Factoring Alternatives for SMEs

In our regular Corporate Finance column, Les Nemethy and El Mehdi Hosni look into the pros and cons of factoring as a source of funding for SMEs.

Factoring is a financing method in which a business owner sells accounts receivable at a discount to a third-party funding source, in order to raise capital, as described by Factoring by Enterpreneur.com. In other words, factoring involves selling unpaid customer invoices to raise capital quickly. It allows business owners that experience slow-paying customers or occasional cash flow squeeze to generate cash flows almost instantly to run their businesses.

My first exposure to factoring was over a decade ago, when we were attempting to raise bank financing for a newly incorporated U.S. subsidiary of a European client. I was astonished to learn that without a few years of operating track record in the United States, no corporate guarantee from a prosperous European parent company, nor anything else, could help to persuade U.S. banks to lend.

Although the subsidiary had no credit record to speak of, its clients had an excellent record. Hence the receivables could be sold at a relatively minor discount. The cost of factoring was only a few percentage points more than bank financing.

Factoring is one of the oldest forms of business financing; it is common in some industries particularly where long receivables are part of the business cycle.

Factoring is commonly perceived as the most expensive way to raise cash – a last-ditch effort by companies about to go under. While it is true that factoring is typically more expensive than bank financing, this perception deserves qualification since factoring is a short-term solution commonly used to provide companies with necessary cash flows to raise working capital in order to drive business growth.

In a typical factoring arrangement, the company makes a sale or provides a service and generates an invoice. The factor buys the right to collect on that invoice by agreeing to pay (usually within 24 to 48 hours) the invoice’s face value less a discount. The factor usually pays 75-80% of the face value immediately and forwards the remainder (less the discount) when the invoice is fully paid.

Factoring companies apply a discount to the invoice’s face value, a factoring fee that typically range from 1- 5% of the invoice amount, depending on several elements:

• The monthly volume of invoices to factor

• The average amount of each invoice

• The industry

• Length of time for payment

• Customers’ creditworthiness

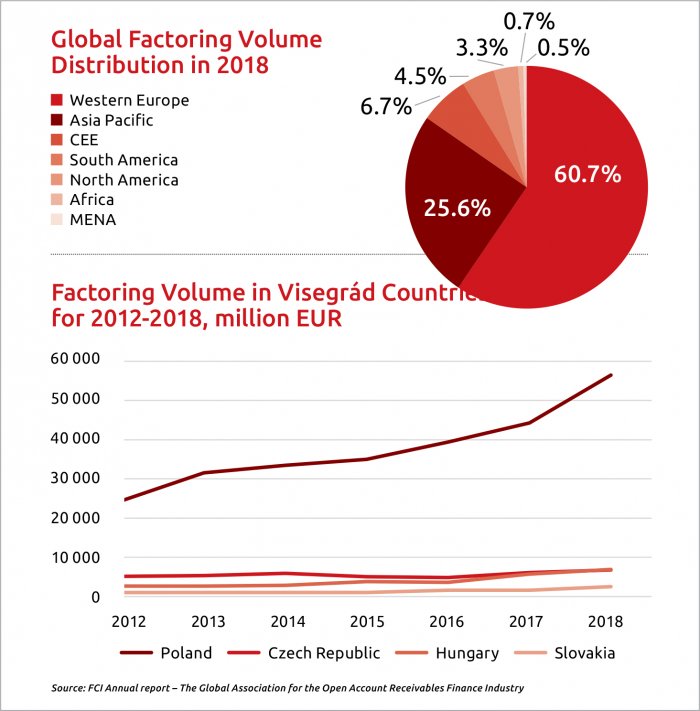

Factoring is a well-established way to raise capital in mature economies: Western Europe alone accounts for more than 60% of the global invoice factoring industry:

The global factoring market was worth EUR 2.767 trillion in 2018, according to the Annual report of FCI (Factors Chain International, the Dutch-based global representative body for the industry).

The factoring industry has been experiencing a significant increase in emerging markets, particularly Asia and Eastern Europe, where SME and entrepreneurial sectors are growing rapidly. Within the Visegrád countries, the factoring industry is much larger in Poland than the other three countries and also growing faster.

Factoring is expanding rapidly in Central Europe for two main reasons:

• CEE is one of the world’s fastest growing areas with a 4.01% average GDP growth for the 2015-2018 period, according to World Bank data.

• Former socialist countries have evolved into market economies over the past three decades. Hence they have experienced intense growth, with great need for capital, and a need to tap into every source of capital available.

Companies that would not normally be eligible for bank debt, due to lack of collateral, poor personal or corporate credit history, or limited operating history, may have relatively quick access to factoring since factors look only at the creditworthiness of customers.

Factoring may also allow SMEs to effectively outsource their credit and collection functions to their factor, as argued by Leora Klapper in “The Role of Factoring for Financing Small and Medium Enterprises”. Moreover, invoice factoring is considered as an off-balance sheet financing method, since no debt or equity is created; hence liabilities do not have to be reported.

As mentioned, factoring fees are on average more expensive than conventional lenders; there may also be hidden fees, such as application, servicing or processing fees.

Factoring entails the loss of direct control on invoice collection. Clients may react adversely if they experience collection pressures from a factor. One should ensure the factor chosen is fair and ethical so as not to undermine your company’s reputation or client relationship.

Most factors will also specify that in the event a company’s client does not pay within a predefined time period, the factor will look for recourse to the company.

In summary, given the choice between a bank loan and factoring, most companies will prefer a bank loan. Nevertheless, where a company has limited access to conventional financing, and can generate higher returns on capital than the cost of factoring, this alternative remains a desirable option.

Les Nemethy is CEO of Euro-Phoenix (www.europhoenix.com), a Central European corporate finance firm, author of Business Exit Planning (www.businessexitplanningbook.com) and a former president of the American Chamber of Commerce in Hungary.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.

.jpg)