Industry Picks up, Inflation on Target

It seems that the worst days for Hungarian industry are over, analysts commenting on the September industrial output data say. However, it is still hard to predict what the yearend will bring given the latest government restrictions announced to slow down the spread of COVID-19. In the meantime, inflation dropped back to the central bank’s 3% target in October.

In September 2020, the volume of industrial production grew by 2.2% year-on-year. Based on working-day adjusted data, production declined by 1%. The growth was 2.3% compared to the previous month according to seasonally and working-day adjusted data.

The increase comes after a decline in August, when the volume of industrial production fell back by 2.1% year-on-year; the largest drop, however, had been registered in April, when industrial production declined by 36.8% on a year-on-year basis.

According to the latest data released by the Central Statistical Office (KSH), in September the volume of production grew in the subsections representing the largest weight. The manufacture of transport equipment, as well as the manufacture of computer, electronic and optical products, rose to a greater extent, while the manufacture of food products, beverages and tobacco products increased to a lesser degree. However, production dropped in the majority of the other manufacturing subsections.

In the first nine months of the year production was 9.2 % lower than in the same period of the previous year. Industrial output in September, according to seasonally and working-day adjusted indices, was 2.3% above the level of the previous month, and it grew by 61% compared to April.

External Demand

Production in September exceeded pre-virus levels, Gábor Regős, head of the macroeconomics unit at research institute Századvég emphasized when commenting on the data. It shows that external demand was higher in September; however, he added that there might have been significant differences among individual industries. For vehicle manufacturing, for example, THE effects of delayed purchases from spring might have occurred, thus increasing demand.

Regős thinks it is encouraging that the second wave of the coronavirus pandemic has had no effect on industrial production thus far, meaning output in the third quarter could have moderated the rate of decline of the annual GDP. However, it is still a question whether it remains like this in the coming months, he added.

Industrial production has fully recovered from the crisis caused by the pandemic, Gergely Suppan, head analyst at Takarékbank said. He noted that output grew by 31% from the previous quarter in Q3, this might have contributed greatly to the rebound of the economy. If so, the decline in GDP might have fallen to 4.7% in the third quarter, down from the 13.6% in the second quarter.

It is a good sign, he added, that new orders in the automotive industry exceeded last year’s level by 33% in August, while the overall order stock was 18.2% higher than in the same period of last year.

According to him, stabilization of industry might continue in the coming months. This year, the annual decline of industry might remain in the single-digit zone, coming to 6.5-7%, while there could be 13-14% growth in 2021; as for April, the annual growth might be as high as 60%, due to the low base effect.

Inflation Surprise

It was not only industrial production data that was pleasing; the latest inflation figures also came as positive surprise. The annual rate of increase of consumer prices slowed down to 3% in October, which is right on the mid-term target of the National Bank of Hungary (MNB).

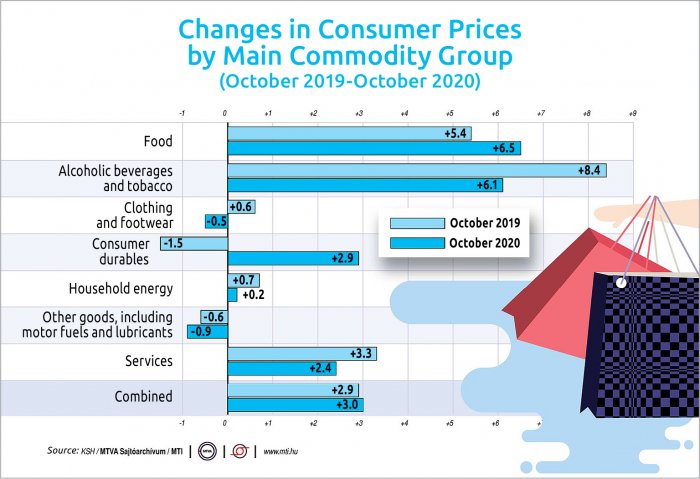

The lower price dynamics were mostly due to more moderate annual price rises for food, alcoholic beverages and tobacco than in September as well as to the price decrease of motor fuels, KSH said.

Consumer prices rose by 0.2% on average in the month, compared to September. Food prices rose by 6.5% and prices of spirits and tobacco, lifted by tax changes, were up 6.1%. Prices for both groups of products climbed at a slower pace than in the previous month. Clothing prices were 0.5% lower, consumer durable prices rose by 2.9% and household energy prices grew by 0.2%. Service prices were up 2.4%.

According to analysts, while annual inflation is back at the 3% mid-term goal of the MNB, thus easing the push for tightening, the 3.8% core inflation, which excludes volatile fuel and food prices, is still pretty high.

“The latest data is not surprising, as we expected a slowdown after the 3.9% peak in August,” said Dávid Németh, head analyst at K&H Bank. October inflation was influenced by uneven factors: while food and tobacco prices grew above the average, fuel prices dropped in the tenth month of the year. According to Németh, inflation might further ease in the coming months. He expects annual average inflation of 3.4%, which might slow to 3.1% in 2021.

Numbers to Watch in the Coming Weeks

The KSH will publish September construction data the day after this issue of the Budapest Business Journal goes to print. It will also release an important figure on Friday, November 13: Hungary’s GDP data for the third quarter of the year.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.