Robot Revolution Making Progress, but not yet Banging Down the Door

There’s a lot going on in terms of robotization in Hungary, but amid a fierce global automation race, it will take even more effort to keep up with the pace.

Japan saw its very first robot bartender taking up duties around one year ago. The model serves tap beer in 40 seconds, while cocktails are fixed by its robotic arm within a minute. The idea behind this pioneering measure is not to replace humans but rather to fight a labor shortage in a society where soon one third of the population will be over 65.

There is no need to look that far for similar trends. Pepper, once the world’s first half-humanoid robot, works as a receptionist in Enjoy Budapest Café & Apartment Hotel, where waitress robot Amy helps serve coffee. The locally invented Robin, on the other hand, is known for cleaning vast areas at Groupama Arena, Ferenc Liszt International Airport and Honvédkórház, a flagship hospital in the capital.

These collaborative robots are still rather the exception, though. As István Komlósi, principal developer at KUKA, a leading supplier on the Hungarian automation market, tells the Budapest Business Journal, the market uptake of collaborative robots lags far behind expectations from 10 years ago. That said, the few examples do help improve the image of machines.

Automotive is responsible for the bulk of local robotization efforts, followed by the metal, rubber and plastic industries. According to the World Robotics Report 2020, Hungary has some legwork to do to keep the pace in the global automation race.

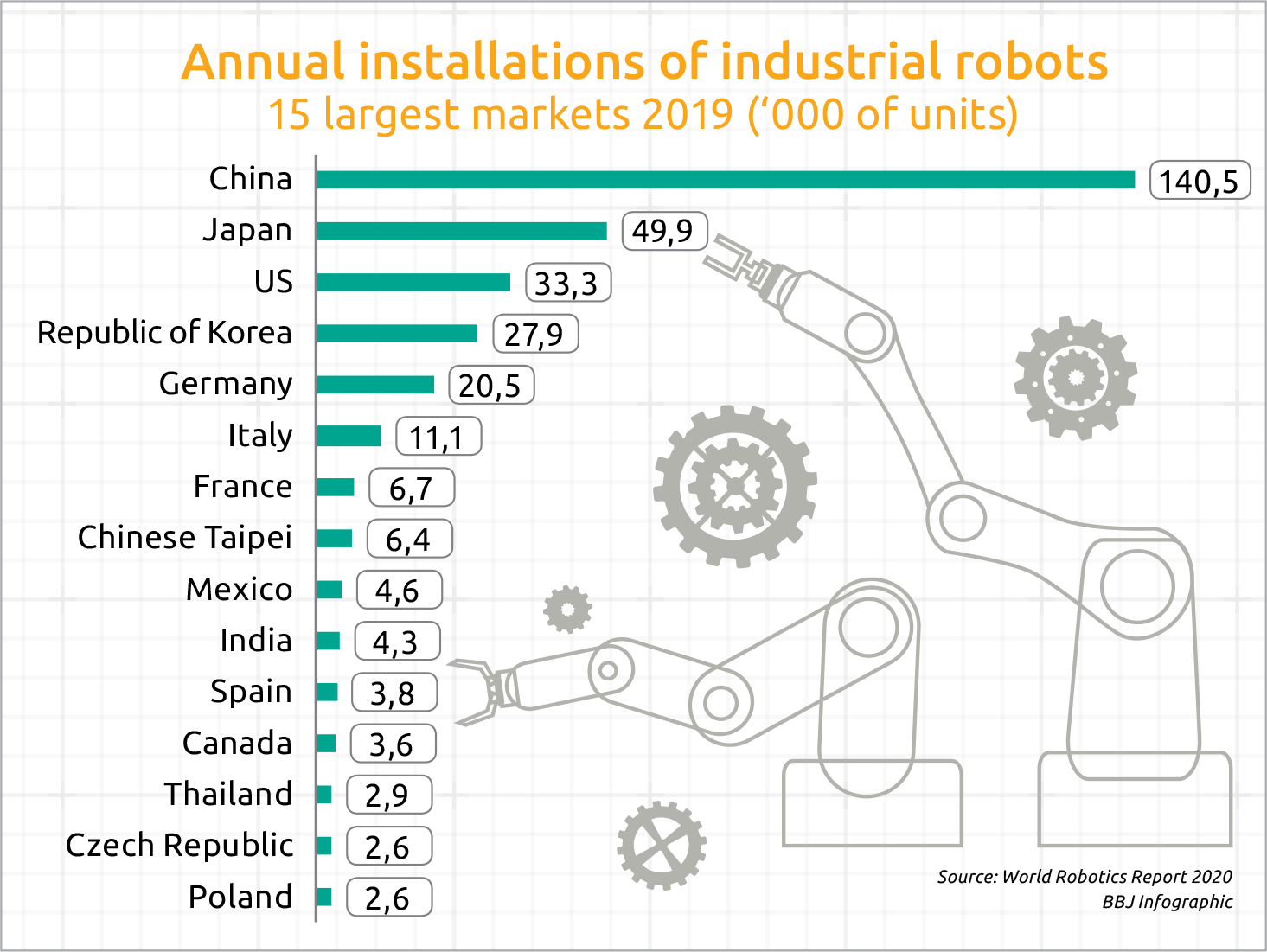

The average number of automated units per 10,000 employees jumped from 18 to 84 in Hungary for the period from 2010 to 2018, but robot density still lags behind the world average of 113 in 2019, not to mention regional rivals such as Slovakia (169) and Slovenia (157). Poland and the Czech Republic both ranked among the top 15 largest markets in the world in terms of annual installations in 2019.

Annual installations peaked in Hungary in 2017 at nearly 2,500 units, markedly higher than the years prior and since (see chart). The year 2017 sticks out with reason, as it was record-breaking for Hungary in terms of FDI hitting EUR 3.5 billion, where automation-driven automotive had a major share.

Encouraging Signs

An encouraging sign is that the country advanced from 32nd in 2016 to 23rd place in 2018 on the global robotization chart, and installations in manufacturing and automotive soared by 13% and 20%, respectively, from 2014 to 2019. As of today, the total number of robotic installations has passed the 10,000 mark.

Other factors hint at a growing trend. Key elements of Industry 4.0 such as the Internet of Things and cloud solutions are popping up on a near continuous basis in Hungarian businesses, with large corporations taking the lead.

Growing demand is satisfied by a thriving ecosystem of some 200 suppliers of integrators, manufacturers of robots and automation solutions, distributors, advisors, and sub-component suppliers, as shown by the 2021 edition of the #HowToRobot supplier market report for Hungary.

KUKA is among those leading suppliers with an ambitious development agenda. As Komlósi points out, what matters most is to make robots that are easy to program and integrate into the manufacturing processes.

One of KUKA’s ongoing developments concerns a robot control mechanism driven by artificial intelligence. Another hot area is related to logistic functions supported by mobile robots. In the latter case, problems arising mostly in automotive are tackled by an interface that defines a common language for mobile robots involved in different manufacturing processes.

As far as the SME sector is concerned, robotics is an emerging trend with manufacturing clearly showing room for automation.

“For SMEs, the main objective may not only be to replace labor but to improve quality and productivity and thus competitiveness,” says Komlósi.

State Support

There is plenty of scope for state incentives. Turnkey solutions are needed that enable players to integrate robotized stations in their own systems and, given the limited financial means of many SMEs, they could certainly use some government help to carry out such investments on a larger scale.

Hungarian SME situation has worsened during the pandemic, with it becoming even more difficult for them to find the resources to upgrade equipment. Paradoxically, though, the COVID crisis revealed the need for more automation more strongly than ever. Entire supply chains collapsed overnight, which made many companies readjust their strategies and opt to install more automated systems.

“Since SMEs are a lot more exposed to losing manpower to illness, they need to robotize more as it would provide more stability by minimizing the human presence at work, thus preventing further infections; yet, the availability of financial means is questionable,” adds Komlósi.

Rescue might come from “above”, meaning the cloud. “The increase in cloud capacities means robots do not need to be so self-sufficient and thus building them becomes cheaper, as only the absolutely necessary elements are left on them. Operability is then subject to the quality of communication, and that’s where importance of 5G kicks in,” says Komlósi.

While all this sounds promising, the reality looks a little harsher. Take the survey of the Industry 4.0 National Technology Platform, run by SZTAKI (the Institute for Computer Science and Control) that found 80% of Hungarian enterprises don’t have an Industry 4.0 strategy.

But what to expect around here if even the global picture is far from rosy in this respect. A recent Deloitte Insights survey involving 1,600 senior executives in 19 countries was conducted with a similar aim, to find out about corporate readiness to benefit from Industry 4.0.

It turns out that just 14% of respondents feel fully ready to exploit the opportunities offered by the latest industrial revolution. The remaining 86% could surely use an algorithm to figure out a way to reap those benefits.

This article was first published in the Budapest Business Journal print issue of March 26, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.