Private Equity in Central Europe

The small and medium enterprise (SME) sector represented 99.8% of companies and 69% of total employment in the Visegrád Four (the regional grouping of Czech Republic, Hungary, Poland and Slovakia also known as the V4) countries in 2019. Les Nemethy and El Mehdi Hosni look at the involvement of private equity in the field.

Much of the rapid growth in Central Europe over the past decades has been driven by SMEs, which in turn has required substantial amounts of capital, including private equity investment.

PE refers to an asset class in which an investor-controlled vehicle purchases shares of privately held companies. In exchange for their capital, PE firms take ownership stakes that can range from a concentrated minority to majority ownership in a company, usually requiring current management to remain in place with a sizeable equity holding.

PE firms typically invest for a period of three to seven years, with the expectation of generating attractive risk-adjusted financial returns. Over the past three years, while target rates may have been higher, PE investments in Europe generated a return of approximately 16% per annum upon exit, according to “The World Bank: Private Equity and Venture Capital in SMEs in Developing Countries”, by S. Divakaran, P. McGinnis and M. Shariff.

Some PE investors provide little more than capital, while others also provide deep expertise in areas such as finance, governance, scaling companies, and sometimes even industry specific expertise.

Because of the three-to-seven-year time horizon typical of PE investors, company owners should not consider a PE investment as an end-goal with respect to exit, rather an important step towards a major liquidity event, such as an initial public offering or eventual total exit.

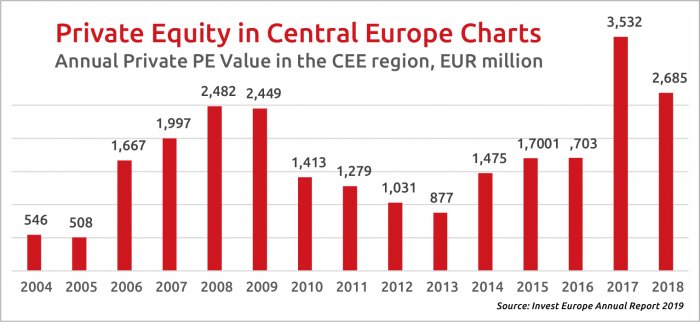

The first chart below summarizes annual PE investments in CEE since 2004.

PE investments hit their peak in 2017 and 2018, thanks to favorable economic outlook, low interest rates and high GDP growth, compared to Western Europe. In 2018, eight countries in the region achieved annual growth above 4%, according to International Monetary Fund data.

As shown in the second chart, PE investors are not sector-agnostic. The biotech and healthcare sectors accounted for 32% of PE investment in CEE in 2018; consumer goods and services represented 27% of PE investments.

Strong Tech

In addition, the region benefits from strong technology credentials: a Romanian start-up process automation company with artificial intelligence expertise, UiPath, achieved a EUR 6.3 billion valuation during its last funding round in early 2019, which provides a regional record and makes it one of the world’s most valuable AI companies.

Success breeds success. PE funds are searching for the next Eldorado, supporting hundreds of new ventures throughout the region.

Poland attracted the highest investment amount in 2017 and 2018 within CEE, while Hungary had the highest number of companies receiving investments (190 in 2018, almost 50% of the total).

This was driven by a particularly high GDP growth rates reaching 5.1% in Poland, 4.9% in Hungary and 4.1% in Romania. Thus, the PE market appears to be concentrated in CEE and relies on a few countries that experience strong economic growth.

Mature stage companies still constitute the major type of investment made by PE firms in CEE. PE firms play a major role in SME development and have a relatively important role as a source of financing SMEs in the aforementioned sectors in which they are active.

However, PE firms provide only a minor slice of the financing pie for SME’s in CEE (see our previous article: Sources of Financing for SMEs in the Visegrád Countries) as SMEs rely heavily on many other financing sources, from banks to Government grants.

The five largest private equity transactions in CEE in 2019 all had a value above EUR 1 bln, according to CMS Cameron McKenna, Emerging Europe M&A report 2019/2020.

They were: Central European Media Enterprises (Bulgaria, Czech Republic, Romania, Slovakia, Slovenia), PPF Group, EUR 1.89 bln; Innogy Grid Holding (Czech Republic), Allianz, Macquarie Group, British Columbia Investment Management, EUR 1.8 bln; Vivacom (Bulgaria), BC Partners Holdings, EUR 1.28 bln; DCT Gdansk (Poland), Tamasek Holdings, Polski Fundusz Rozwoju, Industry Super Holdings, EUR 1.18 bln; and Avito (Russia), Naspers, EUR 1.02 bln.

A final take-away point for SME owners who might be considering PE funding: in our opinion, capital is a necessary but insufficient condition for bringing on board a PE investor. Seek out the “smart” money: those investors who bring industry knowledge and connections, ability to help a company develop systems and governance. Shared objectives and personal chemistry are also key.

Les Nemethy is CEO of Euro-Phoenix (www.europhoenix.com), a Central European corporate finance firm, author of Business Exit Planning (www.businessexitplanningbook.com) and a former president of the American Chamber of Commerce in Hungary.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.