KBC on Hungary’s flattening yield curve

Analysts from KBC Group, the owners of Hungary-based K&H Bank branches and frequent deniers of an exit from the country, have released some macroeconomic analysis while wondering “Is this the end of bearish flattening of the Hungarian fixed-income yield curve?”

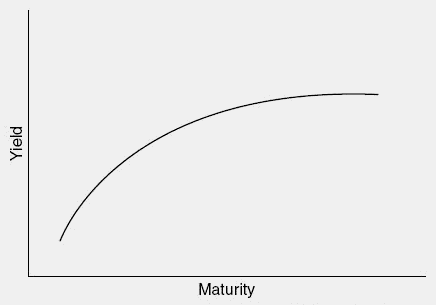

KBC analysts note that said curve “has flattened substantially in the last week. The whole yield curve moved upward, but the weakening [of the forint against the euro] more greatly affected the short end of the curve than the long end of the curve.”

Among the findings and forecasts revealed in the report are the following.

● Another base rate cut by the National Bank of Hungary (MNB) is not expected by KBC to emerge from the February 18 meeting.

● The MNB can be patient, according to the analysts, with the forint exchange rate at between HUF 310 and HUF 315 to the euro; the inflation target of 3% set by the central government should be met.

● In terms of stability, Hungary appears less sensitive to exterior conditions as compared to 2008 in particular.

● With relaxed market sentiment, good demand at the next Debt Management Agency (ÁKK) auction of treasury bills should be healthy.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.