln, with a funding intensity rate of up to 50%. Companies with at least three people on payroll and net annual revenue of HUF 30 mln or more may apply. The deadline for pre-registration is Jan. 19. The tender itself is open from Feb. 10-24.

A couple of days earlier, finance minister Varga announced the Jan. 5 launch of a tender for HUF 140 bln in EU and state grant money for research, development and innovation investments at businesses via, as is so often the case nowadays, a Facebook post. Varga said the funding might be used to develop new products, technologies, or services and bring them to market, as well as experiment, conduct industrial research, or acquire equipment.

In a separate Facebook post, Varga announced HUF 25 bln had been allocated to support investments by big companies in 2022. Last year, 63 big companies were awarded HUF 50 bln under the scheme, supporting investments that added up to HUF 130 bln, Varga said. Since the 2015 launch of the program, which targets companies ineligible for EU funding because of their size, HUF 207 bln in subsidies have supported 241 investments with a combined value of HUF 510 bln, he said. Those investments created close to 4,000 jobs, he added.

Employment

That leads us onto another possible bottleneck for Hungarian economic growth, and certainly one that is often mentioned to the BBJ by CEOs: the tightening labor market. As ever, this is a double-sided metric: if it is hard to find employees, that implies a high employment rate, and no government on earth is going to be unhappy about that.

Nevertheless, severe disturbances can be expected in the Hungarian labor market due to the massive shortage of professionals, the Secretary-General of the National Association of Entrepreneurs, László Perlusz, warned InfoRádió on Jan. 4.

He also highlighted another burning problem: there are many professions with little supply. There are not enough car mechanics, room painters, and wallpapers, while fewer people are learning to become electricians or carpenters. In the view of Perlusz, even a significant increase in the minimum wage and the minimum wage for skilled workers will not change this situation.

The domestic unemployment rate may well remain below 4%, provided the coronavirus pandemic does not cause another shock to the world economy, Zoltán Varga, a senior analyst at Equilor Befektetési Zrt., told Világgazdaság. However, he also suggested that rising energy and raw material prices may slow the expansion of investments, reducing the need for new labor.

Be that as it may, Hungary’s jobless rate fell to 3.7% in November, dropping from 3.9% in both October and the same month a year earlier, according to the latest data released by the Central Statistical Office (KSH) on Jan. 5.

In absolute terms, there were 179,200 unemployed, 9,400 fewer than in October, and 10,200 fewer than in the same month a year earlier. The rolling three-month average jobless rate reached 3.6% in November. KSH noted that data from the National Employment Service (NFSZ) shows there were 242,000 registered jobseekers at the end of November, down 18.3% from 12 months earlier.

Given this tight labor market, pressure on wages will not dissipate anytime soon. Retailers Aldi and Spar reflected what is likely to be a trend across sectors for the year when they announced significant increases for their staff from the start of January 2022.

According to portfolio.hu, Aldi Hungary raised wages for its employees by 8% from Jan. 1, while penzcentrum.hu reported that Spar Hungary had announced on Jan. 3 that it would spend HUF 8.6 bln on pay rises in 2022.

This article was first published in the Budapest Business Journal print issue of January 14, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.