Logistics and Industrial Sector Thriving Across Central Europe

Panattoni BTS project in Poland.

The logistics/industrial market in Central Europe is booming from both a demand and development perspective. Analysts tell the Budapest Business Journal this sector is in the most favorable position in the currently problematic economic and geopolitical environment.

Continued low vacancy rates and rising rental levels are forecast due to high demand. In Prague, vacancy rates stand at less than 3%. The positive indicators for the sector are attracting a growing number of investors with resulting yield compression.

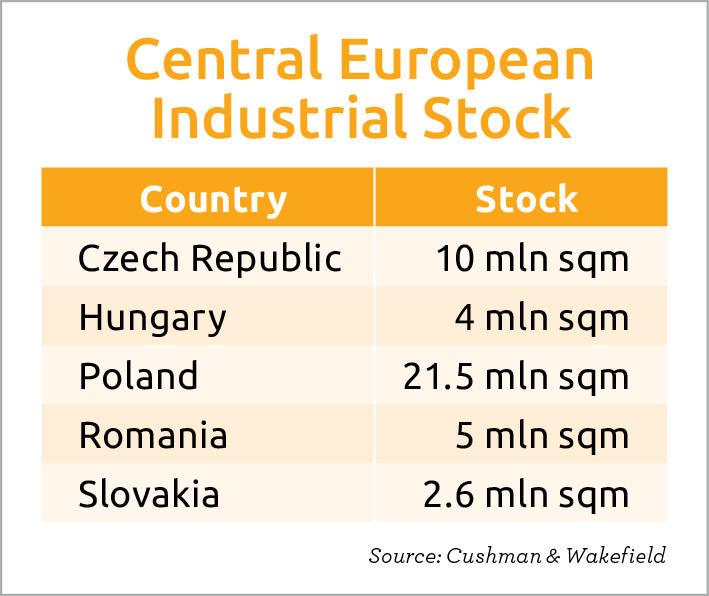

Several industrial portfolio transactions have been concluded over the past year. However, industrial park owners tend to hold onto their assets and, therefore, the sector suffers from low supply. According to Cushman & Wakefield, the industrial sector represented only 13% of investment volume for Central and Eastern Europe (which it classifies as the Czech Republic, Hungary, Poland, Romania and Slovakia) in the first quarter of the year. This low level reflects the lack of available assets, despite the strong interest from investors.

The cumulative industrial/logistics stock for the region stands at more than 40 million sqm, according to Cushman & Wakefield. Despite significant development, the consultancy says that the overall vacancy rate in all markets stands at below 6% as of the first quarter of the year. The Czech Republic has the lowest rate at 1.8%, followed by Poland (3.3%), just ahead of Romania (3.8%), with Hungary at 4.2% and Slovakia trailing at 5.6%. More than 7.8 million sqm was under construction in Q1, 60% of which was in Poland. Of the pipeline, 40% was speculative, reflecting the confidence in these CEE industrial markets.

The Czech Republic has approaching 10 million sqm of industrial space across several different logistics hubs. The county is easily the largest in the regional logistics market in terms of sqm of space per 1,000 inhabitants, followed by Poland and Slovakia, according to Cushman & Wakefield figures. Budapest and Prague have the lowest vacancy rates in the CEE region.

CTPark Plzeň in the Czech Republic.

Dominant Players

Poland, the Czech Republic, and Slovakia continue to be the dominant CEE markets, as the countries benefit from their geographic location within significant logistics and industrial networks, notably with close proximity to Germany and the industrial heartland of Europe. Therefore, all three countries have fully developed industrial hubs away from their respective capitals.

Poland is by far the biggest industrial market in CEE, with a total stock of more than 21 million sqm in various logistics hubs spread across the country and a vacancy rate of 6%, according to JLL. In the first quarter, developers commenced the construction of 1.5 million sqm of industrial space, bringing the total Polish pipeline to 4.8 million sqm, Cushman & Wakefield reckons. Avison Young agrees, saying Poland is breaking all industrial/logistics records.

“The industrial sector’s growth continued in 2021, resulting in almost EUR 3 billion in transaction volume, the highest result in history,” said the consultancy.

Demand remains high in the Czech Republic, with a vacancy rate of just 1.6%. For 2022, 1.5 million sqm of space is planned, with 1.1 million sqm of that already under construction and more than 70% of it pre-let, according to Cushman & Wakefield data. Despite the significant deliveries, the vacancy rate has remained below 2% for the country, leading to rental growth in all industrial hubs.

Romania is emerging as a significant industrial and logistics market with more than 4 million sqm of stock. Major developments are also ongoing in the different areas of the country, an indication that a regional industrial network has emerged in the country outside of Bucharest. CTP, for example, is planning a EUR 300 million regional network of parks that will bring its total space in the country to 2.5 million sqm, according to the company.

Market Growth

One advantage Hungary offers, in the view of analysts, is the possibility for market growth into Southern and Southeastern Europe.

In Serbia, CTP has delivered a 25,000-sqm facility for BMTS Technology at CT Park Novi Sad. Construction of CTPark Belgrade North is ongoing, but, despite this, the stock remains at a low level. Partly as a result, a developer-led industrial market is now emerging. CTP has also acquired development sites in Bulgaria.

With the sector looking to be a clear winner in the post-coronavirus period, developers who have traditionally been active in other mainstream sectors, such as offices and retail, have undertaken industrial projects. These add to the specialist CEE regional industrial/logistics park operators such as Prologis, CTP and Panattoni.

Developers across the region face challenges in the development and construction process in an increasingly competitive and demanding market. Challenges include labor and materials availability and costs, as well as sourcing development plots with direct road and public transport links.

Although the Central European industrial/logistics sector has successfully recovered from the pandemic with thriving logistics markets and light industrial hubs, the war in Ukraine and associated geopolitical and economic concerns have brought a cloud over the market in many parts of the region.

This article was first published in the Budapest Business Journal print issue of July 29, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.