Peak Financial Services closes successful year

Fintech company Peak Financial Services said that it had a successful 2019, with the introduction of new services and the growing role of fintech companies bringing about historic changes in the companyʼs life, according to a press release sent to the Budapest Business Journal.

Peak says that so far, rivalry typically occurred between old firms and newcomers but more and more banks and regulators realized the usefulness of their support and the need for cooperation, and many see this as an opportunity for serious development.

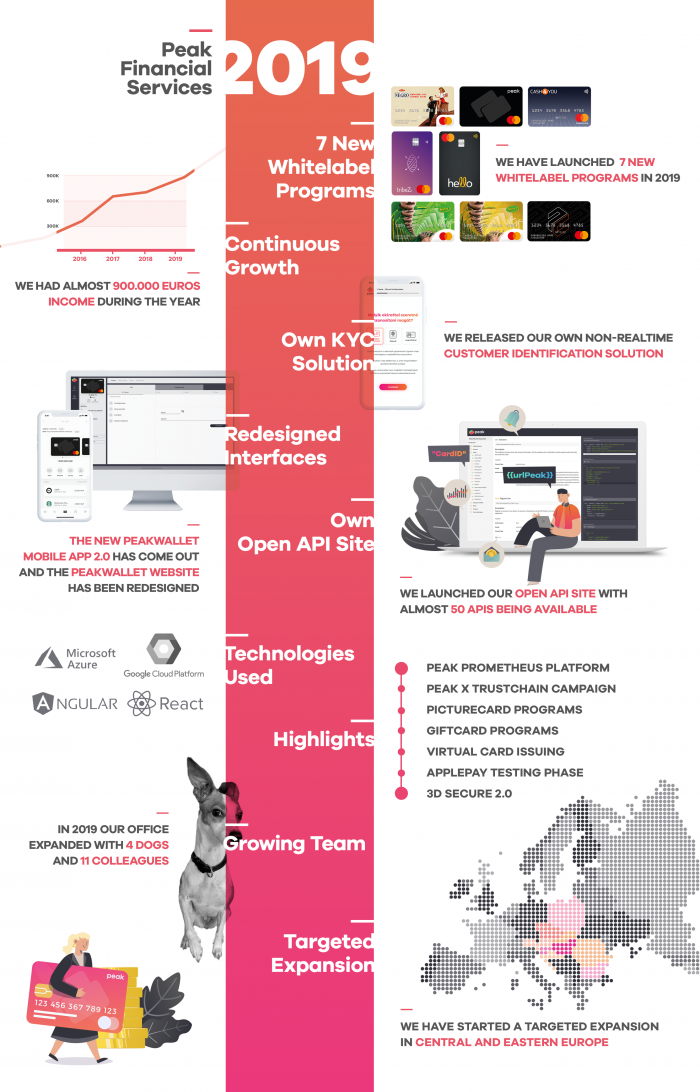

One of the most important solutions by Peak created last year was the own developed non-real-time KYC (Know Your Customer) service, a breakthrough on the Hungarian market. The new service took years of complex development to be able to offer a complete user experience for customers and to make the onboarding process easier for banks, Peak says.

The PeakWallett 2.0 mobile application was also launched in 2019, using the latest trends and technology to create a modern and easy-to-use user interface. Besides the application, PeakWallet Web received a new design too.

The companyʼs self-developed open API portal has been created with 50 different APIs, outstanding quality with easy usage, and constantly expanding functions.

Other developments include Peak Bank and the Prometheus Platform has been launched, which provides a digital banking structure for financial institutions with low investment cost and quick implementation. Peak calls the Prometheus Platform the flagship of the company, because these product lines offer technological help for financial institutions that have been struggling with customer acquisition and IT developments for a long time.

The platform includes two products unique not only in Hungary but also in the European market. One of them is the Cash Card Business, which helps in the reduction of banking costs and administrative burden for SMEs. The other one is the Pocket Money, which helps in the involvement of the younger generation while paying attention to education and responsible decision making in the financial world.

Prometheus Platform already has partner clients such as Budapest Bank, Magyar Posta Biztosító, and TribeZ, which focuses on pocket money card solutions. Beside many card programs in 2019, Peak also introduced its virtual card service, with Apple Pay tests beginning during the last quarter of 2019.

While European regulators pushed the introduction of strong customer identification one-and-a-half years into the future, compared to the original deadline, Peak has made relevant updates available since December 2019 to ensure consumer safety.

Among other things, Peak is planning to launch ApplePay and GooglePay in 2020, also they will work on the expansion of the CashCard Business functions and launch a mobile capable plastic and virtual gift card. The company says that two of its objectives are the dynamic growth of banking clients and the establishment of representative offices in the surrounding countries.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.