Healthy Conditions Help Healthcare Investors Thrive in Hungary

Egis is among those companies that need to attract and retain talents with pharma-focused brains.

Richter may not exactly be a household name globally (yet), but it is certainly well-known to those involved with healthcare. Outside of the country, Hungarian pharma is basically identified with Richter. However, there is life in healthcare beyond this domestic blue-chip; investments in life sciences and medical technology are thriving in Hungary.

Richter is no lonely warrior in the daily battles of the Hungarian healthcare market. As evidenced by data provided by the Hungarian Investment Promotion Agency (HIPA), more than 2,000 businesses employing 50,000-plus people were active in the pharmaceutical industry and the medical technology sector in 2020, up by more than 20% from 2014.

Foreign investor interest has been on the rise in this segment of the economy in particular: its share of the total FDI stock jumped from 2.7% to 6.5% from 2011 to 2021, amounting to EUR 5.8 billion last year. The project catalog of HIPA, an organization dedicated to providing a one-stop-shop management consultancy service that facilitates investments in this country, confirms this trend. Check the most recent announcements, and you cannot help but notice that investors are on fire.

Take Varian Medical Systems, a U.S.-based company specializing in MedTech that has expanded its R&D center in Budapest for EUR 8.5 million over three years to focus on radiotherapy tech development. Another example is Nolato, of Swedish origin; its largest plant outside of China operates in Mosonmagyaróvár (a city 160 km northwest of Budapest by road, close to the Austrian border). It is investing EUR 21 mln in growing its hygienic and medical product manufacturing and storage area. That’s a familiar step; it has been expanding its operation there every couple of years over the last decade.

South Korea-based Samyang Biopharm’s decision to set up shop in Gödöllő (34 km northeast of the capital), a EUR 26.2 mln investment to produce synthetic suture materials, and Schott’s latest EUR 76 mln announcement that it will add pre-fillable glass (PFG) syringes to its local portfolio, further showcase the extraordinary intensity of foreign investors in the medical arena.

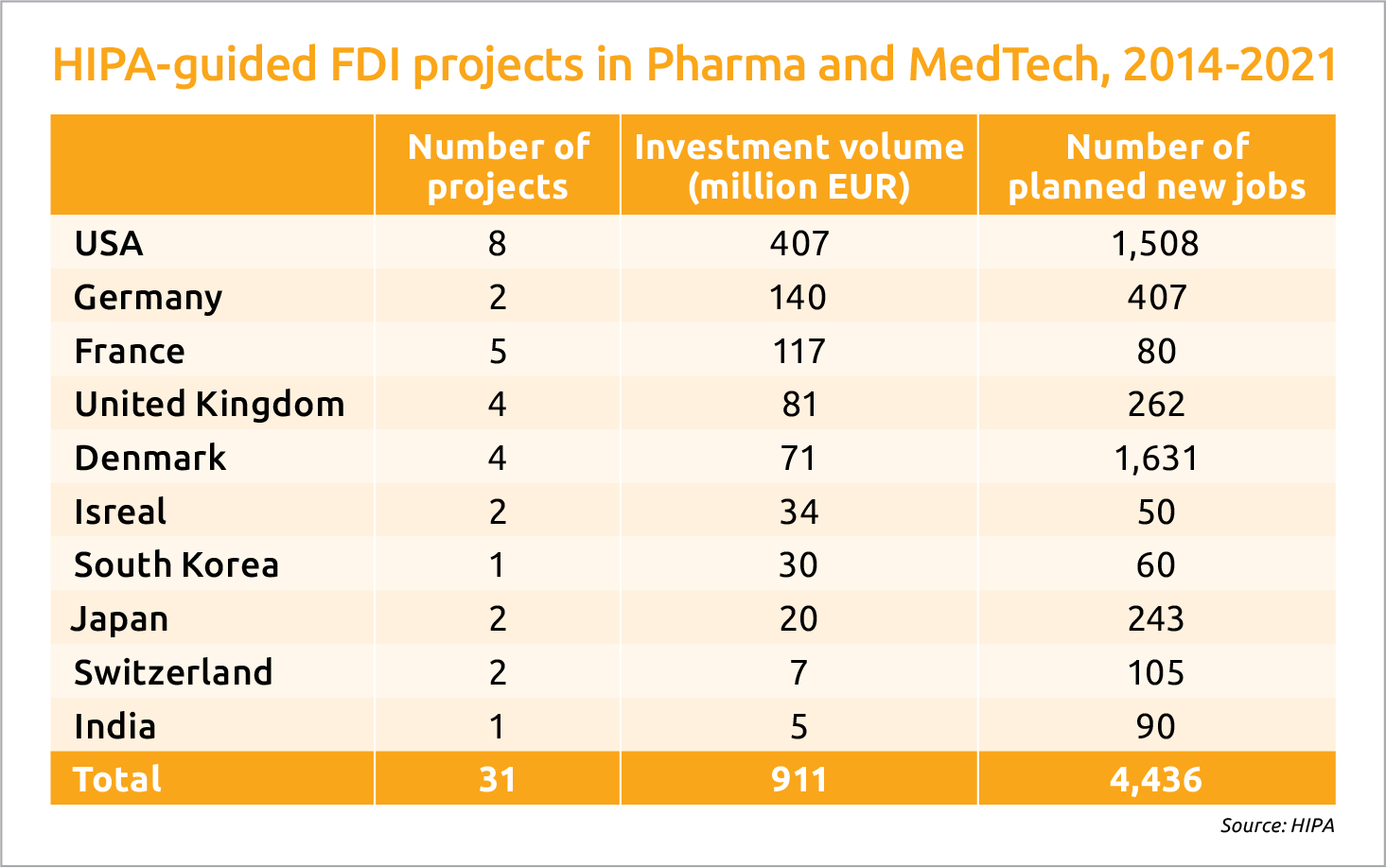

These investment stories hint that both newcomers and established reinvesting veterans have Hungary on their radar. HIPA’s figures further reveal that up to 35 deals were closed between 2014 and 2021 in pharma and MedTech, which accounted for some EUR 900 mln in FDI and created nearly 4,500 jobs. American and Danish firms were responsible for almost half of the investment volume and over two-thirds of new jobs.

Market Proximity

One of those American companies is Becton Dickinson (BD), which has been in Tatabánya (60 km east of Budapest) since 2010. As Csaba Vecsernyés, managing director of BD Hungary, points out, it chose to establish production in Hungary because of the proximity to its European customers, which remains more important than ever today.

He explains that demand has surged for pre-fillable drug systems across Europe as they help healthcare providers administer drug therapies.

“Today, more than 70% of the top 100 biopharmaceutical companies rely on BD pre-fillable syringes. This site [in Tatabánya] enables us to continue to innovate by creating extended manufacturing capacity for our customers as they develop life-saving vaccines and biologic drugs in Europe,” Vecsernyés says.

Following the announcement of a EUR 20 mln investment to produce research reagents required for the production of medical products in 2017, BD hit the headlines with an investment of EUR 188 mln in early March this year to double pre-fillable syringe production. The latter amount equals nearly one-fifth of BD’s global development budget earmarked for the upcoming years.

“Our recent investment in Hungary further positions us to have needed surge capacity for increased pre-fillable syringe demand during times of pandemic response or periods of significant growth of new injectable drugs and vaccine,” he adds.

Pharma-focused brains

Such expansions could not be implemented without skilled staff, and Hungary is known for scoring high on that criterion. In the 2020-2021 academic year, some 30,000 students attended healthcare-related university programs, a sign of the availability of intellectual reserves.

Founded in 1913 in Budapest, Egis Pharmaceuticals Plc., a leading international pharma company, is among those in need of bright pharma-focused brains: it has three sites in the country where its drugs are developed and produced. In its latest EUR 21.8 mln investment, inaugurated in October 2021, a packaging facility and a plant to produce oncology products were established. To ensure the highest quality, the company places a big emphasis on attracting and retaining talent.

“We need well-trained professionals in both white- and blue-collar positions, and lifelong learning is essential in our knowledge-intensive sector,” András Klára, HR director of Egis, says. “To this end, Egis is constantly investing not only in finding a suitably qualified workforce but also in the continuous development of their knowledge and skills.”

To reach an even higher number of young applicants, Egis is already working with its partner universities to find new blood.

“Our top talents are trained in sessions where they can develop their soft skills, build their professional network and increase their engagement. Since the beginning of our talent program in 2018, we could retain 98% of the participants,” Klára adds, shedding light on the long-term corporate HR strategy.

Competence is critical more than ever in challenging times like these, and stakeholders are fighting back by betting on digital. BD’s solutions for Smart Connected Care help providers take a more comprehensive approach to disease management and better coordinate care plans, while Egis’ Habita app supports patients with hypertension and doctors in their quest to make patients compliant with the medication regime.

These are randomly picked yet very telling examples that underline the readiness of market players to adapt to changing circumstances. Given the advantages Hungary has to offer, it seems investors are increasingly likely to make that happen by implementing projects in this country in the future as well.

This article was first published in the Budapest Business Journal print issue of April 8, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.