Lack of Suitable Product Puts Brake on Investment Volume

Development and liquidity in Central European markets continue to be hampered by a limited supply of investment grade product.

Although both international and domestic funds are looking to make acquisitions in Hungary, investment volume for the year is predicted to be slightly lower than for 2018 according to JLL. Poland remains the leading investment market with a predicted EUR 6 billion investment for the year, followed by Czech Republic with a forecast EUR 2.25 bln and Hungary with an estimated EUR 1.5 bln.

The more than EUR 13 bln invested in Czech Republic, Hungary, Poland, Romania, and Slovakia recorded last year represent an 11% increase in investment volume on the previous year according to JLL. “We have seen the most significant volume increase in Poland in 2018 with EUR 7.2 bln traded, a substantial uplift in volumes over previous years,” says Mike Atwell, head of CEE capital markets at JLL.

“For 2019, we expect continued, strong interest for product in CEE markets, although perhaps not quite matching the spectacular levels seen last year. Our current forecast for the full year suggests that CEE regional volumes will total around EUR 11 bln for 2019,” Atwell adds.

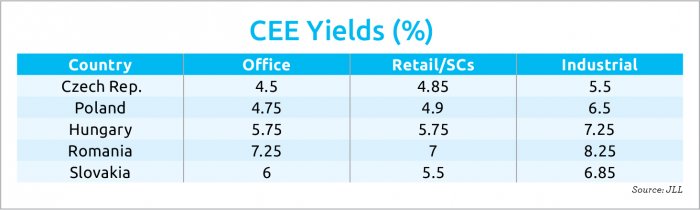

JLL expects further yield compression in most Central European markets in the office and industrial sectors. Hungary provides a 100-125 basis point premium on Czech Republic and Poland in the office and retail markets. Romania, in turn, provides a 125-150 basis point yield premium on Hungary.

Prime yields have broken the psychological barrier of 5% in the Poland and Czech office and retail sectors and reached new lows in the logistics sector. This sets new benchmarks for core assets and opens a door for some yield compression for non-core assets and locations. Some transactions in the office sector have closed at around 4.7-4.75%, while in the retail sector they have been as low as 4%.

In general, the markets are in a healthy position with more domestic and cross-border capital looking to make acquisitions than there is available supply. Hungary and Czech Republic have a fairly high proportion of domestic capital making acquisitions while in Poland it is only around 4-5% of total volume, Atwell told the recent Prague Investment Forum by Portfolio.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.