Central Europe Continues to Attract Investors

2020 is forecast to be another very active year in the Central European investment markets, with further growth in activity only restricted by a limited provision of investment product to meet growing demand from international investors, and increasingly from CEE and domestic capital.

Colliers International has recorded EUR 13.4 in investment volume for 2019 for the region (Bulgaria, the Czech Republic, Hungary, Poland, Romania and Slovakia), representing a slight fall on the previous year.

Poland was the leading market with 55% of this volume according to Kevin Turpin, regional director of research CEE at Colliers International. Preliminary figures indicate that this was followed by the Czech Republic with 22.5%, Hungary at 13.5%, Romania with 6%, Slovakia with 3% and Bulgaria with 2%.

The big three funds (OTP RE Fund, Erste RE Fund, and Diófa RE Fund) are dominant in the Hungarian investment market, notably at the top end of the office, hotel and retail sectors. In addition to these established domestic funds an additional strata of closed-end investment funds and private property companies have become increasingly active.

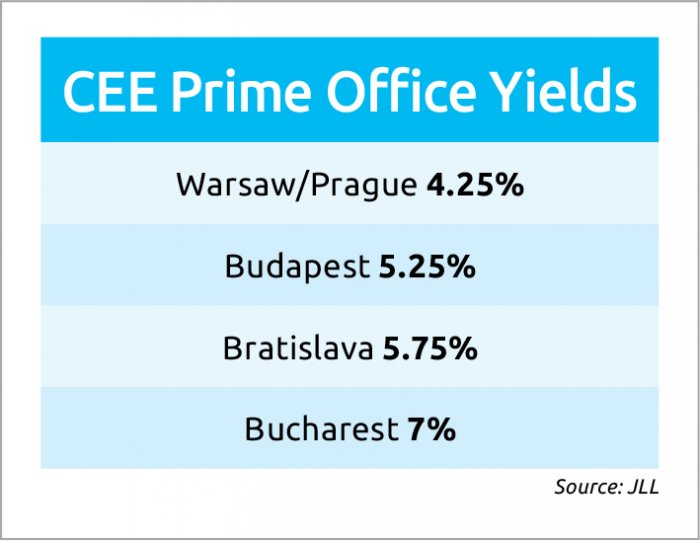

“One of the most interesting aspects of the CEE markets has been the growth of domestic capital, particularly in the Czech Republic and Hungary, with more than 50% and more than 70% of volumes coming from domestic capital sources, although more competition from foreign investors is expected for this year,” commented Mike Atwell, leading director of capital markets CEE at JLL.

Colliers’ Turpin estimates that 68% of the 2019 investment in Hungary was undertaken by domestic capital and 35% in the Czech Republic. From the 2019 CEE total, Colliers has traced 28% of activity from foreign investors, 25% from Western European investors and 15% from investors of Asian origin.

Office remains the sector of choice for investors. Colliers put the CEE 2019 sector split at 51% for office, 16% for retail, 14% for industrial, followed by 8% for the rapidly emerging hotel sector.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.