War Poses Uncertainties for Hungarian Industry

Hungary’s industrial output way surpassed expectations at the beginning of the year, but the short-term future is overshadowed by the war in Ukraine and ever-rising energy prices.

The volume of industrial production in Hungary grew by 4.5% year-on-year in February. The working day adjusted index matches the non-adjusted one, according to the latest data published by the Central Statistical Office (KSH). As for seasonally and working-day adjusted data, the industrial output was 1.6% higher than in January 2022.

The majority of manufacturing subsections contributed to the growth; however, the manufacture of transport equipment, which represents the most significant weight, slightly declined, KSH said. Better news came from the computer, electronic and optical products and the food products, beverages and tobacco subsections; after stagnation in the previous month, both rose in February, with the latter above the industrial average.

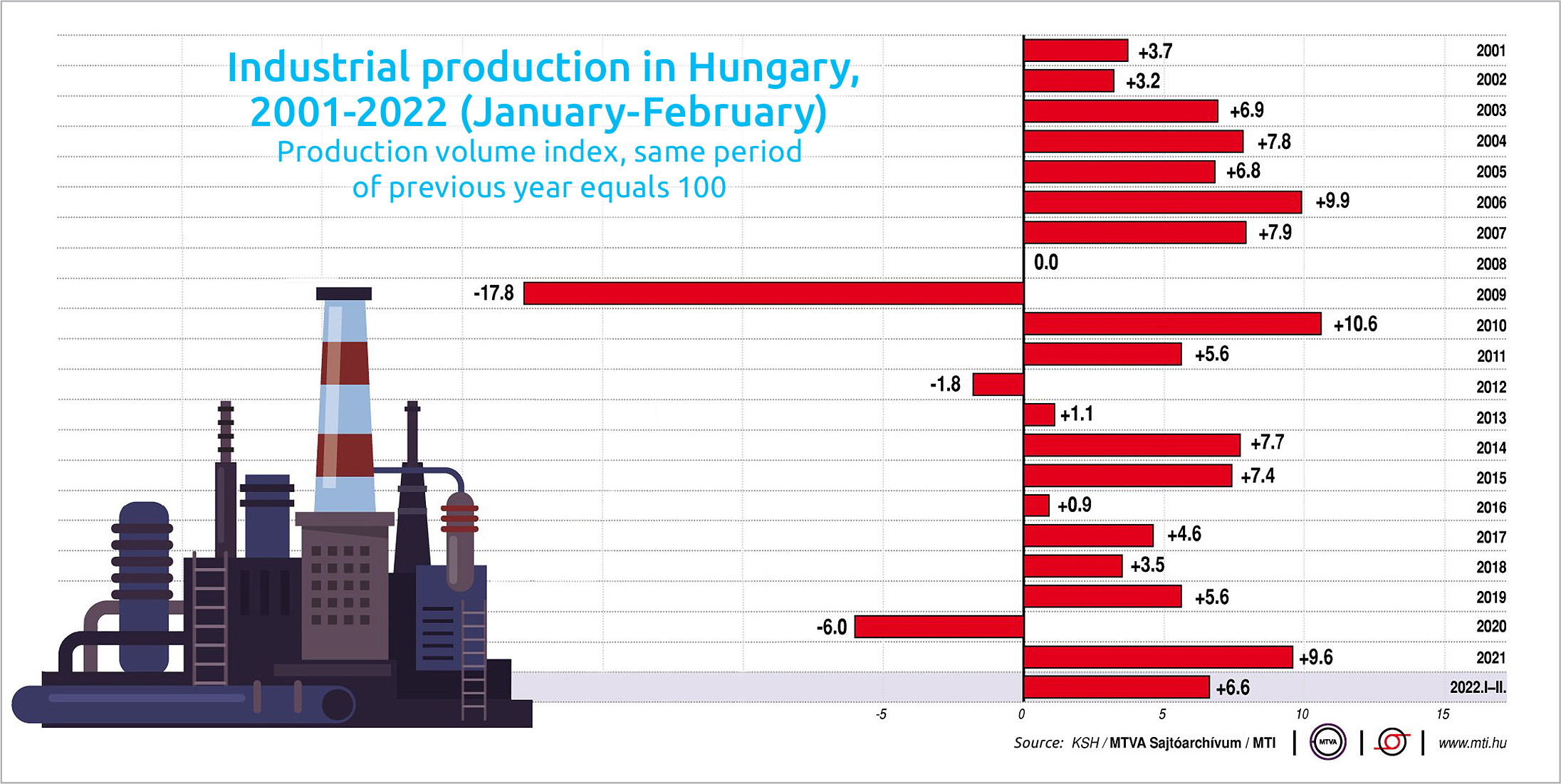

In the first two months of the year, production was 6.6% higher than in the same period of 2021. According to seasonally and working-day adjusted indices, industrial output in February was 1.6% above the level of the previous month.

Gergely Suppan, a senior analyst at Takarékbank, believes that supply and supplier problems may have eased in February, meaning industrial production grew far beyond all expectations. GDP growth could also have accelerated in the first quarter, but the uncertainties due to the outbreak of the war in Ukraine are very significant, he added.

Although vehicle manufacturing slightly decreased in February, automakers are confident that the chip shortage could be substantially alleviated in the second half of the year due to new chip-making capacities, which could lead to a sharp surge in industrial production, he emphasizes.

Due to the price cap on fuel prices, the domestic oil refinery is operating at full capacity, which may somewhat make up for the weaker performance of other sectors. In the medium-term, the Hungarian economy could benefit significantly from developing defense industrial capacities, as a significant increase in military expenditure is expected in the coming years.

This year, due to base effects and the deployment of new capacities, but taking significant uncertainties into account, Takarékbank’s analysts expect industrial production to grow by around 5% after a 9.6% expansion in 2021.

Continued Surprise

According to Dániel Molnár, a macroeconomic analyst at Századvég Gazdaságkutató Zrt., industry continued to surprise analysts in February. The increase is even more prominent given the slight decline in automotive performance, which was offset by other sub-sectors.

Looking ahead, the continued development of industrial production is compromised by significant risks. The war is leading to supply chain disruption, and rising energy prices are also hurting industrial companies. These effects are expected to be reflected in the March data. However, the industrial contribution to Hungary’s economic growth may still be positive in the first quarter.

From the second quarter on, however, the critical questions become how long the war will last, how long will high energy prices persist, and how much will this impede the volume of industrial production, he said.

Péter Virovácz, a senior analyst at ING Bank, emphasized that the Hungarian industry got back to its feet at the beginning of the year and showed a trend-like growth for the first time in a long time. The outbreak of the war at the end of February presumably has not yet had a significant effect on industrial production that would show up in these figures, but he expects a much weaker performance in March.

He sees that, despite the robust expansion in January-February, it has become unsustainable as a result of the war and the sanctions imposed on Russia. The key question for the coming months will be whether there will be a similar level of industrial shutdown as at the low point of the coronavirus crisis.

The recovery potential was relatively high at that time, as the factories could return to production. However, a significant part of the labor force has left Ukraine, which has been integrated into the global value chain, and the war will destroy capital, so it may take longer to replace the parts.

Alternative Supplies

Industrial companies are exploring alternative sources of supply, which can improve supply-side problems while also bringing significantly higher costs. Therefore, there is some confidence for the coming months on the production side, while there is further upward pressure on inflation. Industry’s performance this year is unpredictable, but it is clear that the sector faces another year of extreme shocks, Virovácz summed up.

Erste Bank’s analyst János Nagy was surprised by the increase in industrial production compared to the previous month, making the annual volume index more favorable than previously thought. However, the outlook is uncertain, he agrees.

The positive data from the beginning of the year suggests that supply-side tensions may have eased somewhat, which presumably helped vehicle production the most. However, due to the Russo-Ukrainian war, supply problems and component shortages could worsen again, holding back the sector’s performance in the coming months.

He added that, in the medium term, the transformation of the automotive industry involves risks. Most domestic automotive players specialize in producing and supplying conventional motor vehicles and their components, which will become increasingly redundant over time, while emerging alternative drives are made with significantly fewer parts.

For the manufacturing industry as a whole, significant capacity expansions recently announced could offset the uncertainties, he said.

Numbers to Watch in the Coming Weeks

Today (April 8), the Central Statistical Office (KSH) publishes March consumer prices. On April 13, February construction data will be released, and on the same day, KSH will also publish its second reading of February industrial production.

This article was first published in the Budapest Business Journal print issue of April 8, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.