1st Quarter Performance Stands out, but Slowdown is Likely

Exceeding analysts’ expectations, the Hungarian industry grew by an unadjusted 8.2% on a year-on-year basis in the first quarter of 2022. While all sectors contributed to the growth, a low base effect had a significant role in the increase. A slowdown is likely to come from the second quarter on.

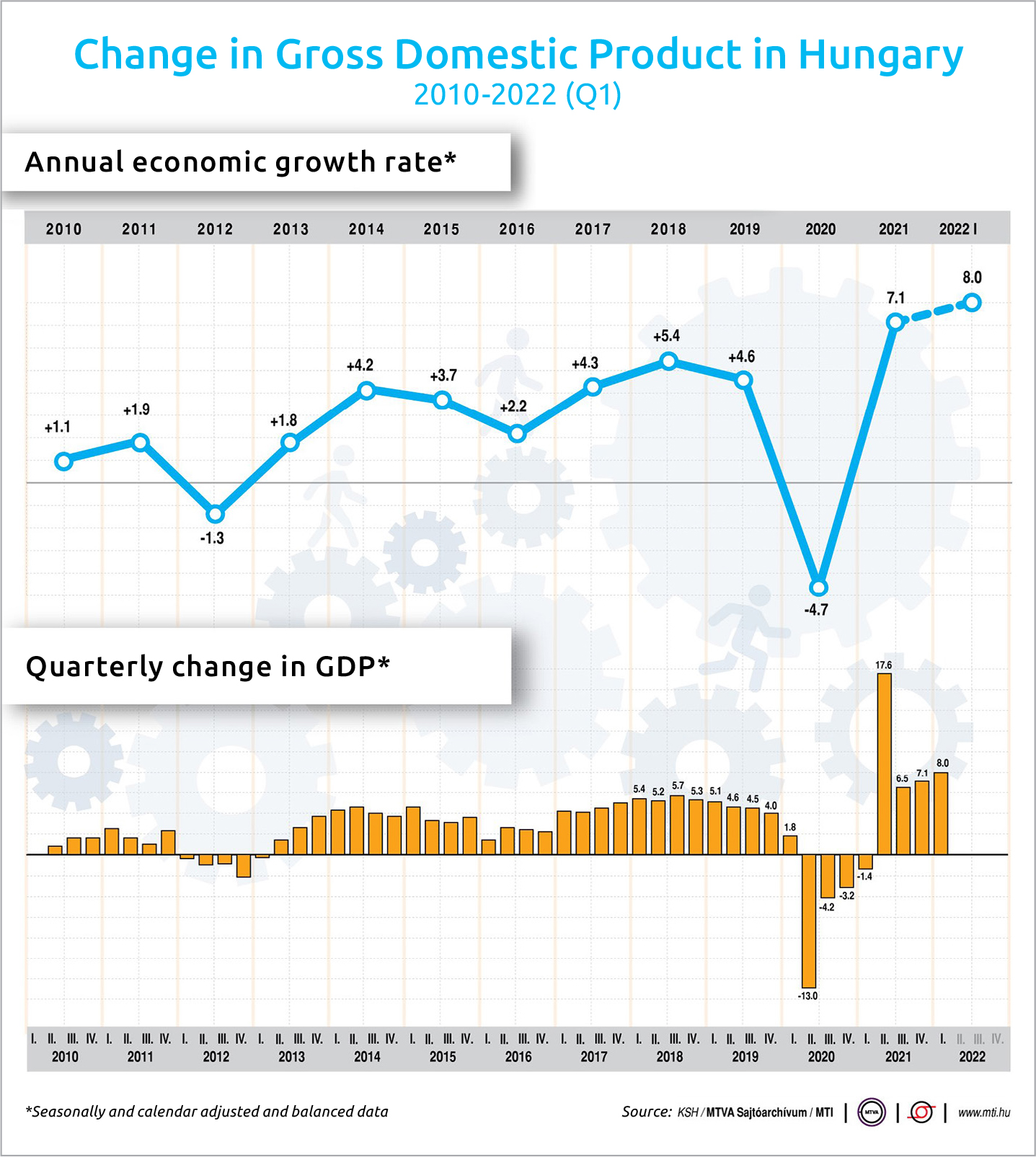

Adjusted for the calendar year and other effects, GDP rose by 8% in the first three months of the year; according to raw data, the increase was 8.2%. In a quarter-on-quarter comparison, GDP climbed a seasonal and calendar year-adjusted 2.1%.

The Central Statistical Office (KSH) said that practically all branches of the national economy contributed to the expansion, but industry and market services were at the fore. Growth was also significant in food and drink production, crude refining, and electrical equipment manufacturing, as well as in commerce, commercial accommodations, catering, and logistics, the data shows.

Gergely Suppan, the chief analyst at Magyar Bankholding, said that the first-quarter GDP growth was driven by the strong performance of the last quarter of 2021 and also by robust sector growth in the quarter. The very low base also accelerated Q1 growth. Thanks to higher-than-expected figures, it is possible that the bank’s experts will slightly improve their growth forecast for this year to 5.9%, he said.

Bankholding analysts expect a slowdown in the coming quarters, with risks posed by supply chain issues and a shortage of raw materials and commodities due to the war in Ukraine and the related sanctions, rising costs and lending rates, and declining purchasing power, mainly due to soaring inflation.

The most significant economic risk would be an oil and gas embargo. However, Suppan and his colleagues do not expect this to be a factor this year, as negotiations should result in allowing Hungary some delay in joining the embargo.

‘Bumpy Road’

According to Dávid Németh, head analyst at K&H Bank, the Hungarian economy had a flying start, but “there is a bumpy road ahead.” GDP growth in the first quarter was partly driven by base effects, industry and services, and soaring household consumption, he said. He noted that the war could slow down the growth in the following quarters. According to Németh, this year’s growth is expected to reach 4.8% on an annual basis.

Orsolya Nyeste, the chief macroeconomic analyst at Erste Bank, recalled that previously published monthly production data had already shown that the industry had proved relatively resilient to supply tensions and that the sector had made a positive contribution to growth. Meanwhile, continued wage outflows and accelerating domestic consumption have supported the performance of services. The short-term outlook, however, is unfavorable. She warned that the coming quarters could bring a gradual slowdown in GDP growth.

Despite the deteriorating outlook, strong economic spillovers from last year and high first-quarter performance could boost annual economic growth to somewhere between 4% and 5% this year, she estimates. Erste Bank’s current forecast is 4.3%. However, a lot depends on when the war will end and how quickly the still subdued external demand recovers, Nyeste said.

Gábor Regős, head of the macro-economic unit at the Századvég Gazdaságkutató Zrt., stated that economic growth in the first quarter was significantly higher than expected and was particularly dynamic.

Retail sales, driven by wage increases and government transfers, and low-starting tourism due to last year’s coronavirus restrictions, played a role in the growth of market services.

Crude Boost

Within the industry figures, the KSH also highlighted crude oil refining, which could be explained partly by the growing volume and partly by the relatively cheap purchase price, Regős noted.

As a result of better-than-expected growth, the annual expansion rate may be higher and might exceed 5%. In the coming quarters, it will become apparent to what extent the damage caused by war and inflation will hold back economic growth. At the same time, due to the favorable data, the budget revenues may turn out better than expected, which will help achieve this year’s deficit target, he emphasized.

Although the first-quarter data was a positive surprise and made several analysts upgrade their annual growth projection, the European Commission lowered its forecast for 2022 for Hungary and for the entire European Union.

According to the EC spring forecast for Hungary, GDP will grow by 3.6% this year. In its previous forecast, it put the figure at 5.4%. As for 2023, growth is expected to slow further to 2.6%.

The expectation is driven by the EU’s forecast for higher import prices, world trade turmoil, greater uncertainty and rising risk premia, all of which are holding back growth, contributing to rising inflation, and worsening the external balance. Inflation in Hungary will increase from 5.2% in 2021 to 9% in 2022 before declining to 4.1% in 2023. The previous EC forecast indicated a 5.4% inflation for 2022 and 3.6% for 2023.

Numbers to Watch in the Coming Weeks

On May 26, KSH will publish April’s labor market data, followed by the first quarter investment figures on May 30. The second estimate of the first-quarter GDP data will be released on June 1.

This article was first published in the Budapest Business Journal print issue of May 20, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.