The Impact of Industry 4.0 on Your Business

Industry 4.0 is sweeping Central Europe, indeed the world. But how does this affect your business? Les Nemethy and François Lesegretain investigate in their latest corporate finance column.

The four industrial revolutions are usually defined as follows:

• The First Industrial Revolution used water and steam power to mechanize production;

• The Second used electric power to create mass production;

• The Third used electronics and information technology to automate production.

• Industry 4.0 is defined by Wikipedia as the “ongoing automation of traditional manufacturing and industrial practices, using modern smart technology. Large-scale machine-to-machine communication (M2M) and the internet of things [or IoT, a system of interrelated, internet-connected objects that can collect and transfer data over a wireless network without human intervention] are integrated for increased automation, improved communication and self-monitoring, and production of smart machines that can analyze and diagnose issues without the need for human intervention.” In other words, the entire chain is networked and can communicate, enabling new ways of production while analyzing large amounts of data to solve problems.

Industry 4.0 offers Central European companies the potential to remain competitive in light of increasingly scarce labor and rapidly rising wages. Whereas in 2010, only 5% of companies in CEE countries, taken here to include Bulgaria, Croatia, the Czech Republic, Estonia, Hungary, Lithuania, Latvia, Poland, Romania, Slovenia, and Slovakia, reported labor shortages, this had increased to 40% by Q3 2018, according to The Conference Board website.

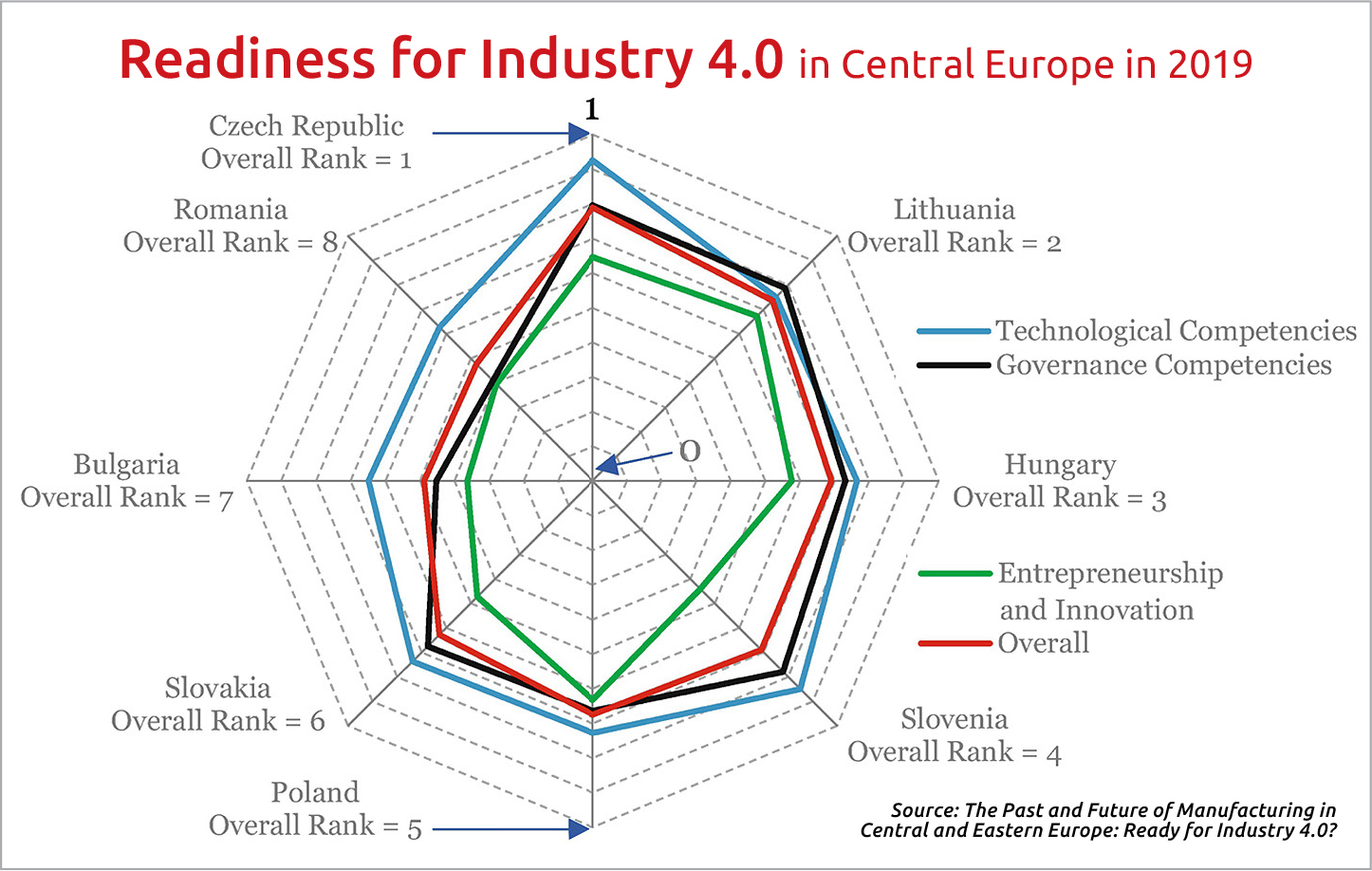

A February 2019 report called “The Past and Future of Manufacturing in Central and Eastern Europe: Ready for Industry 4.0?” ranked Central European countries by their readiness to adopt Industry 4.0, taking into account three main criteria: Technological competencies, entrepreneurship/innovation, and governance.

We would predict that early adopters of Industry 4.0 would enjoy higher valuations, first, because more efficient and productive companies would enjoy higher margins and EBITDA, and second because buyers are generally more prepared to value a business at higher multiples when a business is competitive. To provide an oversimplified example, let’s assume that pre-Industry 4.0, a company makes an EBITDA of EUR 1 million, and a buyer is prepared to give a seven-times multiple, the enterprise value would be in the range of EUR 7 mln.

Now, let’s assume that post Industry 4.0, EBITDA goes to EUR 1.5 mln on similar revenues, and buyers are prepared to pay a ten-times multiple. Enterprise value would be in the range of EUR 15 mln, more than a doubling in value. (Of course, it may take several million euros of equipment costs, design, consultancy, etc., to implement Industry 4.0.).

But for those companies early-to-adopt and early-to-exit, the valuation premium can be pretty substantial. Late adopters, however, will see their margins squeezed and valuation fall. For example, due to high labor costs, and labor shortages (possibly even missing out on orders), let’s assume EBITDA falls to EUR 0.6 mln. A buyer might only pay a 5X multiple. In these circumstances, the enterprise value would drop to EUR 3 mln. (Assumptions as to EBITDA and multiples are purely arbitrary, merely to illustrate the point.)

New Normal

In the longer term, however, one would expect businesses with shrinking EBITDA to be driven out of business, and for Industry 4.0 to become the new normal, at which point, Industry 4.0 companies would no longer enjoy a premium, as competitors would have similar levels of technology.

We are not aware of any studies comprehensively comparing the value of businesses that have adopted Industry 4.0 compared to those that have not. There is, however, some weaker evidence supporting our hypothesis.

A report by William Blair studied a universe of industrial technology companies that in 2015 had gross profit margins in the range of 40%, EBITDA margins in the field of 20%, and enterprise values at 8-12 times EBITDA; by 2019, companies that had introduced Industry 4.0 saw gross profit margins increased to more than 50%, and EBITDA to over 25% on average, with enterprise values augmented to 12-14X EBITDA.

In conclusion, we believe that those companies that adopt Industry 4.0 will tend to be the consolidators while the non-adopters will, in many cases, be driven out of business.

A company owner who has not yet begun implementation of Industry 4.0 has three choices: Do nothing and risk that the company may see a substantial decline in value or be driven out of business; Sell the company before the effects of industry 4.0 become too pronounced; or Go full speed ahead to implement Industry 4.0.

Les Nemethy is CEO of Euro-Phoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www.businessexitplanningbook.com) and a past president of the American Chamber of Commerce in Hungary.

This article was first published in the Budapest Business Journal print issue of July 16, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.