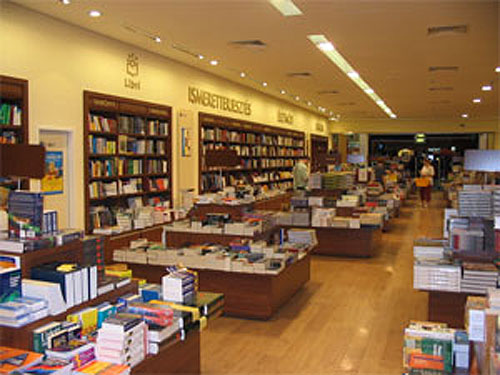

Libri-Shopline merger: Is Amazon on the horizon?

In July, the Hungarian Competition Authority (GVH) launched a prior authorization process concerning a possible merger of two major Hungarian booksellers, Libri and Shopline. If the economic regulator finds the potential deal in compliance with the prohibition of excessive economic power, the nascent Libri-Shopline might even challenge the position of the market-leading bookstore chain Alexandra. However, no impact of the merger is likely to take effect before the great Christmas book fair.

“As soon as the competition watchdog settles the pre-endorsement process, our acquisition agreement will go into effect,” announced Ákos Balogh, the majority owner of Libri, late this spring. Collecting the relevant data for the prior authorization took Libri and Shopline two months, however. Furthermore, four months are allowed by law for GVH to make a decision in such a case. A long time, which can even be prolonged by another two months if required, let alone the time it requires to carry out the technical unification of the companies.

“Even if GVH approves the deal this autumn without reservation (which is not the most likely outcome at all), the management of the merged company will hardly be able to turn its strengthened position into a profit by the end of the year,” a market expert who wished to remain anonymous told the BBJ. Surely not before the Christmas fair, during which one-third of all annual book sales take place: bad news for the merging partners, good news for all the other book market players.

In the first step of the merger process, according to Balogh’s plan, Shopline will buy out Libri. The next step would involve SQ Holding, the present owner of Libri, acquiring a 67% stake in Shopline. Complicated as it looks, the only purpose of the two-step acquisition process is to keep – and possibly increase the value of – Shopline shares on the stock market.

The final outcome is simple: Ákos Balogh, chief owner of SQ Holding, will possess a controlling stake in the merged Shopline-Libri company, while Zoltán Spéder, owner of CEMP Holding, will reduce his indirect majority ownership in Shopline to a mere 255 interest in the merged company. The total outstanding shares of Shopline-Libri available to the public would amount to 5. (For further details of deal, including the price, see BOX1)

All these legal details are hypothetical, until the competition authority has excluded any possibility of the merged company being in a monopolistic position. “The annual turnover of Libri is about HUF 8 billion, the revenue of Shopline stemming from books is less than HUF 4 bln a year, while the annual output of the book retail market is about HUF 60 billion,” insisted Péter Kovács, managing director of Libri. “So Shopline-Libri would still be light years away from achieving market dominance.”

Book market experts, however, argue that the more sensitive point concerns the online book trade. In that submarket Shopline’s share alone might well exceed 50%, to which the turnover of Libri.hu would add at least another 8%. “Their share in online book sales may well surpass 60%, which would give them a monopolistic advantage over all other competitors,” a book market expert who wished to remain anonymous told the BBJ.

The Hungarian book retail market has been in deep crisis since 2008. Nominal turnover in 2013 was 10% less than five years ago, to which inflation adds another 10% decrease. Whereas the decade between 1998 and 2008 had been characterized by rapid expansion and soaring sales, the last five years have brought about a steady decline, both in the number of titles published and turnover.

The Hungarian book market in the past ten years has been dominated by fierce competition between the large book chains, among which Libri ranks second and Shopline fourth. Market leader Alexandra controls approximately 20% of the market, so a possible merger of Libri and Shopline would hardly challenge its position. Líra, however, would fall behind its competitors, especially because it has suffered the most during the crisis.

There have been some recent rumors suggesting US-based book distributor Amazon plans to enter Hungary. The merger of Libri and Bookline could be interpreted as a kind of preventive strike, designed to defend the current position on the domestic market.

Further market concentration, however, is not so much about competition among retail bookstore chains. Most market actors think book retail giants wish to use their strengthened bargaining position against their business partners, achieving even more favorable conditions by sharing selling costs and business risks than what they enjoy today.

“As both Libri and Shopline have central warehouses of their own, the merged company would possess two, which is totally superfluous,” Kovács told the BBJ. “We would keep the one whose landlord offers us the more favorable conditions.”

Libri has always been infamous among publishing houses for demanding very high commission fees deducted from fixed retail book prices: “Up to now they have asked for 54% commission from the retail price of each book of ours sold in their store, which is hardly bearable. What will they demand if they merge with Shopline?” one owner of a small literary publishing house rhetorically asked.

It is a big deal, isn’t it?

“Price and payment details qualify as business secrets,” Kovács told the BBJ. This confines the possibilities of any deal measurement, even though in July SQ Invest made a public purchase offer to CEMP for its 3.3 million shares at a piecemeal price of HUF 575, which would mean a total price of HUF 1.9 billion. “The piecemeal price is just a little more than the legal minimum protecting small investors, which would be HUF 541. Via the merger, Shopline’s turnover would at least triple, so the official purchase offer is well below what could be expected,” a stock exchange expert close to the deal told the BBJ.

The above estimate was confirmed by the CEO of Shopline, Ákos Starcz himself: “The future deal is sort of unique as its major beneficiaries are the small investors who would become the owners of a company triple the size from one day to another. It is just an instance of our decent business behavior, ” Starcz claimed.

Market capitalization, however, does not reflect such expectations: stock prices have not changed much since SQ Invest’s purchase offer. By the end of the official purchase offer period, which ended on August 6, 23,316 shares had been sold to SQ Invest.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.